Bitget Daily Digest (4.22) | Trump Calls on Powell to Cut Rates Again, SEC Welcomes Crypto-Friendly Chairman

View original

远山洞见2025/04/22 01:50

By:远山洞见

Today's Preview

1. Federal Reserve Vice Chair Jefferson speaks at the Economic Liquidity Summit

2. The US Richmond Fed Manufacturing Index for April to be announced today

3. zkLink announces a delay of 6 months for the token unlock schedule for investors and teams

4. SCR will unlock 39 million tokens on April 22, valued at $8.69 million, accounting for 3.9% of circulation

Key market highlights

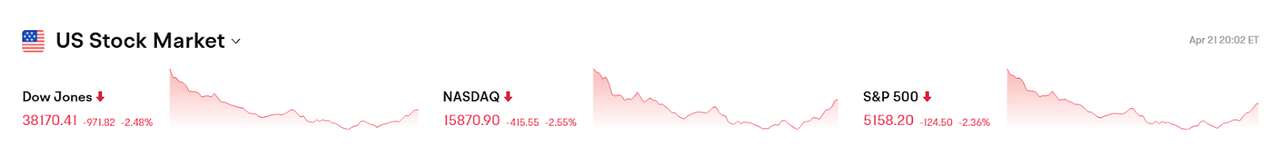

1. US stocks plunged, President Trump lashes out at Powell, calling for the Fed Chair to cut rates. Trump expressed on his social media site that he favors "preemptive rate cuts" and brazenly labeled the Fed Chair as a "loser." Trump asserted that inflation is almost nonexistent and urged Powell to lower interest rates; otherwise, economic growth might slow down.

2. The US Securities and Exchange Commission (SEC) announced that Paul S. Atkins has officially been sworn in as the 34th SEC Chair, confirmed by the Senate on April 9. Atkins, a former SEC Commissioner, has been deeply involved in digital asset and market regulation reforms, emphasizing regulatory transparency and cost-efficiency. As chair, he will face the review of applications for 15 altcoin and Meme token ETFs and over 70 application files including funds tied to Solana, XRP, DOGE, Pengu, among others.

Bloomberg ETF Analyst Eric Balchunas indicated that currently, there are 72 cryptocurrency-related ETF applications in the US awaiting feedback, including requests for listing option products. This new crypto-friendly chair will make his debut judgment on which cryptocurrencies could be approved for listing as commodity trust products.

3. The Grayscale Decentralized AI Fund, launched by Grayscale, is now open to eligible investors. The fund offers a diversified investment opportunity in the intersection of AI and cryptocurrency. The fund's portfolio includes 6 tokens: $NEAR, $TAO, $RENDER, $FIL, $GRT, and $LPT.

4. According to Coinmarketcap data, the market has slightly recovered, with the altcoin season index rising from the recent low of 14 during Trump's tariff days to 18, though still significantly down from the March average of 32. Since hitting an annual high of 87 on December 4, 2024, the index has been declining, and only 10 tokens in the top 100 by market cap have outperformed Bitcoin in the past 90 days. The top-performing altcoin tokens in the past 90 days include $FORM, $AB, $XCN, $IP, $MKR.

5. The CAKE Tokenomics 3.0 is set to be implemented on April 23; veCAKE and Gauges Voting will officially exit the market. All CAKE and veCAKE stakes will be unlocked, and users who staked CAKE directly through the PancakeSwap interface can exchange veCAKE for CAKE at a 1:1 ratio. Users have 6 months to redeem their staked CAKE and veCAKE through the PancakeSwap interface.

Market Trends

1. $BTC spiked to the line of $88,000 before experiencing fluctuations, with mixed market trends; new currency $EPT continues to fluctuate, small currencies $PIXFI $PIRATE, etc., surged, and $PROMPT entered the top ten by trading volume.

2. Trump's call for Powell to cut rates led to a US stock-bond-currency downturn, with the dollar plunging below a three-year low and gold surging over 3%.

