News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

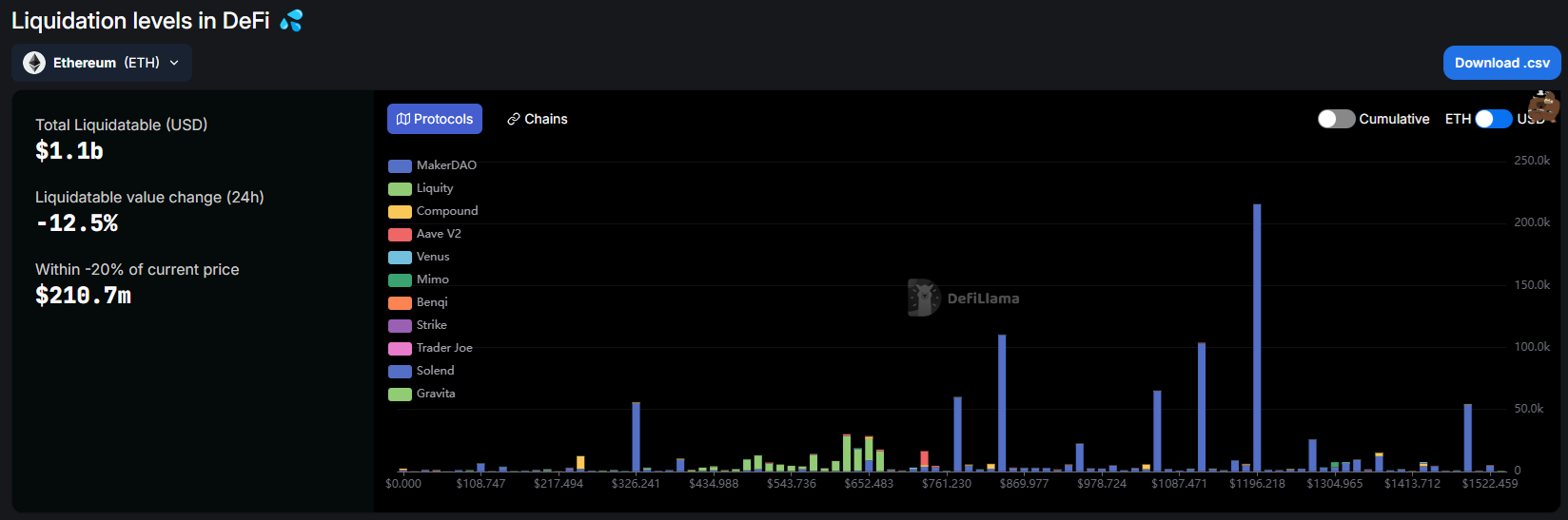

Share link:In this post: Whales panic-sold ETH, in addition to the series of liquidations. One whale on Maker added collateral to push the liquidation price down to $912.02. The Seven Siblings whale started buying again at around $1,700, signaling the local low may be near.

Share link:In this post: The popular Hyperliquid whale is active again with a new 20X leveraged long on Ethereum. The position started at $1,459, suggesting ETH may bounce without reaching the liquidation price. Hyperliquid remains relatively stable, despite recent ETH position liquidations and the JELLY token price manipulation.

Bitcoin battles everything from a "death cross" to record low sentiment as US trade tariffs wreak havoc across global markets — will 2021 prices return?

- 07:07Data: The total open interest of Bitcoin contracts across the network rises to $59.84 billionAccording to Coinglass data, the total open interest of Bitcoin futures contracts across the network is 679,590 BTC (approximately $59.84 billion).

- 06:25Citi: Fed May Cut Rates Up to 5 Times This YearAccording to a report by Jinse, Citibank predicted on Monday that by June, the U.S. economy will show clear signs of weakening, prompting the Federal Reserve to make its first rate cut of the year, potentially cutting rates up to five times. Economists at Citibank stated that Federal Reserve officials will focus more on the health of the economy and the labor market rather than inflation. Citibank wrote: We anticipate that a series of data will make Federal Reserve officials more dovish by June. This leads us to believe the risks are inclined towards quicker and/or more substantial rate cuts. Currently, Citibank states that by the end of 2025, the key federal funds rate is expected to decrease from the current 4.25% to 4.5% range to a range of 3% to 3.25%.

- 06:24Solana's 29.1 Million Active Addresses in the Past 7 Days Lead All ChainsAccording to Odaily, Nansen data shows that in the past 7 days, the blockchains with the highest number of active addresses are: Solana (29.1 million), Tron (5.8 million), BNB Chain (4.7 million), Base (4.3 million), and Bitcoin (2.7 million). Solana leads with a significant margin, with activity far surpassing other public chains.