News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

Quick Take MANTRA’s token rebounded over 50% on Tuesday after a disastrous drop over the weekend. The project’s co-founder, John Patrick Mullin, promised to share a “post-mortem report detailing the events” that led to the price collapse of MANTRA’s token.

Quick Take Improving market dynamics and the launch of a leveraged product last week position XRP ahead of other assets when it comes to spot ETF approval by the SEC, analysts at Kaiko argue. May 22 is the next important date to watch as the SEC must respond to Grayscale’s spot XRP ETF filing by then.

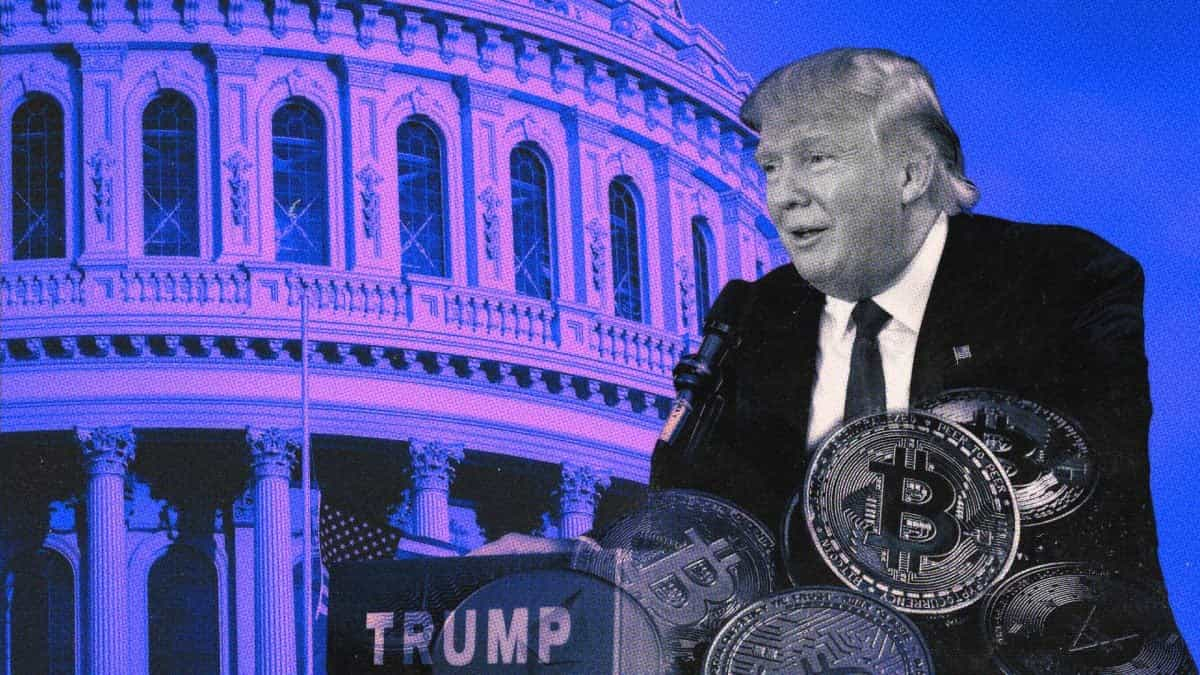

Quick Take Bitwise CIO Matt Hougan said bitcoin is acting “notably different” to prior pullbacks and could outperform the stock market during a correction for the first time since 2011. Despite President Trump’s tariff turmoil in recent weeks and the ensuing volatility, bitcoin has effectively been flat over the past month, Hougan noted.

Bukele to meet Trump amid El Salvador’s $1.4B IMF deal tied to Bitcoin constraints. Trump’s potential pro-Bitcoin stance could shift global crypto politics. BTC nears $85K after breaking downtrend, showing strength amid macro volatility.

Quick Take The OM token plunge has seen over $71.8 million in liquidations over the past 24 hours. The project’s co-founder disclosed that the price movements were caused by “reckless forced closures” initiated by centralized exchanges on OM account holders.

The total crypto market cap chart has formed a bullish falling wedge pattern. The analyst also highlighted a bullish divergence on the altcoin market cap chart. The last time such a setup was seen, a massive altcoin rally was seen in 2020.

Solana’s price has grown by more than 10% over the past week while ether’s has fallen by a similar proportion, leading the SOL/ETH price ratio to a new all-time high at daily close. The ratio of ETH to BTC has also fallen to its lowest value since early 2020. Ethereum co-founder Vitalik Buterin hinted on X that future hard fork upgrades to the blockchain network could come faster following the upcoming Pectra upgrade set for early May.

- 08:31Bleap, a blockchain bank account platform founded by former Revolut employees, has signed a strategic partnership with MastercardAccording to The Block, Bleap, a blockchain bank account platform founded by former Revolut employees, has signed a strategic partnership with payment giant Mastercard. This collaboration will enable Bleap to leverage Mastercard's resources and global network to accelerate its international expansion. The company stated that it will initially focus on developing the European market before entering the Latin American market. Bleap is built on top of Ethereum Layer 2 network Arbitrum and supports fast transactions without gas fees. It utilizes PortalHQ's multi-party computation technology, replacing traditional seed phrases with cloud storage and social login. After creating a Bleap account, users can deploy an intelligent wallet supported by Account Abstraction (ERC-4337). Users can add stablecoins from external wallets or use fiat currency through Bleap's free cryptocurrency deposit and withdrawal service.

- 08:26Slow Fog: The fundamental reason for the R0AR's vulnerability is the existence of a backdoor in the contractSlow Fog issued a security alert, stating that the fundamental cause of The R0AR vulnerability is the existence of a backdoor in the contract. During deployment, the R0ARStaking contract tampered with the balance (user.amount) of a specified address by directly modifying storage slots. Subsequently, all funds in the contract were withdrawn by attackers using an emergency withdrawal function.

- 08:25CryptoQuant: BTC fell 16.7% after the tariff announcement, underperforming traditional assets such as goldAccording to CryptoQuant data, since the announcement of tariffs, Bitcoin's price has fallen by 16.7%. Although it has rebounded from its previous low point of 26.7%, it still lags behind the performance of most traditional assets. During the same period, gold rose by 12.9%, while silver and the US dollar index both fell by 4.8%. The SP 500 index fell by 13.8% and Nasdaq dropped by 17.5%. Despite high volatility, Bitcoin's current decline is between that of Nasdaq and crude oil, showing some signs of recovery but not yet demonstrating characteristics as a safe-haven asset.