Bitget Daily Digest (April 18) | Trump reportedly considered firing Powell; Fed independence in spotlight

Bitget2025/04/18 10:18

By:Bitget

Today's preview

1. Markets in the U.S. and Europe are closed for Good Friday.

2. G20 finance ministers and central bank governors will convene for a meeting.

3. Melania Meme (MELANIA) is unlocking approximately 26.25 million tokens on April 18, representing 17.5% of the total circulating supply, valued at around $13.1 million.

4. Fasttoken (FTN) is unlocking approximately 20 million tokens on April 18, representing 4.65% of circulating supply, valued at around $81 million.

Key market highlights

1. According to the Wall Street Journal, sources revealed that U.S. President Donald Trump had been privately discussing the possibility of firing Federal Reserve Chair Jerome Powell for several months. A final decision on whether to remove him before the end of his term next year had not been made. At a meeting held at Mar-a-Lago, Trump reportedly spoke with former Fed Governor Kevin Warsh about removing Powell before his term ends and possibly appointing Warsh as his successor. However, Warsh advised against the move, arguing that Powell should be allowed to complete his term without interference. Treasury Secretary Scott Bensen also opposed the idea of removing Powell.

Evercore ISI analyst Krishna Guha noted that as tariffs begin to feed into consumer prices, the Federal Reserve's independence is likely to become a key market focus in the coming days. He added, "If you liked the tariff debacle in markets, you'd love the loss-of-Fed-independence trade." Meanwhile, Keith Lerner, Chief Market Strategist at Truist Advisory Services, downgraded his U.S. equity outlook, writing to clients that "from historical, fundamental, and technical perspectives, the evidence suggests taking a slightly defensive stance."

2. The U.S. Securities and Exchange Commission (SEC) has announced a roundtable titled "Know Your Custodian: Key Considerations for Crypto Custody," scheduled for April 25, from 1:00 PM to 5:00 PM (ET) at its Washington, D.C. headquarters. Topics include custody via broker-dealers and beyond, as well as custody for investment advisers and funds. Attendees will include Acting Chair Mark Uyeda, other SEC commissioners, and representatives from leading industry players such as Fidelity and Fireblocks.

3. Synthetix's stablecoin sUSD dropped another 13.9% in the past 24 hours, currently trading at $0.7038 with a market cap of $22.96 million. Earlier, Synthetix founder Kain explained that the sUSD peg repair mechanism is undergoing a transition, with 90% of ETH reserves sold to boost SNX holdings. The sUSD depeg was not caused by bad debt or system failure, but rather as a side effect of SIP-420. The proposal shifted the model from individual sUSD minting and debt responsibility to a shared pool structure, aimed at eliminating liquidations and individual debt exposure. However, with debt now centralized in a public pool, stakers no longer have a direct incentive to buy back sUSD when it trades below the peg, effectively removing the system's prior self-correcting mechanism. To address this, the Synthetix team is exploring new demand drivers, including integrations with Aave, Ethena, and enhanced Curve incentives.

4. Bitget completes its first BGB quarterly burn, permanently removing 30,006,905 BGB from circulation—approximately 2.5% of the total supply. According to CoinMarketCap, BGB has a market cap of around $5.2 billion and ranks 24th globally among all cryptocurrencies. Following the burn, the total supply now stands at 1,169,993,095 BGB, with 100% in circulation.

Market overview

1. $BTC saw a slight short-term pullback with negative funding rates, possibly signaling a local sentiment bottom. Aergo and newly listed GM led the gains.

