Bitget Daily Digest (4.17) | Powell says Fed won't act without clear signals, California sues Trump over tariffs

远山洞见2025/04/17 09:47

By:远山洞见

Today's preview

1.U.S. initial jobless claims (week ending April 12) will be released today, with the previous reading at 223,000.

2.The European Central Bank will announce its interest rate decision today.

3.deBridge (DBR) will unlock approximately 1.14 billion tokens today, representing 63.24% of the current circulating supply, with a value of around $26.50 million.

4.EigenLayer, an Ethereum restaking protocol, launches its slashing mechanism on the mainnet.

Key market highlights

1.Fed Chair Jerome Powell dampens market expectations, dismissing the possibility of Fed intervention. In a speech delivered in Chicago, Powell downplayed hopes that the Fed would step in to counter the sharp decline in the stock market. He attributed recent market turbulence to investor uncertainty, noting that the volatility reflects the market adjusting to the Trump administration's abrupt shifts in tariff policy. Powell also pointed to hedge fund deleveraging as a contributing factor and warned that the instability could persist in the short term. He emphasized that it's too early to draw firm conclusions, tempering expectations of a so-called "Fed put." On a different note, Powell acknowledged crypto's growing adoption and stressed the need for a clear legal framework for stablecoins. He also hinted that some banking regulations may be selectively eased.

2.According to data released on Wednesday by the Bureau of Labor Statistics, job seekers outnumbered available positions in 14 U.S. states as of February—the highest number since April 2021. New additions to this group include Kentucky, New York, Ohio, and Rhode Island, signaling a worsening employment situation. From November 2022 to April 2023, as the U.S. economy gained momentum following the pandemic, the unemployment-to-vacancy ratio in all 50 states remained below 1. This suggests that, at least in theory, there were enough jobs for all unemployed individuals. That changed in May 2023, when California and New Jersey became the first two states where the ratio exceeded 1. In February, the most recent month with available data, California had the highest ratio: about 150 unemployed workers for every 100 job openings. The growing number of states with more unemployed people than open positions points to an increasingly strained labor market.

3.California Governor Gavin Newsom's office has announced legal action against former President Trump in an effort to block his tariff policy. California, whose economy relies heavily on global trade—spanning industries from Silicon Valley to agriculture—stands to lose billions due to the tariffs. In the statement, Newsom said Trump's "illegal tariffs" are wreaking havoc on California's families, businesses, and economy, driving up prices and putting jobs at risk. The lawsuit marks Newsom's most significant legal challenge to Trump's policies since his inauguration earlier this year. Newsom is contesting the use of the International Emergency Economic Powers Act of 1977 (IEEPA), which Trump invoked to raise tariffs without congressional approval. The Democrat governor argues that Trump lacks the authority under this law to impose such tariffs—a position that aligns with a similar lawsuit filed by a coalition of U.S. businesses earlier this week.

4.An industry report suggests that mounting tariffs and broader macro uncertainty may have ushered in a new crypto winter. The total crypto market cap, excluding BTC, now stands at $950 billion, down 41% from its December 2024 peak and 17% year-over-year. Major indices like COIN50 and assets such as BTC have dropped below their 200-day MAs, indicating bearish momentum. While crypto fundraising saw a slight uptick in Q1, it remains down 50–60% compared to the highs of 2021–2022, limiting new capital inflows—particularly for altcoins. With sentiment yet to recover, analysts advise maintaining a defensive stance for now, though a mid-year rebound remains possible.

5.Raydium has launched a new token issuance platform, LaunchLab, drawing attention on the Solana network. Using the JustSendIt model, liquidity is automatically migrated to the Raydium AMM once 85 SOL is raised, allowing projects to kick off trading with zero barriers. The base transaction fee is set at 1%, with 50% of the fees allocated to a community pool to incentivize creators and traders, 25% used for RAY buybacks, and the remaining 25% for platform operations. The launch of leading tokens like $TIME, $MONR, and $AURA has already generated significant on-chain buzz.

