News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (April 18) | Trump reportedly considered firing Powell; Fed independence in spotlight2Mantra (OM) CEO Plans to Burn 300M $OM Tokens – Is a Relief Rally Coming?3Bitcoin Cash (BCH) Retesting Its Descending Channel Breakout: Is a Bounceback Ahead?

Mantle (MNT) Heading Toward Key Support – Double Bottom Setup Hints at a Possible Reversal

CoinsProbe·2025/04/17 07:55

CORE Approaches Key Resistance – Could Breakout Spark a Recovery?

CoinsProbe·2025/04/17 07:55

Is Render (RENDER) Gearing Up For Another Breakout Rally? This Fractal Says Yes!

CoinsProbe·2025/04/17 07:55

Uniswap (UNI) Testing Key Support – Could This Pattern Spark a Reversal?

CoinsProbe·2025/04/17 07:55

Bitcoin Eyes Breakout above $90,000 as Dip Buyers and Derivatives Traders Fuel Momentum | US Crypto News

Bitcoin is gearing up for a potential breakout above $90,000, supported by bullish trader sentiment and rising Bitcoin dominance, despite ongoing macroeconomic volatility.

BeInCrypto·2025/04/17 06:48

VanEck Announces NODE ETF for Digital Asset Market Growth

Cryptotale·2025/04/17 05:30

Crypto in a bear market, rebound likely in Q3

Coinbase reports a shrinking crypto market and bearish signals but expects a potential rebound later in 2025.

Cointelegraph·2025/04/17 01:56

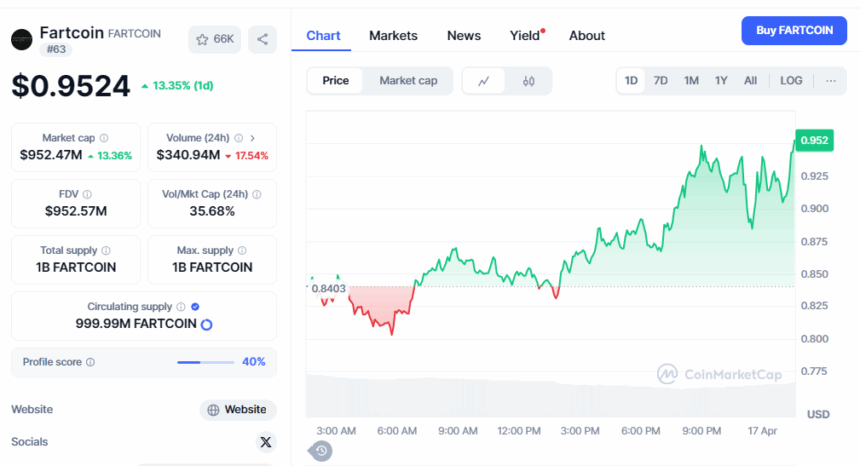

Fartcoin Pumps More 12% As Whales Keep Buying; Can it Break $1 by Sunday?

Cryptotimes·2025/04/16 21:22

Bitcoin Sets Higher Lows—Can Bulls Target $88K Resistance?

Cryptonewsland·2025/04/16 20:55

Flash

- 21:28ZK Universal Proof Layer Protocol ZkCloud to Launch MainnetAccording to official information, the ZK universal proof layer protocol ZkCloud will launch its mainnet. ZkCloud can aggregate proof requirements, making new applications utilizing provable computation economically viable by reducing costs to a fraction of the standard proof outsourcing costs of AWS and GCP. It also ensures that prover nodes can achieve maximum resource efficiency for scaling and privacy use cases and more demands in the future by aggregating workloads across the industry.

- 21:12Mainstream CEX T Contracts Reach Extreme Negative Funding Rate, $2.07 Million Liquidated in 24 HoursAccording to data from Coinglass, the T (Threshold) perpetual contracts on major CEXs have reached an extreme negative funding rate, with the main trading platform showing -2%. Market information shows T (Threshold) is currently priced at $0.021, with a 24-hour gain of 44.5%. The total 24-hour trading volume of T contracts across the network is currently $1.03 billion, with a 24-hour increase of 10614%. The total open interest for T contracts across the network stands at $65.08 million. In the past 24 hours, T contracts saw liquidations amounting to $2.07 million, of which $1.57 million were short positions.

- 21:10Fragmetric, a liquidity restaking protocol, receives funding from the Solana FoundationAccording to an official tweet, the Solana ecosystem liquidity restaking protocol Fragmetric announced that it has received a grant from the Solana Foundation. The project aims to establish a new standard for liquidity restaking. Fragmetric officials stated that this move will benefit all participants in the restaking ecosystem. The Solana ecosystem restaking protocol Fragmetric has completed a $5 million strategic funding round, led by Rockaway Capital, with participation from Robot Ventures, Amber Group, Hypersphere, and BitGo.