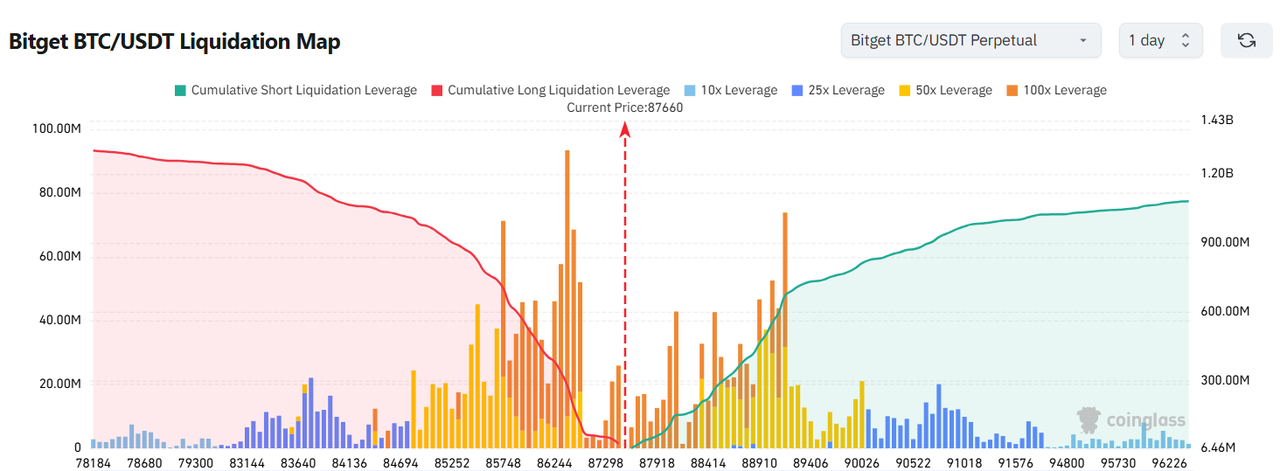

3. In the Bitget BTC/USDT liquidation map, at the current price of 87,576 USDT, if it drops 1,000 points to around 86,576,

the cumulative liquidation amount for long positions exceeds $110 million. If it rises 1,000 points to around 88,576,

the cumulative liquidation amount for short positions exceeds $315 million. The short liquidation amount far exceeds the long, suggesting reasonable leverage control to avoid large-scale liquidations amid market movements.

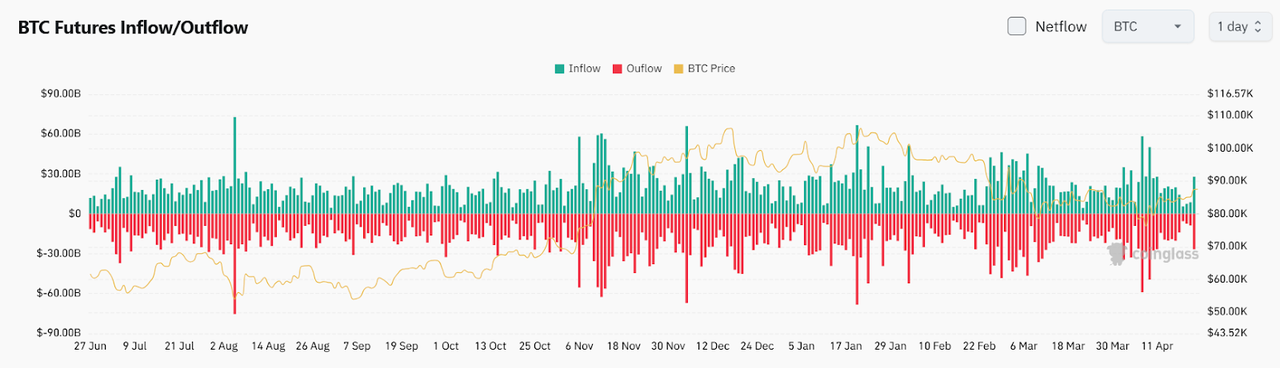

4. Over the past 24 hours, BTC spot inflows were $3.3 billion, with outflows of $3 billion,

a net inflow of $300 million

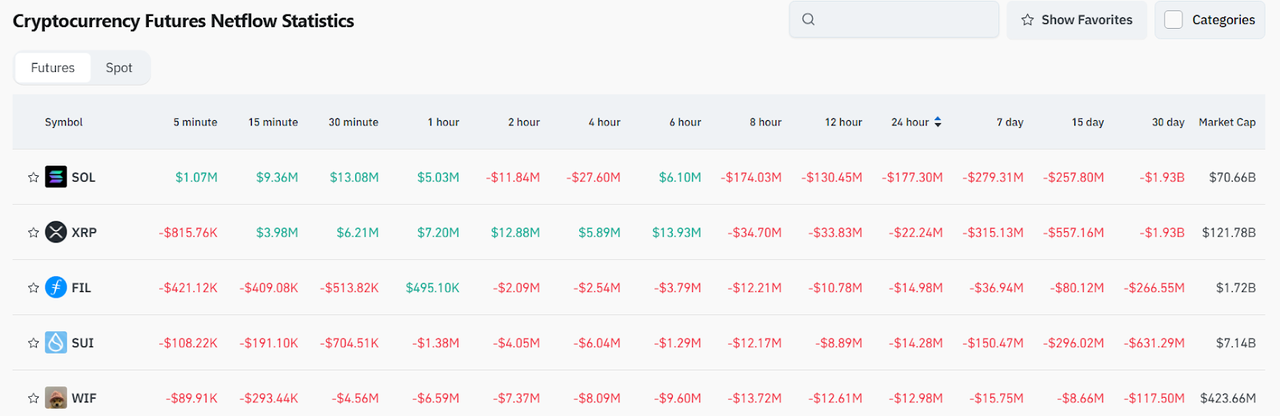

5. In the past 24 hours, contract trading in $SOL $XRP $FIL $SUI $WIF

leads in net outflows, indicating potential trading opportunities

Institutional Insights

10x Research: Bitcoin's rise to $87,000 may be driven by a drop in the dollar index and an increase in gold

X post:

https://x.com/markus10x/

QCP: Watch Bitcoin's key resistance level at $88,800, institutional confidence is initially recovering

