News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (April 18) | Trump reportedly considered firing Powell; Fed independence in spotlight2Mantra (OM) CEO Plans to Burn 300M $OM Tokens – Is a Relief Rally Coming?3Bitcoin Cash (BCH) Retesting Its Descending Channel Breakout: Is a Bounceback Ahead?

Bitcoin Slips Below Trendline—Can $82.8K Hold the Line?

Cryptonewsland·2025/04/16 20:55

Bitcoin’s Bull Score Index Hits 58 Days Below 50: What’s Next?

Cryptonewsland·2025/04/16 20:55

Solana Faces 50% Drop Risk as $125–$137 Range Holds the Key Amid Market Volatility

Cryptonewsland·2025/04/16 20:55

Retail curiosity is rekindled as Google search volume for 'Bitcoin' and 'Ethereum' jumps

Quick Take This marks a 26% month-over-month relative increase in search volumes for “Bitcoin.” The following is an excerpt from The Block’s Data and Insights newsletter.

The Block·2025/04/16 16:00

Crypto Market ‘Banana Zone’ Is Just Around the Corner, Says Analyst Michaël van de Poppe – Here’s Why

Daily Hodl·2025/04/16 16:00

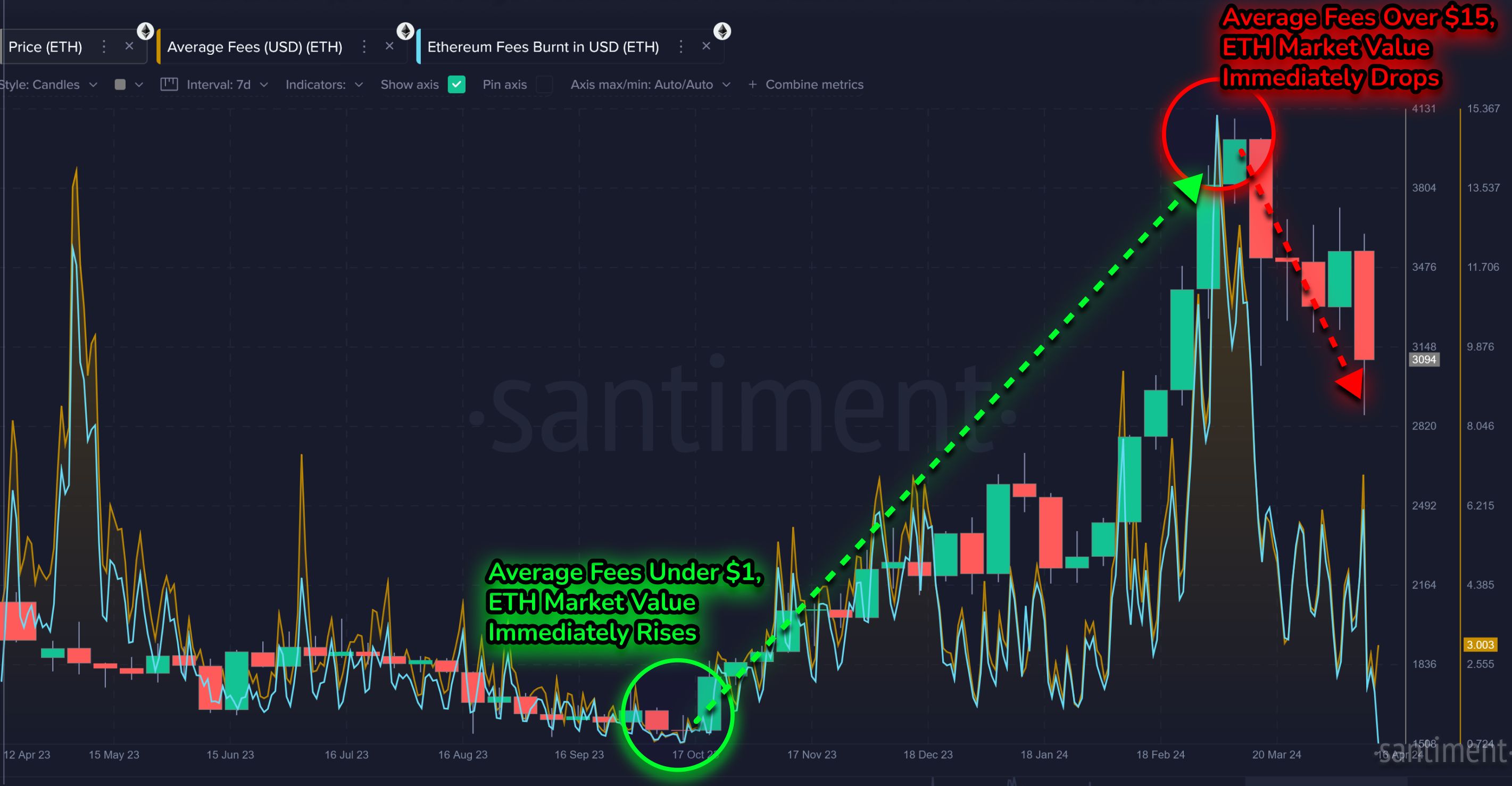

Ethereum Metric That Historically Precedes Price Rebounds Is Flashing Bullish, Says Analytics Firm Santiment

Daily Hodl·2025/04/16 16:00

Alchemy Pay (ACH) Price Prediction 2025 to 2030: Will ACH Break Past $2.50 by 2030?

Coinedition·2025/04/16 16:00

Render (RENDER) and Near Protocol (NEAR) Spearhead Crypto Surge

Cryptodaily·2025/04/16 16:00

Potential Outcomes of SEC Case Stay Amid New Regulatory Direction for Cryptocurrency

Coinotag·2025/04/16 16:00

Crypto Market Lost $633 Billion in Q1 2025, CoinGecko Report Shows

CoinGecko's Q1 2025 report reveals a grim crypto market, with substantial losses across all sectors, despite Bitcoin’s rising dominance and a few isolated positives. Recession fears are heavily impacting the industry.

BeInCrypto·2025/04/16 16:00

Flash

