News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Whales and Institutions Build Bitcoin Holdings Amid Predictions of a Steady Easter Weekend2Solana (SOL) Gains Momentum With Key Breakout — Is Render (RENDER) Gearing Up For A Similar Move?3XRP Price Rebound Faces Potential 40-50% Correction Amid Bearish Patterns and Profit-Taking

Ethereum’s Price Drop Signals Potential Buying Opportunities for Long-Term Investors

In Brief The recent price drop of Ethereum may offer strategic buying opportunities. Historical data supports potential recovery after dips below realized price. Investor psychology plays a crucial role during uncertain market conditions.

Cointurk·2025/04/08 22:11

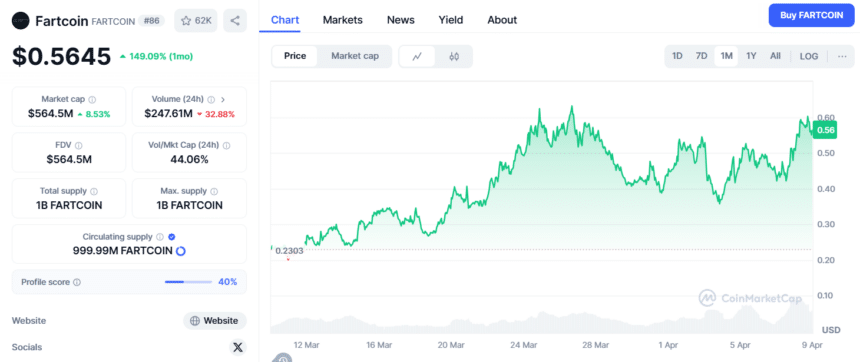

Whale Makes Bold $1.89M Bet on Fartcoin, Would it play out?

Cryptotimes·2025/04/08 21:00

FIL Price Over $150 Emerges as Filecoin Shows Highly Bullish Signals Amid Bitcoin Mirroring 2024 Correction

Cryptonewsland·2025/04/08 20:33

What a 1% Fed Rate Cut Could Mean for Crypto if Trump’s Tariff Triggers The Simpsons Prediction

Cryptonewsland·2025/04/08 20:33

Ethereum ETFs Hold Steady as Cumulative Inflows Hit $2.36B

Cryptonewsland·2025/04/08 20:33

Bitcoin shows resilience as stocks and gold falter

Grafa·2025/04/08 19:50

Analyst sees rising odds of US Bitcoin purchase in 2025

Grafa·2025/04/08 19:50

Ripple forecasts $18.9T tokenisation market by 2033

Grafa·2025/04/08 19:50

BlackRock CEO Forecast: Will a Recovery Follow the Crypto Market Crash ?

