cVault.finance 價格CORE

您今天對 cVault.finance 感覺如何?

cVault.finance 今日價格

CORE 的最高價格是多少?

CORE 的最低價格是多少?

cVault.finance 價格預測

什麼時候是購買 CORE 的好時機? 我現在應該買入還是賣出 CORE?

CORE 在 2026 的價格是多少?

CORE 在 2031 的價格是多少?

cVault.finance 價格歷史(TWD)

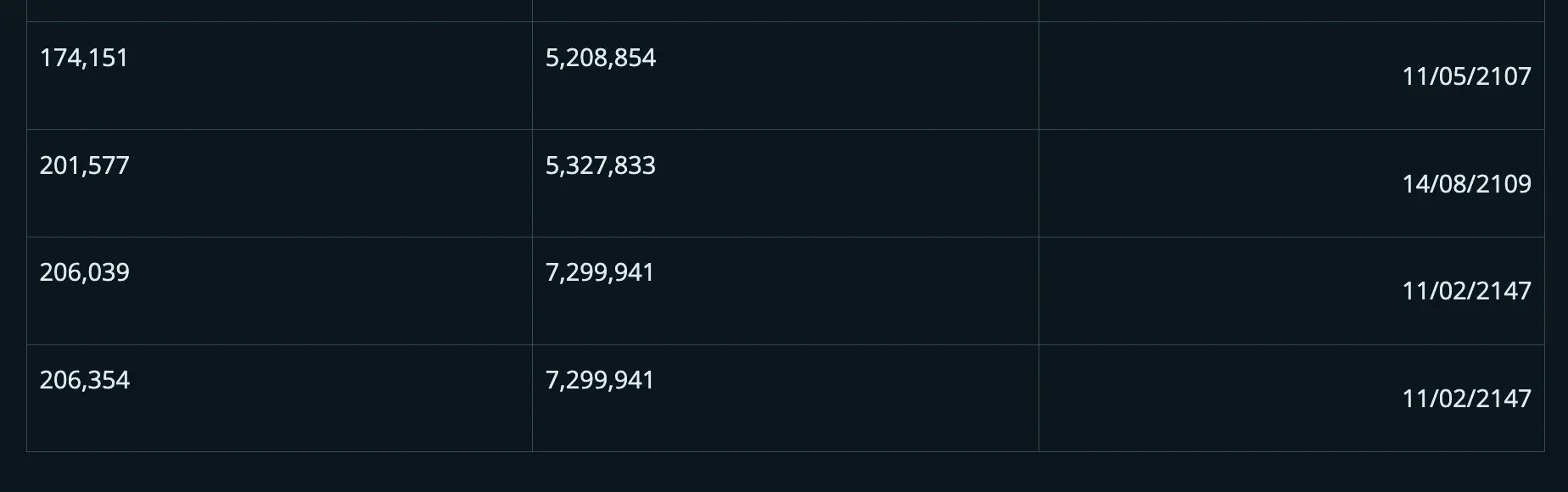

最低價

最低價 最高價

最高價

cVault.finance 市場資訊

cVault.finance 持幣

cVault.finance 持幣分布矩陣

cVault.finance 持幣分布集中度

cVault.finance 地址持有時長分布

cVault.finance 評級

cVault.finance (CORE) 簡介

cVault.finance是一个具有重要历史意义和独特功能的加密货币。它是一个基于以太坊的智能合约平台,旨在提供安全、去中心化的价值储存和资产管理解决方案。

作为去中心化金融(DeFi)运动的一部分,cVault.finance赋予用户在数字资产领域更大的自治权和控制权。它为用户提供了一种安全、透明和高效的方式来存储和管理他们的加密资产。

cVault.finance的主要特点之一是其创新的加密货币储存解决方案。它通过将用户的加密资产存放在智能合约中,以确保这些资产的安全性和不可变性。这种储存方式消除了传统金融机构和银行的中介角色,使用户能够直接掌控自己的资产。