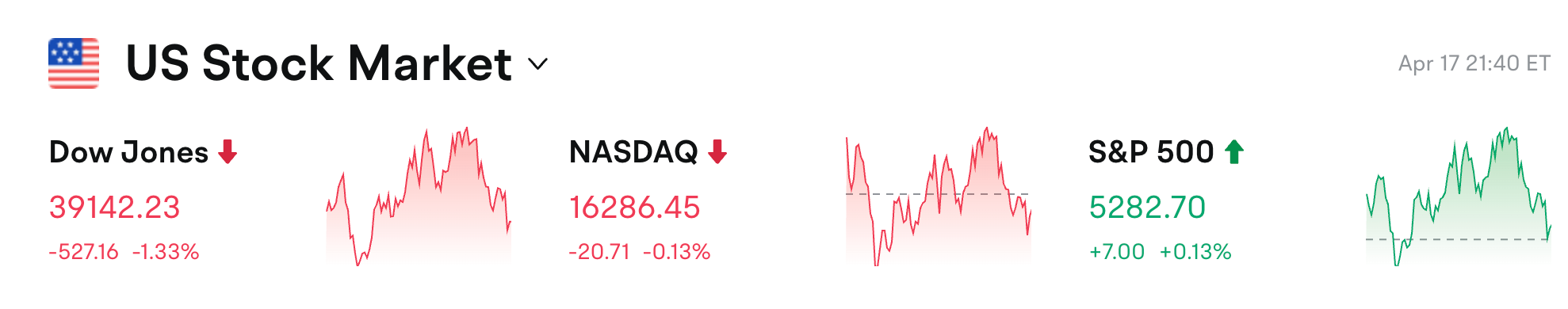

2. U.S. stocks closed mixed: the Dow fell 1.31%, the Nasdaq dipped 0.13%, while the S&P 500 edged up 0.13%.

3. Currently at 84,910 USDT, BTC is in a potential liquidation zone. If BTC drops by 1000 points to around 83,910 USDT,

cumulative long position liquidations will exceed $170 million. Conversely, a rise to 85,912 USDT could lead to

more than $440 million in cumulative short-position liquidations. With short liquidation volumes far surpassing long positions, it's advisable to manage leverage carefully to avoid large-scale liquidations.

4. Over the past day, Bitcoin has seen $1.391 billion in spot inflows and $1.641 billion in outflows, resulting in

a net outflow of $250 million.

5. In the last 24 hours, $ETH, $XRP, $OM, $FARTCOIN, and $KERNEL led in

net outflows in futures trading, signaling potential trading opportunities.

Institutional insights

Analyst: When gold hits a new high, historical trends suggest that Bitcoin typically follows within 150 days.

Read the full article here:

https://cointelegraph.com/news/

Opinion: The Federal Reserve's independence may become a key market focus in the coming days.

Read the full article here:

https://finance.sina.com.cn

Glassnode: Slower growth in stablecoin issuance points to tightening liquidity in the crypto market.

Read the full article here:

https://x.com/glassnode

Analyst: The TD Sequential indicator suggests that if Bitcoin holds above

$86,000,

further upside is likely.

Read the full article here:

https://x.com/ali_charts

News updates

1. Trump believes Powell will cut rates at some point.

2. The ECB lowers all three key interest rates by 25 basis points, in line with market expectations.

3. Slovenia's finance ministry proposes a tax on individual crypto income.

4. Ukraine and the U.S. sign a memorandum on the mineral deal.

5. U.S. initial jobless claims for the week ending April 12 came in at 215,000, slightly below the forecasted 225,000.

6. U.S. Department of Justice to review its approach to returning assets to victims in crypto-related crime cases.

Project updates

1. Bitcoin network hash rate reaches an all-time high.

2. EigenLayer launches a slashing mechanism on its mainnet.

3. The Ethereum Foundation opens applications for the 6th round of the Ethereum Protocol Fellowship.

4. Eliza Labs releases auto.fun, a no-code Launchpad platform.

5. Ethena and Securitize plan to launch the Converge mainnet in Q2.

6. Melania team has sold 13 million MELANIA tokens over the past month.

7. Solana DEXs captured 39.6% of the market share in Q1 2025, ranking first among all blockchains.

8. Initia is set to launch its mainnet on April 24.

9. deBridge Foundation opens DBR token airdrop and LFG treasury token claims.

10. Lybra Finance burns 63,000 peUSD via a configured contract, unlocking an equivalent amount of eUSD.

Highlights on X

1. SEA: Bitcoin ecosystem sees a major upgrade with the launch of Bitcoin Thunderbolt

According to information reposted on HSBC's official website, Bitcoin Thunderbolt has officially launched. The project upgrades Bitcoin's base layer via a soft fork, introducing two key features, UTXO Bundling and OP_CAT, designed to improve the network's scalability and programmability.