Cryptoticker·2025/04/08 18:33

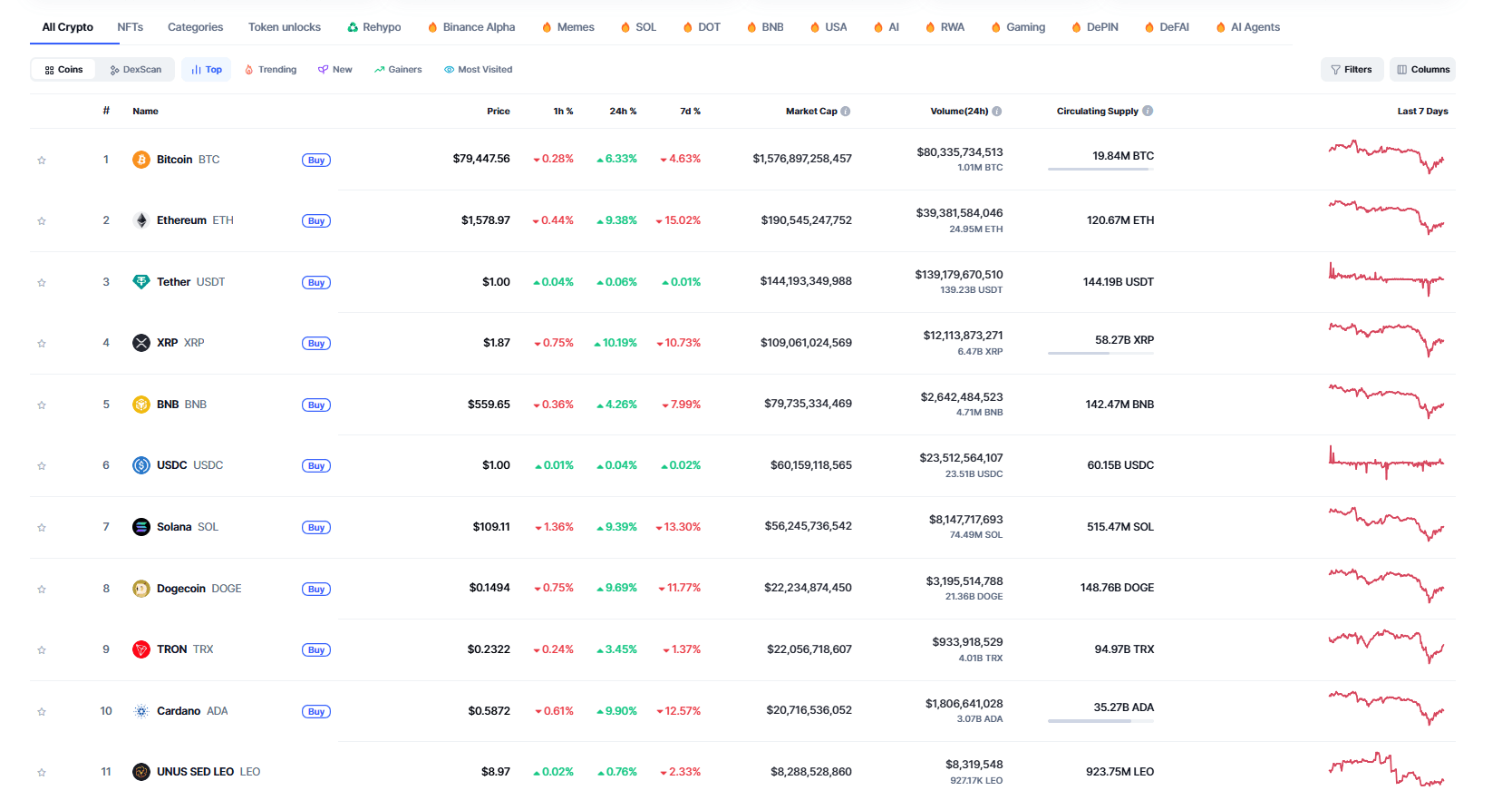

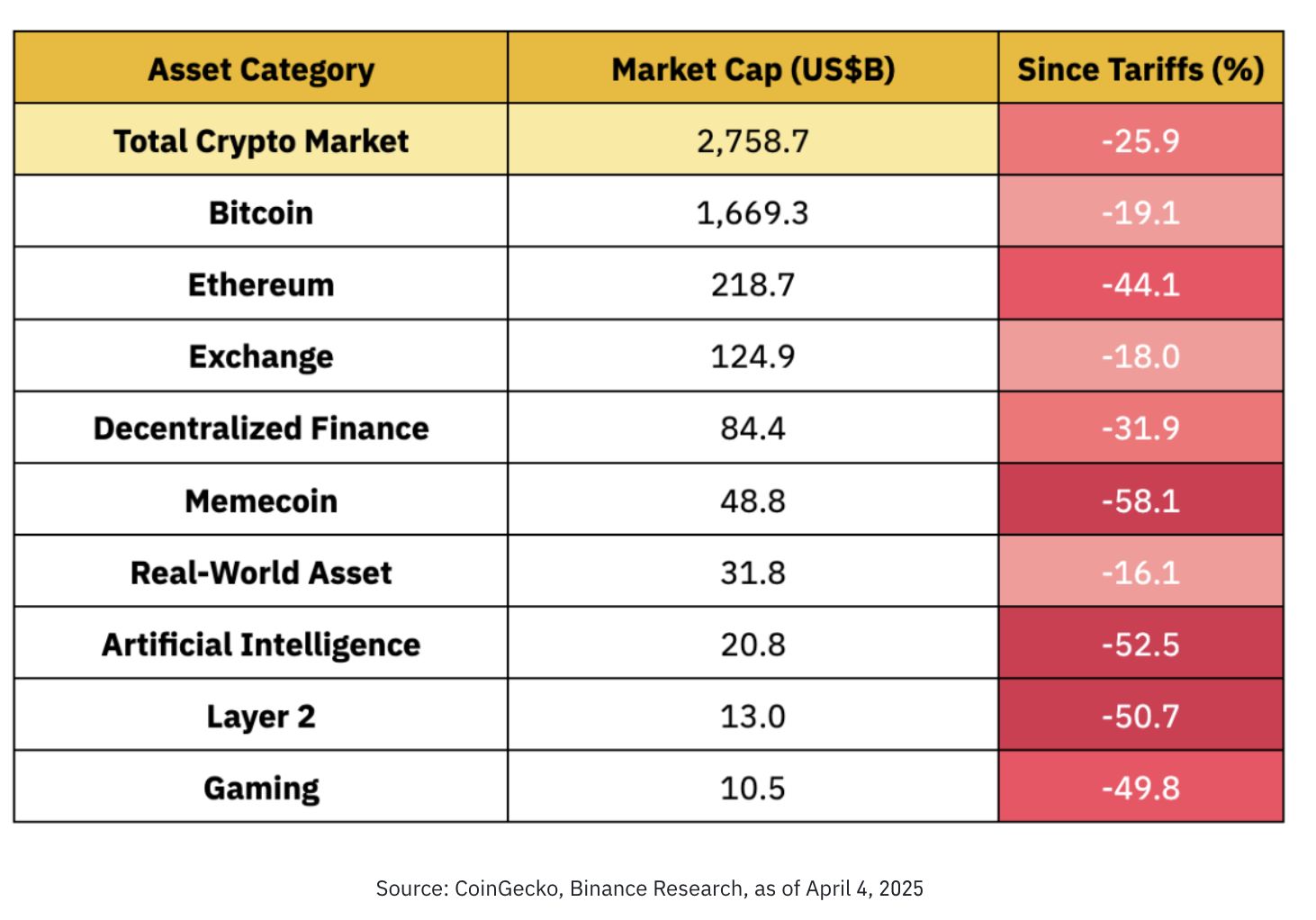

Altcoin liquidity’s dropped since President Trump’s tariff announcement: Kaiko Research

An altcoin season is looking less and less likely as the reciprocal tariffs loom

Blockworks·2025/04/08 16:11

Flash

- 03:10Burwick Law Sues Parties Involved in M3M3 Token IssuanceThe American law firm Burwick Law announced that it has joined forces with the law firm Hoppin Grinsell to file a lawsuit on behalf of investors against the Meteora platform and individuals such as Hayden Davis, Gideon Davis, CT Davis, and Kelsier. They are accused of fraud, securities fraud, and other illegal activities related to the launch of the M3M3 token on the Meteora platform. Previously, on March 18th, Burwick Law stated on social media that on behalf of its clients, it filed a lawsuit in the Supreme Court of New York against Kelsier, KIP, Meteora, and related parties, alleging misconduct in the issuance of the LIBRA token. The class action lawsuit accuses them of orchestrating an unfair token issuance, misleading buyers, and harming the interests of retail investors.

- 03:10CME Bitcoin Futures Show Divergence Between Institutional and Retail Traders, with Net Long Positions of the Latter SurgingThe Chicago Mercantile Exchange (CME) Bitcoin futures open interest suggests a shift in market dynamics, as a group of traders appears to be reducing their positions, possibly indicating a cautious stance or profit-taking after a strong rally. The data shows a divergence in the behavior of asset managers and other participants, with asset managers’ net long positions peaking at $6 billion by the end of 2024, but significantly reduced to about $2.5 billion since then. On the other hand, the "others" category (likely including retail investors and small institutions) has seen a sharp increase in net long positions, reaching approximately $1.5 billion, the highest level in over a year, indicating a renewed bullish sentiment among non-institutional market participants.

- 03:10Bitdeer: Total Bitcoin Holdings Increased to 1,212.2 CoinsNasdaq-listed Bitcoin mining company Bitdeer released its latest Bitcoin holdings data on the X platform, reporting that as of April 18, its total Bitcoin holdings have increased to 1,212.2 coins (note: this quantity is net holdings, excluding customer-deposited Bitcoin). Additionally, its Bitcoin mining output this week was 40 BTC, but it sold 22 BTC.