Market overview

1.BTC saw a short-term dip amid price volatility, while the broader market showed mixed performance. Newly listed tokens like PAWS and $GM led the gains. SocialFi tokens such as $SNT and $MBL stood out with strong performances, and Solana ecosystem tokens also showed signs of recovery.

2.Fed Chair Jerome Powell dismissed the possibility of a "Fed put," causing the Nasdaq to drop over 3% and Nvidia to plunge as much as 10%. In contrast, gold surged to a new all-time high.

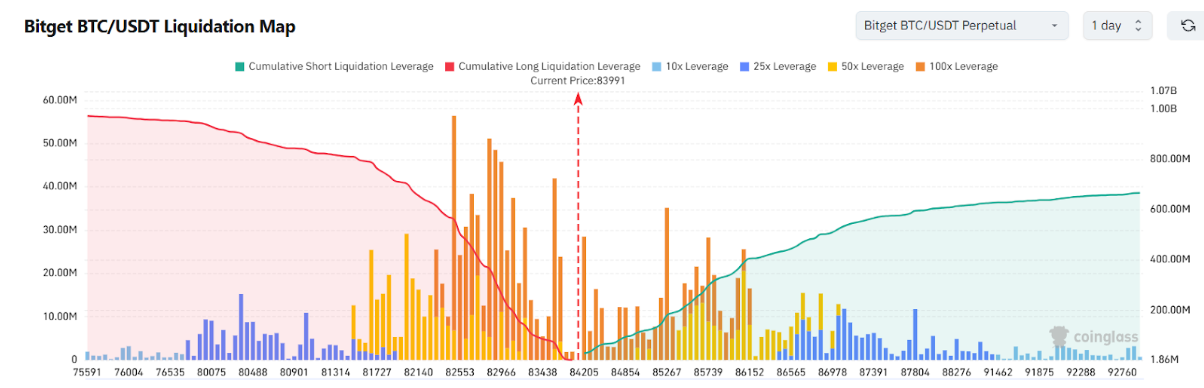

3.Currently standing at 83,991 USDT, Bitcoin is in a potential liquidation zone. A 1000-point drop to around 82,991 USDT could trigger

over $311 million in cumulative long-position liquidations. Conversely, a rise to 84,991 USDT could lead to

more than $111 million in cumulative short-position liquidations. With long liquidation volumes far surpassing short positions, it's advisable to manage leverage carefully to avoid large-scale liquidations.

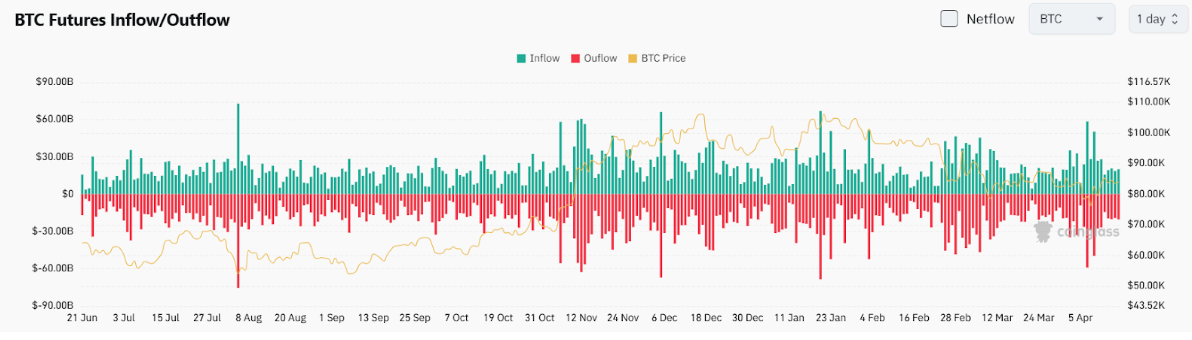

4.Over the past day, Bitcoin has seen $1.94 billion in spot inflows and $2.05 billion in outflows, resulting in

a net outflow of $90 million.

