News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

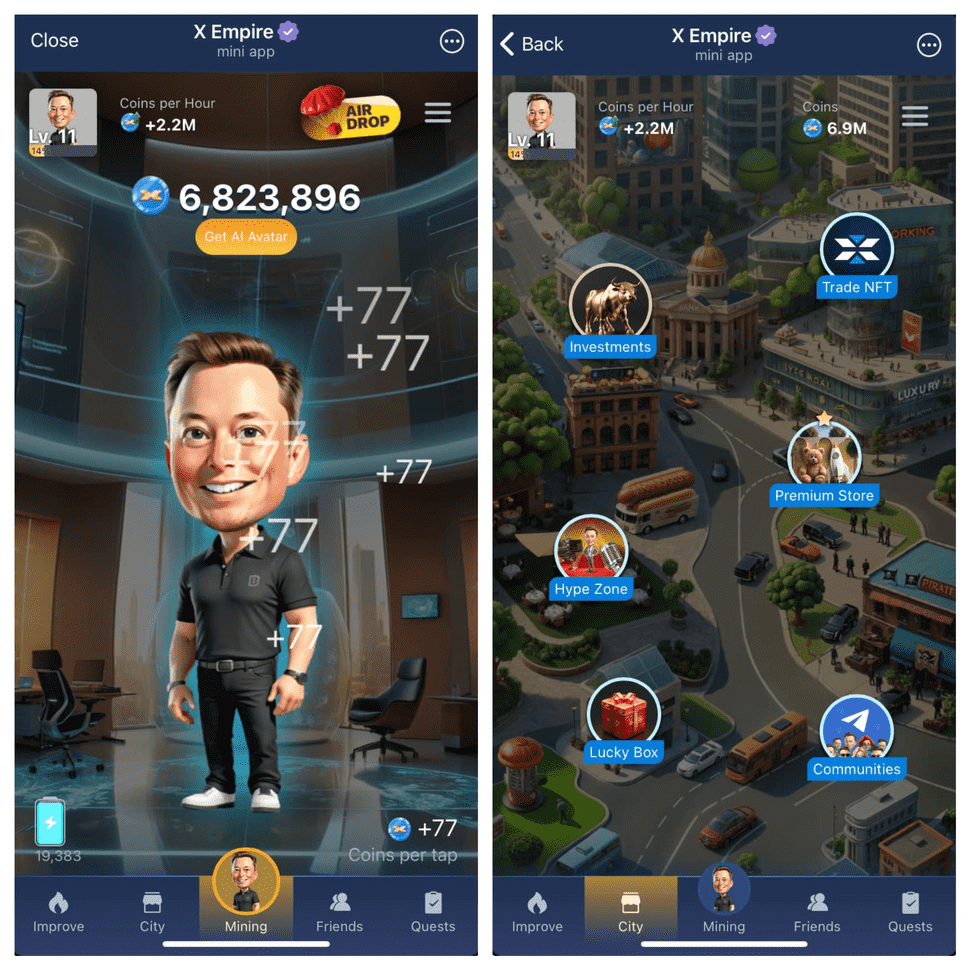

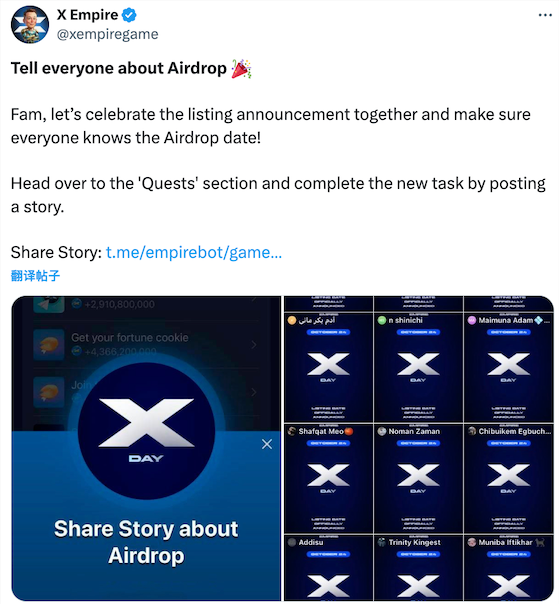

The countdown is on—X Empire is about to make serious waves! In just a few days, the X token airdrop and listing will drop on October 24, 2024, and this is your chance to be part of something HUGE. Whether you’ve been playing along or are ready to jump in, the excitement is real, and this airdrop could be your gateway to the next big thing in crypto. With the token listing on major exchanges, it's time to get ready for a game-changing moment. In this guide, we’ll cover how you can participate in the airdrop, key features, and how to link your TON wallet. It’s fast, it’s exciting, and it’s happening soon—are you ready to join the empire? Let’s dive in!

Just 2 days left until the end of the Chill Phase! Prepare for the X Empire Investment Fund on October 15-16, 2024, to decide which cards we should invest in. Make sure you join in on the excitement and bonuses—time is running out!

In the wake of the market narrative surrounding the "Solana Killer," SUI, which recently launched the Grayscale Sui Trust and Binance futures, has doubled in value within a month. The leading projects in the Sui ecosystem have also benefited from the generous subsidies and strong support provided by the Sui Foundation. This surge has brought numerous opportunities within the Sui ecosystem.

- 18:01Trump: talks with Putin on ending Russia-Ukraine conflict and bilateral issues going wellUS President Donald Trump said via social media that serious discussions are underway with Russian President Vladimir Putin on ending the Russia-Ukraine conflict as well as major economic development deals to be made between the United States and Russia, and that negotiations are going well. He also said he addressed the G7 summit that day along with French President Emmanuel Macron. He said that all sides expressed the goal of wanting the conflict to end. He emphasised the importance of the Key Minerals and Rare Earths Agreement between the United States and Ukraine and expressed the hope that it would be signed as soon as possible.

- 17:19The US Dollar Index DXY briefly dipped 10 pips and is now at 106.56The US Dollar Index DXY briefly dipped 10 points and is now at 106.56.

- 17:09OPINION: Bitcoin's retail demand picks up, may signal price riseBitcoin retail investor demand is rebounding, with the 30-day rate of change in demand having risen to neutral levels from -21%, a level last seen in 2021, according to Cointelegraph. Historical data shows that such rallies usually precede price increases.