News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

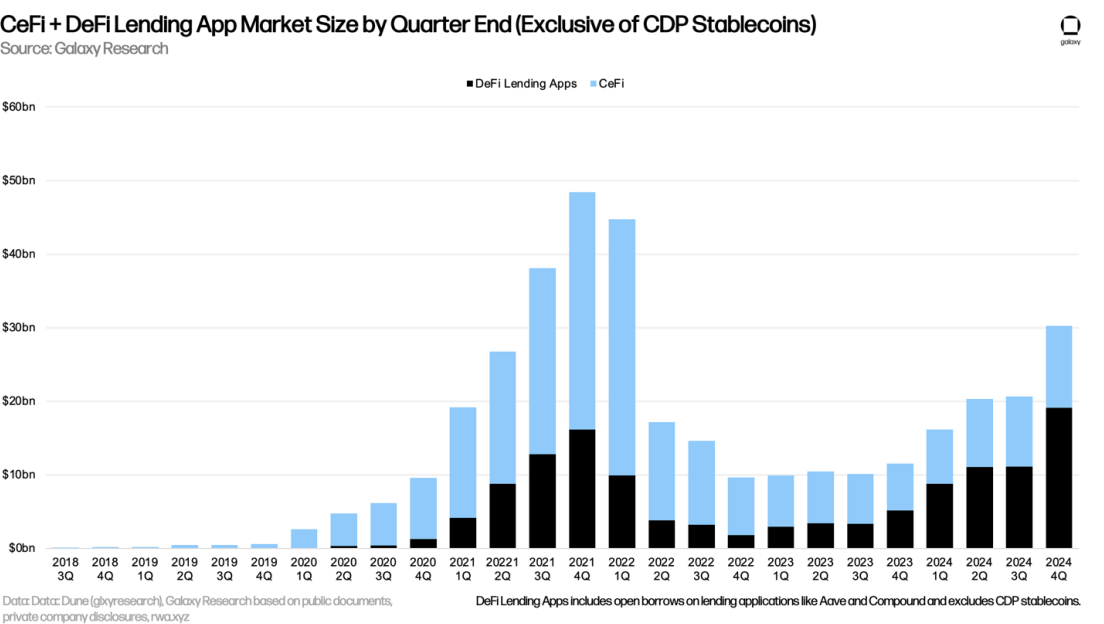

Both CeFi and DeFi lending have made a comeback, Galaxy noted

As global tensions push nations to diversify away from the US dollar, Bitcoin emerges as a key alternative. Experts predict its growth, but challenges like volatility and scalability remain.

Hoskinson predicts that rate cuts and the stabilization of the recent tariff war will send the crypto market much higher.

XRP could be primed for a breakout above its recent downtrend. Here's how high it could go.

Bitcoin bulls predict a rally to $90,000 if Treasury yields continue to fall alongside the Trump administration’s adjustments to its current tariff policy.

In Brief Analyst Pseudonym identifies recovery signals in BONK, ALCH, and Bitcoin. Short-term trading strategies recommended for cautious positions. Increasing interest in meme tokens amid market volatility.

In Brief Ethereum's price fluctuations shift focus to technical indicators among market players. Analysts signal potential recovery and long-term growth opportunities for Ethereum. Competition from networks like Solana raises challenges for Ethereum's market position.

- 08:31Bleap, a blockchain bank account platform founded by former Revolut employees, has signed a strategic partnership with MastercardAccording to The Block, Bleap, a blockchain bank account platform founded by former Revolut employees, has signed a strategic partnership with payment giant Mastercard. This collaboration will enable Bleap to leverage Mastercard's resources and global network to accelerate its international expansion. The company stated that it will initially focus on developing the European market before entering the Latin American market. Bleap is built on top of Ethereum Layer 2 network Arbitrum and supports fast transactions without gas fees. It utilizes PortalHQ's multi-party computation technology, replacing traditional seed phrases with cloud storage and social login. After creating a Bleap account, users can deploy an intelligent wallet supported by Account Abstraction (ERC-4337). Users can add stablecoins from external wallets or use fiat currency through Bleap's free cryptocurrency deposit and withdrawal service.

- 08:26Slow Fog: The fundamental reason for the R0AR's vulnerability is the existence of a backdoor in the contractSlow Fog issued a security alert, stating that the fundamental cause of The R0AR vulnerability is the existence of a backdoor in the contract. During deployment, the R0ARStaking contract tampered with the balance (user.amount) of a specified address by directly modifying storage slots. Subsequently, all funds in the contract were withdrawn by attackers using an emergency withdrawal function.

- 08:25CryptoQuant: BTC fell 16.7% after the tariff announcement, underperforming traditional assets such as goldAccording to CryptoQuant data, since the announcement of tariffs, Bitcoin's price has fallen by 16.7%. Although it has rebounded from its previous low point of 26.7%, it still lags behind the performance of most traditional assets. During the same period, gold rose by 12.9%, while silver and the US dollar index both fell by 4.8%. The SP 500 index fell by 13.8% and Nasdaq dropped by 17.5%. Despite high volatility, Bitcoin's current decline is between that of Nasdaq and crude oil, showing some signs of recovery but not yet demonstrating characteristics as a safe-haven asset.