News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Jan.7)|Walmart’s OnePay app launches BTC and ETH trading services; Polymarket introduces taker fees; Discord confidentially files for IPO2Bitget US Stock Daily | Tariff Ruling Suspense to Be Revealed This Week; Fed Officials' Interest Rate Debate Intensifies; Metals Surge with Gold and Silver Hitting New Highs (26/01/07)3Bitcoin Price Analysis: Critical $94K Resistance Threatens Alarming Drop to $85K Support

AUD/JPY Price Forecast: Attracts some sellers, initial support level emerges above 102.50

101 finance·2026/01/08 05:57

GBP/JPY struggles below 211.00 as flight to safety benefits JPY; lacks bearish conviction

101 finance·2026/01/08 05:57

EUR/JPY stays muted around 183.00 as BoJ's move toward policy normalization gathers momentum

101 finance·2026/01/08 05:39

Why Wall Street Is Paying Attention to XRP? A Brief On Market Sentiments

CoinEdition·2026/01/08 05:24

AI to boost copper demand 50% by 2040, but more mines needed to ensure supply, S&P says

101 finance·2026/01/08 05:15

USD/INR recovers as investors brush off RBI’s intervention

101 finance·2026/01/08 05:06

ICB Network Partners with Elderglade to Pioneer AI-Driven Retro Fantasy Gaming

BlockchainReporter·2026/01/08 05:00

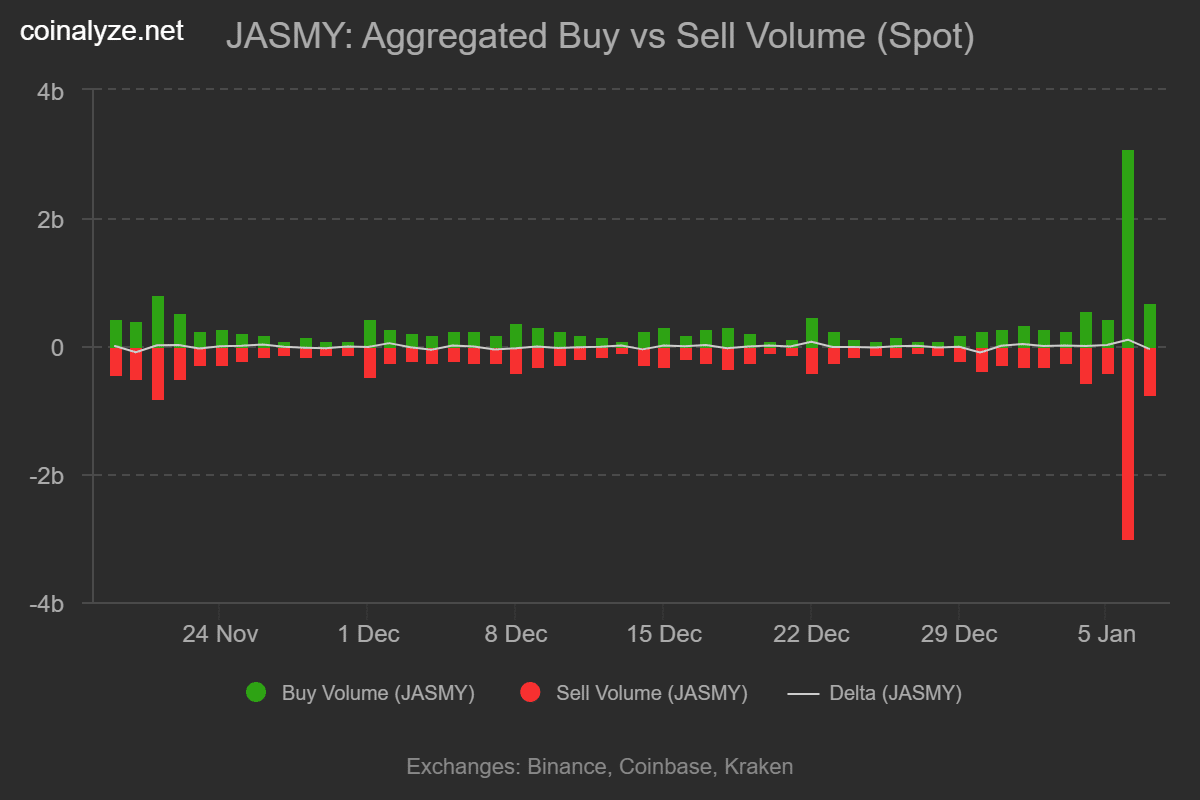

JasmyCoin surges 12%, breaks its range – Can this rise continue?

AMBCrypto·2026/01/08 04:03

Flash

05:52

Spot silver continues to decline, falling below the $76 markPANews, January 8 – Spot silver continues its sharp decline in the short term, falling more than 3.00% intraday and is now quoted at $75.82 per ounce.

05:49

Tom Lee's first overseas trip of the new year: A broad-based market rally at the start of the year is a good sign, but a bear market may emerge by mid-year. Tom Lee stated in an interview with CNBC that a broad market rally (stocks, precious metals, cryptocurrencies, etc.) at the beginning of 2026 has always been a good sign for investors and institutional investors. This year will be one of "joy, depression, and rally," similar to the pattern in 2025. There will be a moment this year that feels like entering a bear market, but it will be followed by a strong rebound, and the stock market will ultimately end on a bullish note. He predicts the S&P 500 index could reach 7700 points by the end of 2026.

He believes that when the market tests the new Federal Reserve Chair, there may be a 15% to 20% pullback, especially in the second half of the year, but this is not the end of the cycle, rather a buying opportunity.

05:46

Tom Lee makes his first appearance of the new year: A broad rally at the start of the year is a good sign, but a bear market may emerge mid-year.BlockBeats News, January 8, Tom Lee stated in an interview with CNBC that a broad-based rally at the beginning of 2026 (across stocks, precious metals, cryptocurrencies, etc.) has always been a good sign for both individual and institutional investors. This year will be one of "joy, depression, and rally," similar to the pattern expected in 2025. "There will be a moment this year when it feels like we are entering a bear market," but there will be a strong rebound afterwards, and ultimately the stock market will end on a bullish note. He predicts that the S&P 500 index could reach 7,700 points by the end of 2026. He believes that when the market tests the new Federal Reserve Chair, there may be a 15% to 20% correction. This is especially likely in the second half of the year, but it will not mark the end of the cycle; instead, it will be a buying opportunity.

News