另一个重要的特点是cVault.finance的资产管理功能。它为用户提供了丰富的工具和功能,使其能够有效地管理其数字资产组合。这包括自动的风险控制机制、流动性提供者奖励计划和挖矿收益分配机制。通过这些功能,用户可以获得更好的资产配置和更稳定的收益。

cVault.finance的重要历史意义在于它推动了加密货币行业的发展。它展示了去中心化金融的潜力,并为用户提供了更多的自由和灵活性。它也促进了智能合约技术的应用和发展,为整个加密货币生态系统带来了新的可能性。

总之,cVault.finance是一种具有重要历史意义和独特功能的加密货币。它的创新储存和资产管理解决方案使用户能够更安全、高效地管理他们的加密资产。同时,它也推动了去中心化金融和智能合约技术的发展。这使得cVault.finance成为加密货币行业中备受关注的项目之一。

CORE 兌換當地法幣匯率表

- 1

- 2

- 3

- 4

- 5

cVault.finance 動態

比特幣、以太幣等在美國宣布全面進口關稅的“解放日”後大幅下跌。行業專家警告稱,不斷上升的硬件成本可能會擠壓美國礦工,而其他人則猜測政府可能會利用新的關稅收入來購買比特幣。

比特幣的回調幅度相對於其他加密貨幣較小,因為週五的美國PCE指數數據再次強化了對通脹的擔憂。更廣泛的加密貨幣市場受到更大衝擊,ETH、SOL和XRP在過去24小時內下跌超過6%。專家表示,通脹數據可能會使美聯儲在5月進一步降息的意願減弱,但市場反彈的催化劑仍然存在。

自 2017 年 SegWit 升級以來,Coinbase 交易也可以包含對一個區塊中所有交易的承諾。這些 BIP34 之前的區塊並不包含見證承諾。因此,要產生一個重複的 Coinbase 交易,礦工需要從區塊中排除任何 SegWit 輸出贖回交易,這進一步增加了攻擊的機會成本,因為區塊可能無法包含許多其他支付費用的交易。

購買其他幣種

用戶還在查詢 cVault.finance 的價格。

cVault.finance 的目前價格是多少?

cVault.finance 的 24 小時交易量是多少?

cVault.finance 的歷史最高價是多少?

我可以在 Bitget 上購買 cVault.finance 嗎?

我可以透過投資 cVault.finance 獲得穩定的收入嗎?

我在哪裡能以最低的費用購買 cVault.finance?

在哪裡可以購買加密貨幣?

影片部分 - 快速認證、快速交易

Bitget 觀點

相關資產

![Giftedhands [Old]](https://img.bgstatic.com/multiLang/coinPriceLogo/e070d317cb2c472f68ff9c08fc2583561710435803801.png)

cVault.finance 社群媒體數據

過去 24 小時,cVault.finance 社群媒體情緒分數是 3,社群媒體上對 cVault.finance 價格走勢偏向 看漲。cVault.finance 社群媒體得分是 10,024,在所有加密貨幣中排名第 218。

根據 LunarCrush 統計,過去 24 小時,社群媒體共提及加密貨幣 1,058,120 次,其中 cVault.finance 被提及次數佔比 0.01%,在所有加密貨幣中排名第 177。

過去 24 小時,共有 492 個獨立用戶談論了 cVault.finance,總共提及 cVault.finance 151 次,然而,與前一天相比,獨立用戶數 增加 了 1%,總提及次數增加。

Twitter 上,過去 24 小時共有 1 篇推文提及 cVault.finance,其中 0% 看漲 cVault.finance,0% 篇推文看跌 cVault.finance,而 100% 則對 cVault.finance 保持中立。

在 Reddit 上,最近 24 小時共有 0 篇貼文提到了 cVault.finance,相比之前 24 小時總提及次數 減少 了 100%。

社群媒體資訊概況

3