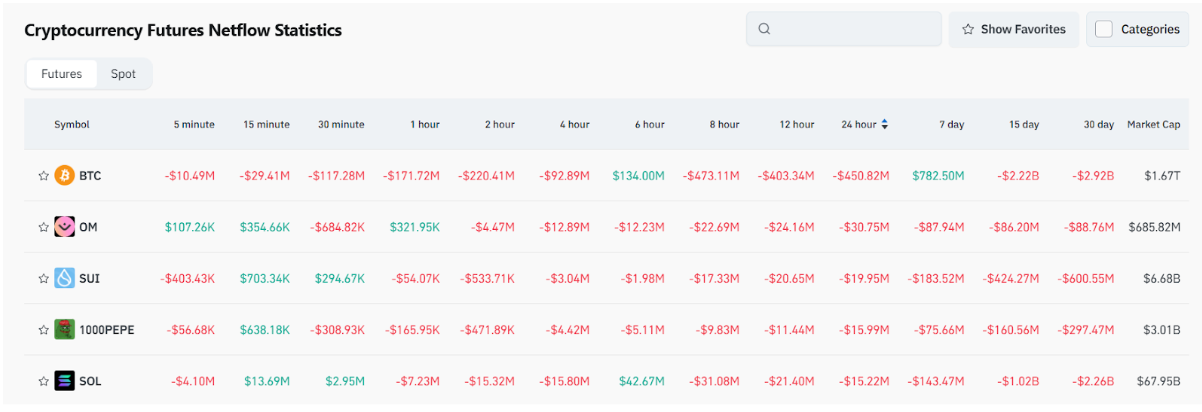

5.Over the past 24 hours, $BTC, $OM, $SUI, $PEPE and $SOL

led in futures trading net outflows, signaling potential trading opportunities.

Institutional insights

Matrixport: Bitcoin ETF capital inflows are mostly driven by leading institutions, reflecting stronger institutional demand than retail participation

X post:

https://x.com/Matrixport_CN

Coinbase Research: BTC breaks below key support level, suggesting the potential onset of a sustained downtrend

Article:

https://www.coinbase.com/

VanEck: Bitcoin bonds could help refinance up to $14 trillion in U.S. debt.

QCP:

BTC

not yet seen as a safe haven—defensive sentiment to continue until macro clarity emerges

Article:

https://t.me/QCPbroadcast/1439

News updates

1.Powell: Bank regulation related to crypto is expected to be "partially relaxed."

2.California sues Trump's tariff policy as illegal and harmful to the economy.

3.South Korean presidential candidate Hong Chun-pu vows pro-crypto and pro-blockchain policies, following the Trump administration.

4.Trump's second son was invited to TOKEN2049 Conference in Dubai.

Project updates

1.The joint motion filed by SEC and Ripple to pause appeal has been approved.

2.Four.meme launches a buyback and burn program for PancakeSwap V3 LP revenue.

3.Raydium launches LaunchLab, a token issuance platform.

4.DWF Labs buys $25M worth of WLFI tokens.

5.Bitget unveils an on-chain rebate program bridging CEX and DEX returns.

6.MANTRA co-founder reaffirms his commitment to destroy his individual OM holdings and to implement a comprehensive OM burn plan.

7.The TRUMP project team removes liquidity and withdraws $4.6 million.

8.Data: Bitget's derivatives market share rose to 13.25%, ranking fourth among global CEXs.

9.Pump.fun: Only one graduated token has exceeded $1 million in market cap in the past 24 hours.

10.Hyperlane Foundation: HYPER pre-claim ends and will be officially opened next week.