- 21:28ZK Universal Proof Layer Protocol ZkCloud to Launch MainnetAccording to official information, the ZK universal proof layer protocol ZkCloud will launch its mainnet. ZkCloud can aggregate proof requirements, making new applications utilizing provable computation economically viable by reducing costs to a fraction of the standard proof outsourcing costs of AWS and GCP. It also ensures that prover nodes can achieve maximum resource efficiency for scaling and privacy use cases and more demands in the future by aggregating workloads across the industry.

- 21:12Mainstream CEX T Contracts Reach Extreme Negative Funding Rate, $2.07 Million Liquidated in 24 HoursAccording to data from Coinglass, the T (Threshold) perpetual contracts on major CEXs have reached an extreme negative funding rate, with the main trading platform showing -2%. Market information shows T (Threshold) is currently priced at $0.021, with a 24-hour gain of 44.5%. The total 24-hour trading volume of T contracts across the network is currently $1.03 billion, with a 24-hour increase of 10614%. The total open interest for T contracts across the network stands at $65.08 million. In the past 24 hours, T contracts saw liquidations amounting to $2.07 million, of which $1.57 million were short positions.

- 21:10Fragmetric, a liquidity restaking protocol, receives funding from the Solana FoundationAccording to an official tweet, the Solana ecosystem liquidity restaking protocol Fragmetric announced that it has received a grant from the Solana Foundation. The project aims to establish a new standard for liquidity restaking. Fragmetric officials stated that this move will benefit all participants in the restaking ecosystem. The Solana ecosystem restaking protocol Fragmetric has completed a $5 million strategic funding round, led by Rockaway Capital, with participation from Robot Ventures, Amber Group, Hypersphere, and BitGo.