Original link:

https://t.me/QCPbroadcast/1439

Greeks.live: The community is cautiously optimistic in the short term, expecting BTC to oscillate between $85,300 and $87,000

X post:

https://x.com/GreeksLive/

News Updates

1. Paul S. Atkins officially inaugurated as the 34th SEC Chair

2. The Bank of Japan sees no need to change its basic rate hike stance

3. Fox reporter: Musk may announce an exit date from the "Efficient Government Department of the U.S." on Tuesday

4. Trump reiterates low inflation, urging Powell to cut rates

5. U.S. Conference Board Leading Economic Index in March recorded a month-on-month rate of -0.7%, the largest drop since October 2023

Project Updates

1. Hyperlane Foundation: Airdrop to open for claims at 20:00 on April 22

2. SKYAI announces the open application for MCP custody applications and MCP protocol committee observer seats

3. Omni Network launches $10 million user reward program

4. Mantra: In the process of burning 150 million OM tokens belonging to the team

5. In the past month, the number of active USDT addresses on the BSC chain hit a record high

6. Ethereum Foundation announced its recent focus shift towards user experience and L1 scalability

7. pump.fun platform's weekly token graduation rate has been increasing for three consecutive weeks

8. PancakeSwap announces CAKE Tokenomics 3.0 implementation starting April 23

9. Of Bybit's stolen funds, 27.59% are untraceable, while 68.57% remain traceable

10. Bloomberg Analyst: There are currently 72 crypto asset-related ETFs awaiting U.S. SEC approval

Highlights on X

I. Phyrex: ETH Data Remains Weak, Institutional Selling Slows, but Buying Lacks Momentum

Although the phenomenon of some institutional sell-offs has noticeably decreased, ETH's overall data continues to be sluggish, with no net inflows recorded in the past week. The size of selling in the 38th week is almost the same as the previous week. Compared to BTC's stable buying sentiment, ETH currently lacks effective purchasing power support, showing a continual pessimistic market expectation for its short-term performance. If the current trend remains unchanged, most of the selling pressure may be unleashed by the end of the year.

II. Millionaire Eric: Haven’t Boarded the Bitcoin Train Yet? Don’t Worry, Real Opportunities Are Ahead

Bitcoin is currently in a consolidation phase with an unclear direction, and blindly chasing the rise is not a high probability strategy. The real high-reward opportunity is to enter when the trend breaks out clearly and the direction is established, with clear stop-losses and low judgment costs. Most people buy at the bottom during consolidation, hesitate during breakouts, and are indecisive during rises, only to chase high "wishes" driven by emotion, often missing good opportunities. The core of trading is waiting, not fantasizing.

III. Underwater Observer: New Phase for On-Chain Version Switch: VC and Industry Funds Leading the Way

As the “trader version” led by on-chain leaders reaches its limits, liquidity games dominated by Meme are hard to break through their ceilings. VCs and exchanges with industry collaboration capabilities will gradually become the leading force on-chain. The core value of the leaders lies in investment research and trading but lacks infrastructure and new user capabilities. After experiencing two-year cycles, VC institutions are gradually turning to on-chain activities, equipped with funds, resources, and willingness to build, ushering the on-chain ecosystem into a new cycle from "trading-driven" to "industry collaboration."

IV. Honest Michael: First Lesson from $TROLL: Don’t Buy the Bottom of “Attention” Draining Out

Meme coins are not value investments; they're more like a game of attention and liquidity. When a coin's popularity, topic level, and FOMO emotion peak, attention begins to decline, and liquidity follows. At this point, buying the bottom on the left side equals sending yourself to death. The key to deciding whether to enter the market isn't how much it's declined, but whether there “is another bigger attention and liquidity station.” Without new attention, boosting the price becomes meaningless. The following buyers will cause the main holder to abandon the shell and run away, creating the "instant halving" you see. Remember: Only play the new, not the old, is the only consensus in the Meme market.

4

3

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Locked for new tokens.

APR up to 10%. Always on, always get airdrop.

Lock now!

You may also like

ARK Invest Raises 2030 Bitcoin Price Target to as High as $2.4M in Bullish Scenario

Cointime•2025/04/25 12:44

XRP News: What's on May 19 for XRP?

Cryptoticker•2025/04/25 12:11

ADA Explodes Past $0.70 — What Now?

Cryptoticker•2025/04/25 12:11

PEPE Dips Slightly – But Whales Are Still Accumulating. Should You Follow?

Pepe's funding rate has risen strongly in the past couple of days, one of several signals that more gains are coming.

CryptoNews•2025/04/25 09:55

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$95,577.21

+2.78%

Ethereum

ETH

$1,811.28

+3.18%

Tether USDt

USDT

$1

+0.03%

XRP

XRP

$2.21

+0.64%

BNB

BNB

$606.64

+1.58%

Solana

SOL

$152.95

+2.05%

USDC

USDC

$0.9999

+0.00%

Dogecoin

DOGE

$0.1847

+3.23%

Cardano

ADA

$0.7256

+0.03%

TRON

TRX

$0.2437

-1.07%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new Bitgetters!

Sign up now