Solana price falls below $100 as $200M unlock nears

- $114.57 held as support earlier, but trend now weakening.

- RSI at 44 shows slight overselling, momentum unclear.

- Solana’s DeFi TVL climbs to $56 million, highest in 3 years.

Solana (SOL) is now trading at $97.86, slipping below the key $120 level that had acted as a major pivot in recent weeks.

The drop comes just as the network sees its Total Value Locked (TVL) climb to a three-year high of $56 million and ahead of a scheduled $200 million token unlock, the largest of its kind until 2028.

The combination of rising DeFi activity and an increase in circulating supply has placed the token at a crucial crossroads, with traders closely monitoring support levels and potential volatility.

Broader crypto market weakness has also contributed to the decline, impacting sentiment across altcoins.

Source: CoinMarketCap

Solana price holds $114 support

Despite the latest dip, Solana had earlier shown strong buying interest around the $114.57 level.

This price zone, once a resistance area through 2023 and early 2024, had flipped into support before the current correction.

Market participants had been eyeing $120 as a key reversal zone, but price action has since weakened.

The next resistance remains at $135, which may come into play if SOL recovers.

A continued drop below $97 could expose the token to further downside, particularly if buyer support weakens near previous demand areas.

RSI and momentum indicators mixed

Solana’s Relative Strength Index (RSI) is currently at 44, indicating the asset is slightly oversold.

Although RSI had been trending upward earlier, the latest price decline suggests buying momentum is weakening again.

The Awesome Oscillator remains in negative territory, although its histogram recently began turning green, hinting at a possible momentum shift.

However, the current indicators do not confirm a clear trend reversal yet, and traders are cautious ahead of the upcoming unlock.

Market structure remains fragile, and sudden price moves are not uncommon around major token release events.

DeFi TVL hits $56M on Solana

Solana’s blockchain is showing growth on the decentralised finance (DeFi) front. Its TVL has risen to $56 million, the highest level in almost three years.

This milestone points to growing interest in Solana-based DeFi platforms, with more capital being deployed across protocols.

The growth in TVL highlights increasing user activity and potentially stronger long-term fundamentals.

However, the positive DeFi trend contrasts with short-term price weakness, creating a mixed market picture.

$200M Solana unlock sparks caution

On-chain data confirms a $200 million token unlock is imminent, marking the largest single-day release of SOL tokens until 2028.

Unlock events tend to introduce temporary price pressure by increasing the circulating supply, especially if some recipients opt to sell.

The timing of the unlock—while Solana trades below $100—has raised concerns about near-term volatility.

The unlock could accelerate price moves in either direction, depending on how the market absorbs the additional supply.

Traders are positioning cautiously, with some watching for entry points on further weakness and others adjusting risk amid the uncertain outlook.

Liquidity conditions around the unlock date will likely determine the scale of market reaction.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

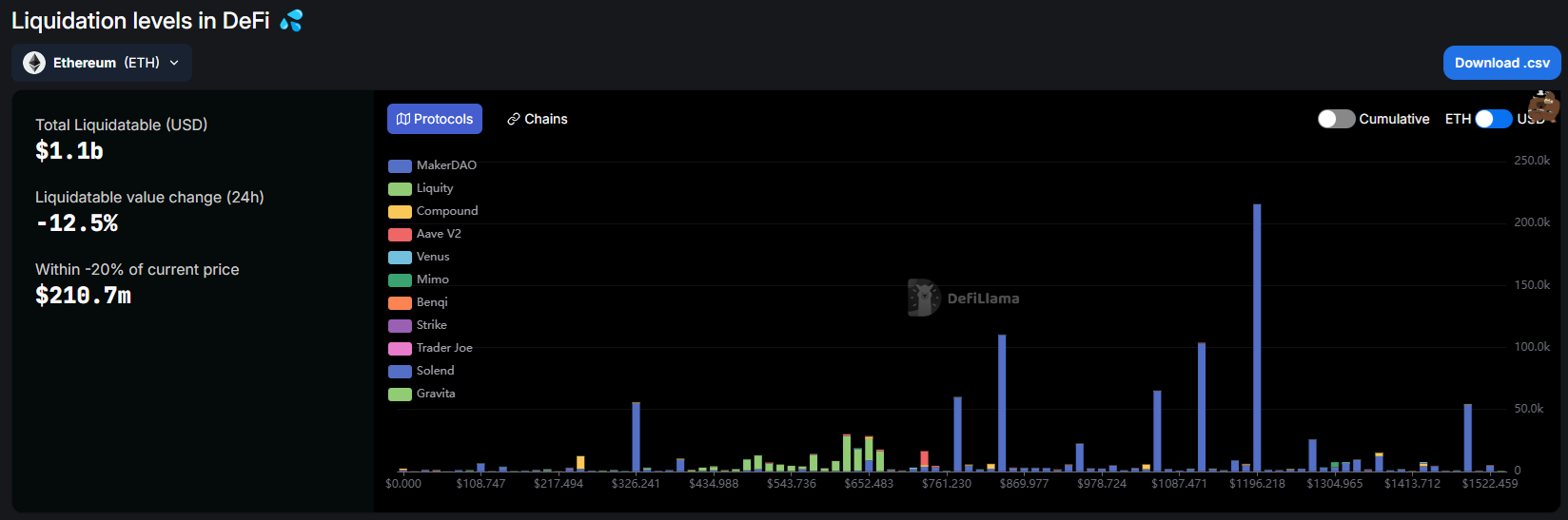

Ethereum (ETH) crashed on selling and liquidation pressure, but whales are still buying the dip

Share link:In this post: Whales panic-sold ETH, in addition to the series of liquidations. One whale on Maker added collateral to push the liquidation price down to $912.02. The Seven Siblings whale started buying again at around $1,700, signaling the local low may be near.

The 50X Hyperliquid whale is back with new leveraged long on Ethereum (ETH)

Share link:In this post: The popular Hyperliquid whale is active again with a new 20X leveraged long on Ethereum. The position started at $1,459, suggesting ETH may bounce without reaching the liquidation price. Hyperliquid remains relatively stable, despite recent ETH position liquidations and the JELLY token price manipulation.

Dogecoin’s support under threat amid rising liquidation pressure

Cardano Price Dips Below $0.64 Amid Bearish Sentiment—Could a Recovery Be Imminent?