UTXO Bundling enables the bundling of multiple small transactions for processing, significantly reducing on-chain data size and potentially increasing transaction efficiency by up to 10 times. Meanwhile, the reactivation of the OP_CAT opcode brings native programmability to the Bitcoin network, laying the groundwork for asset issuance and DeFi applications. The project is jointly initiated by early miners, Bitcoin whales, and core tech contributors from the Satoshi era. It is currently in its early stages and is only accessible to users with a Boosting Code. The Bitcoin ecosystem has already shown strong market interest in asset and application layer innovation through protocols like Ordinals, BRC-20, and Runes. As liquidity tightens, Bitcoin's ecosystem will either grow organically through infrastructure improvements or rely on short-term price-driven hype. Either way, the launch of Bitcoin Thunderbolt marks a significant step forward in the network's foundational capabilities and is worth watching closely.

2. @jason_chen998: Bitcoin dominance hits new high, and altcoins may be set for a major rebound

Bitcoin's dominance continues to rise, recently reaching a new all-time high, while many altcoins remain near historic lows. Analysts suggest that if Bitcoin dominance retreats by five percentage points or more, the capital rotation could trigger a significant altcoin rebound. With many legacy altcoins currently undervalued, even a modest shift could unlock considerable price elasticity across the altcoin market.

3. Adam@Greeks.live: Market cools down, but black swan risk still looms

This Friday, 23,000 BTC options and 177,000 ETH options are set to expire, with notional values of $1.97 billion and $280 million, respectively. The maximum pain points are $82,000 for BTC and $1600 for ETH. Put-call ratios of 0.96 (BTC) and 0.84 (ETH) reflect growing bearish sentiment.

With fewer headlines from Trump this week, market sentiment has softened. Short-term implied volatility (IV) has dropped sharply below 40%, while realized volatility (RV) has declined to 30%. However, medium- to long-term volatility remains elevated in the 50–60% range. Analysts note that ongoing uncertainties around trade and tariff disputes may continue to drive volatility. With settlement volume accounting for less than 10% of total open interest and positions remaining relatively stable, the market appears to be leaning toward sideways movement as sentiment stays subdued. Given that transitions from bull to bear markets are often accompanied by unexpected shocks, institutions are advising a hedge with a small allocation of deep out-of-the-money put options to protect against potential black swan events.

4. DaPangDun: Solana ecosystem may see fresh memecoin frenzy

Raydium (@RaydiumProtocol) has launched its new "Pump" initiative, receiving official backing from its foundation, which has sparked major interest in the Solana ecosystem. The poster has already taken a position in $TIME, currently a leading Solana memecoin, though questions remain about whether it can maintain its top spot, especially given the currently limited capital inflow. According to the poster's analysis, Solana's ecosystem appears to be advancing with a deliberate pace:

- Large token unlocks have been managed to ease sell pressure.

- Progress on the Solana spot ETF continues, strengthening long-term outlook.

- The memecoin space has already seen early-stage capital validation.

Now, Raydium is officially leading the Pump initiative, which is expected to operate through OTC (over-the-counter) methods to reduce the risk of sell pressure caused by direct token dumping and fee extraction, as seen in projects like Pump.fun. Against this backdrop, the poster believes that Solana may be on the verge of a new wave of memecoin hype, with market sentiment likely to continue heating up.

9

2

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Locked for new tokens.

APR up to 10%. Always on, always get airdrop.

Lock now!

You may also like

Pyth Network (PYTH) To Rise Further? Key Harmonic Pattern Signaling an Upside Move

CoinsProbe•2025/04/26 07:55

Sonic (S) To Continue Rebound? Key Harmonic Pattern Signaling an Upside Move

CoinsProbe•2025/04/26 07:55

LUNC Bulls Take Charge: Technicals Point to a Major Reversal and Moonshot Target

Cryptonewsland•2025/04/26 06:22

Dogwifhat (WIF) price jumps 60% as meme coin market rebounds, but pullback signs appear

Coinjournal•2025/04/26 02:22

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$94,234.87

-0.24%

Ethereum

ETH

$1,793.56

+1.04%

Tether USDt

USDT

$1

+0.03%

XRP

XRP

$2.2

+0.20%

BNB

BNB

$604.88

+0.03%

Solana

SOL

$148.49

-3.21%

USDC

USDC

$1

+0.01%

Dogecoin

DOGE

$0.1821

+0.61%

Cardano

ADA

$0.7081

-0.76%

TRON

TRX

$0.2520

+3.48%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new Bitgetters!

Sign up now