Highlights on X

@Trader_S18: On the brink of a "big short age"—interglacial lull, Trump's tariff game, and cracks in US equity and debt markets

Markets are in a lull between two "ice ages"—a 90-day break in tariff wars as Trump courts allies. US equities and BTC are consolidating but lack breakout momentum amid rising concerns over a looming debt crisis. The Buffett Indicator is flashing red, U.S. Treasury auctions are weak, and the Fed faces open pushback from Wall Street—all shaking the U.S. Treasury's role as a "consensus anchor". Trump's aggressive tariff stance appears is caught between internal resistance and external pressure. A major shorting wave could be on the horizon. In this environment of creeping instability, investors should watch for short setups when macro headwinds coincide with high valuations and a rebound opportunity when extreme pessimism meets market indifference to bad news. As a liquidity proxy, Bitcoin will continue to resonate with U.S. stocks, ushering in a volatile cycle where short-term opportunities and long-term risks coexist.

Murphy: Whale accumulation isn't FOMO—it's timing

Whales recently accumulated heavily in the $83k–$85k range. While this may appear to be chasing, it's actually part of a long-term strategy. Unlike retail investors who aim to "buy the bottom," whales tend to focus on the intersection of market structure and medium-term trend shifts. They often open large positions early in a rebound and scale out precisely near local tops. Historically, whales build early and exit at the top—except in black swan events like FTX. This latest round of accumulation may signal strong conviction in further upside, even if the current level isn't the cycle bottom.

@ChillTRD: Hidden AI gem on Solana: Why I'm all in on $MAIAR

MAIAR is one of the few AI Agent projects in the Solana ecosystem that combines strong technical infrastructure, a low valuation, genuine innovation, and ongoing development. Its plugin-based design addresses the rigidity and integration difficulties of most frameworks and enables real-time decision-making, making it a strong challenge to ARC and ai16z. The core developers behind it have previously led the development of the core modules of ElizaOS (formerly ai16z), and GitHub's frequent updates indicate its ongoing development. With one-click deployment on the horizon, the barrier to entry for developers will drop significantly, accelerating adoption. As the market shifts its focus back to practical, real-world AI applications, MAIAR could emerge as a breakout contender in the Solana AI space — with 9-figure potential in the medium to long term.

@market_beggar: Bitcoin cycles are fading: Time to rethink how we trade —The on-chain perspective on bull bear markets

The once-reliable "four-year cycle" narrative tied to halving events is losing its grip. The 2021 double top already signaled that we should not expect history to repeat itself. On-chain data reveals that the percentage of "1–3 year holders"—historically the most reliable indicator of bull/bear transitions—is now flattening. Simultaneously, URPD shows unprecedented concentration at peak price levels, signaling a new market structure phase. If the cycle effect truly disappears, traders may need to ditch legacy frameworks and adopt more logical and adaptive on-chain tools like AVIV Heatmap to stay ahead in a lower-volatility world. BTC is still early in its journey to mainstream adoption — only by evolving our mindset can we stay relevant.

7

2

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Locked for new tokens.

APR up to 10%. Always on, always get airdrop.

Lock now!

You may also like

Bitcoin ETFs Experience Influx Amid Positive Sentiment Shift in Crypto Market

Coinotag•2025/04/26 11:55

Pi Network Price Consolidation Holds Key to Possible Breakout Above $0.68

Coinotag•2025/04/26 11:55

ARK Invest’s Bitcoin Forecast: Exploring Potential Paths to $2.4 Million Amid Adoption Concerns

Coinotag•2025/04/26 11:55

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$94,279.73

-1.49%

Ethereum

ETH

$1,795.84

-0.60%

Tether USDt

USDT

$1

-0.03%

XRP

XRP

$2.2

-0.82%

BNB

BNB

$605.16

-0.40%

Solana

SOL

$148.66

-4.31%

USDC

USDC

$1

+0.01%

Dogecoin

DOGE

$0.1820

-1.78%

Cardano

ADA

$0.7087

-2.09%

TRON

TRX

$0.2506

+2.61%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new Bitgetters!

Sign up now