News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (April 15) | MicroStrategy adds 3459 BTC; Canada to launch spot Solana ETFs with staking capabilities this week2SOL Strategies and Pudgy Penguins Launch PENGU Validator on Solana Network3Canada to launch spot Solana ETFs this week: report

Market Structure Legislation Will Boost Bitcoin: Satoshi Act Co-Founder Dennis

With market structure legislation picking up steam, states and global players are discreetly preparing for a future that incorporates Bitcoin, identifying a major shift in policy and investment trends.

CryptoNews·2025/04/16 00:22

Mantra CEO Breaks Silence After Historic OM Crash

Cointribune·2025/04/15 22:44

How Many Bitcoins Can The U.S. Government Actually Buy?

Cointribune·2025/04/15 22:44

Expert Says XRP Case Win Won’t Guarantee Price Surge—Here’s Why

CryptoNewsFlash·2025/04/15 22:22

FIL Price Forecast: Explosive Growth Likely After Filecoin (FIL) v1.32.2 Upgrade

CryptoNewsFlash·2025/04/15 22:22

SEC Pushes Back WisdomTree Bitcoin ETF Verdict to June

CryptoNewsFlash·2025/04/15 22:22

EURC Hits New Record as Demand Grows Across Blockchains

CryptoNewsFlash·2025/04/15 22:22

XRP Price Could Regain Momentum—Is a Bullish Reversal in Sight?

Newsbtc·2025/04/15 20:55

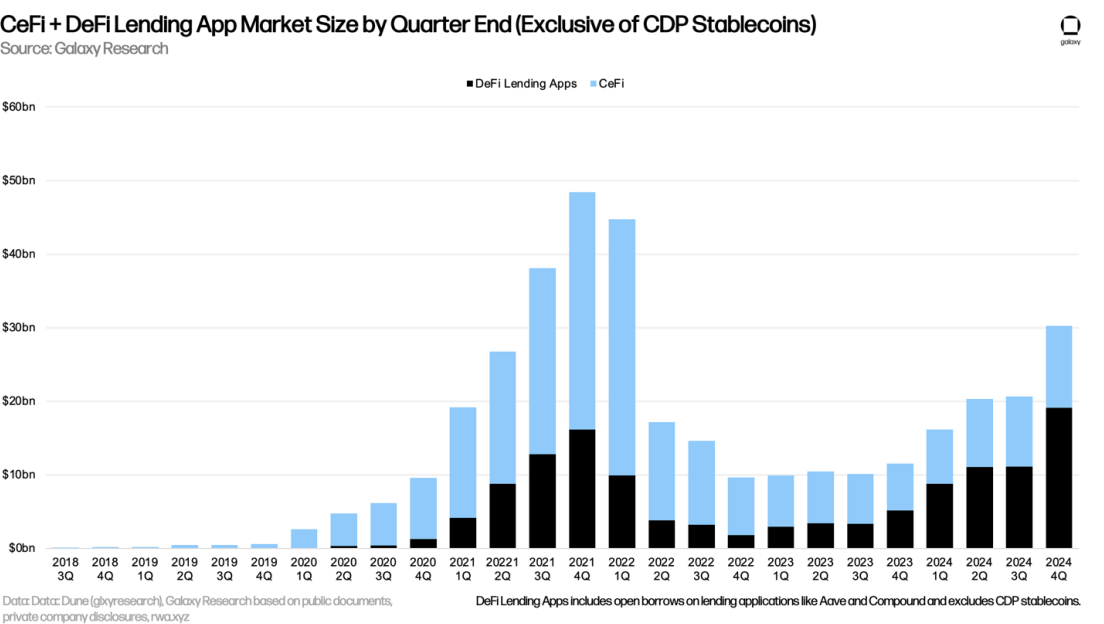

CeFi lending’s up 73% after the sector’s collapse: Galaxy

Both CeFi and DeFi lending have made a comeback, Galaxy noted

Blockworks·2025/04/15 17:23

Flash

- 02:50Support for Staked Spot Solana ETF to Begin Trading on Toronto Stock Exchange TodayExchange-traded fund issuer Purpose Investments announced the launch of the spot Solana ETF: Purpose Solana ETF (ticker: SOLL). This ETF will begin trading today on the Toronto Stock Exchange, aiming to provide direct spot exposure to Solana and staking rewards, while also offering CAD-hedged, CAD-unhedged, and USD-unhedged options.

- 02:50VanEck Proposes Bitcoin-Linked Treasuries to Offset $14 Trillion US DebtOn April 16th, it was reported that Matthew Sigel, Head of Digital Asset Research at VanEck, proposed a new debt instrument called "BitBonds," which combines US Treasuries with Bitcoin exposure as a new strategy to manage the government's upcoming $14 trillion refinancing need. This concept was introduced at the Strategic Bitcoin Reserve Summit, aiming to address the sovereign funding needs and investors' demand for inflation protection. The BitBonds would be designed as 10-year securities composed of 90% traditional US Treasury exposure and 10% Bitcoin, with the Bitcoin portion funded by proceeds from the bond sales. Upon maturity, investors would receive the full value of the US Treasury component, i.e., $90 for every $100 bond, plus the value of the Bitcoin allocation. Additionally, investors would gain all the upside from Bitcoin until their yield reaches 4.5%. Any gains beyond this threshold would be split between the government and bondholders. Sigel stated that for investors who believe in Bitcoin, BitBonds would be a "convex bet," as the instrument would provide asymmetric upside potential while retaining a layer of risk-free return. However, its structure implies that investors would bear all the downside risks associated with Bitcoin exposure. Previously, the Bitcoin Policy Institute (BPI) proposed issuing Bitcoin bonds (BitBonds) to assist in repaying US national debt.

- 02:49Three Programmers Insert Backdoor into iToken Wallet to Steal Wallet Private Keys, Illegally Obtaining a Total of 27,622 Mnemonic PhrasesOn April 16th, it was reported that three programmers inserted a "backdoor" into the iToken wallet application to illegally obtain users' digital wallet private keys and mnemonic phrases. They were sentenced to three years in prison and each fined 30,000 yuan. According to the investigation, the three individuals illegally obtained a total of 27,622 mnemonic phrases and 10,203 private keys, successfully converting 19,487 digital wallet addresses. The three defendants were responsible for writing the request logic code, setting up the back-end server, purchasing domains, and encrypting private keys. The court also ruled that they are prohibited from engaging in network security management and network operations, as well as related work, for three years after completing their sentences.