News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

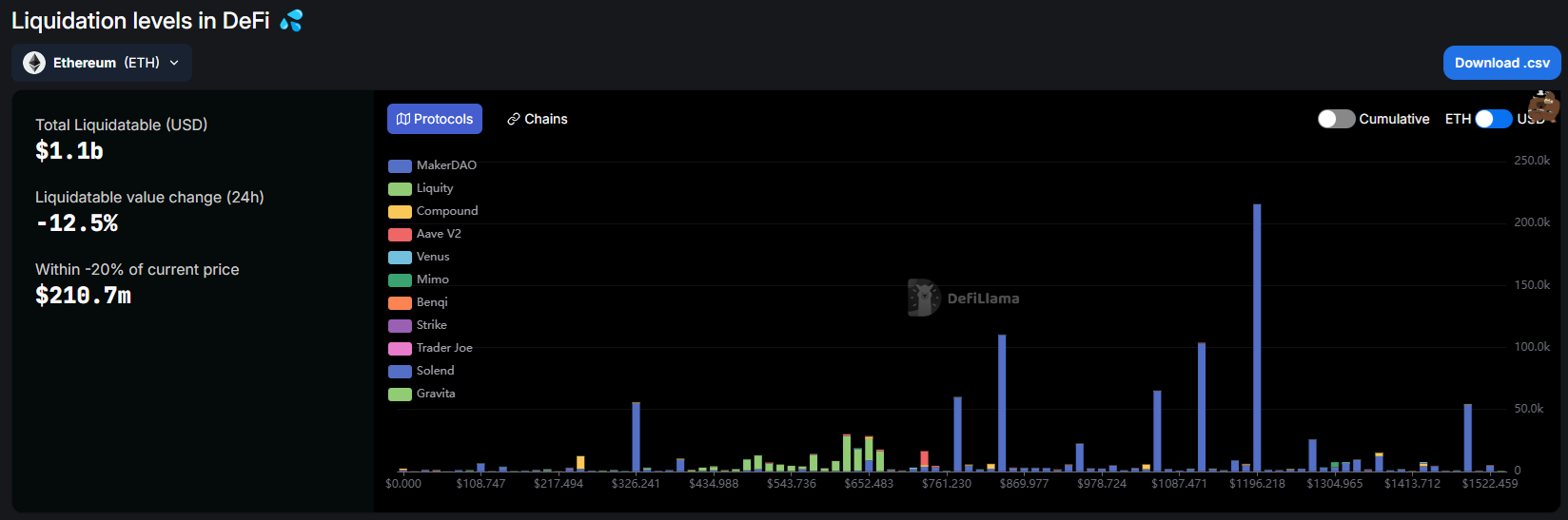

Share link:In this post: Whales panic-sold ETH, in addition to the series of liquidations. One whale on Maker added collateral to push the liquidation price down to $912.02. The Seven Siblings whale started buying again at around $1,700, signaling the local low may be near.

Share link:In this post: The popular Hyperliquid whale is active again with a new 20X leveraged long on Ethereum. The position started at $1,459, suggesting ETH may bounce without reaching the liquidation price. Hyperliquid remains relatively stable, despite recent ETH position liquidations and the JELLY token price manipulation.

Bitcoin battles everything from a "death cross" to record low sentiment as US trade tariffs wreak havoc across global markets — will 2021 prices return?

- 11:22Solana's High Staking Yields Briefly Boost Its Staked Value Above EthereumPANews, April 21 - According to Cryptoslate, on April 20, the total staked value of Solana (in USD) briefly exceeded that of Ethereum. Based on staking data shared by Nansen CEO Alex Svanevik, the value of staked SOL tokens on Solana peaked at over $53.9 billion. This figure was slightly higher than Ethereum's staking market value of $53.7 billion on the same day. However, Solana's lead was short-lived. At the time of writing, Ethereum regained the top spot with a staked value of $56 billion, while Solana's was $54 billion. Although Solana's lead was temporary, this event rekindled discussions about staking incentives, network security, and user behavior within the two ecosystems. Market observers noted that a key factor in Solana's rise is its attractive staking yields. According to Staking Rewards, Solana currently offers a network-level return rate of 8.31%, significantly higher than Ethereum's 2.98%. This difference may encourage users to choose staking their tokens rather than engaging in borrowing or providing liquidity through DeFi protocols. Furthermore, Solana's staking participation rate is approximately 65%, indicating active community involvement. However, Solana lacks a stringent penalty mechanism for misbehaving validators. Therefore, critics like Ethereum researcher Dankrad Feist argue that while Solana encourages staking, it sacrifices economic security in the process.

- 11:21USDC Treasury Mints Additional 250 Million USDC on SolanaAccording to Whale Alert monitoring, at 18:38 (UTC+8), the USDC Treasury minted an additional 250 million USDC on the Solana chain.

- 10:51Founder of Telegram: French Parliament Rejects Encrypted Communication Backdoor Bill, Telegram Will Never Compromise User PrivacyTelegram founder Pavel Durov stated that the French National Assembly has rejected a bill that would have required communication apps to implement law enforcement backdoors, preventing France from becoming the first country to legislate against end-to-end encryption. He emphasized that backdoor mechanisms threaten the privacy and security of all users, and Telegram would rather exit a market than compromise on encryption protection. (Cointelegraph)