BlackRock CEO Forecast: Will a Recovery Follow the Crypto Market Crash ?

Crypto Market Crash: Recovery or More Losses Ahead?

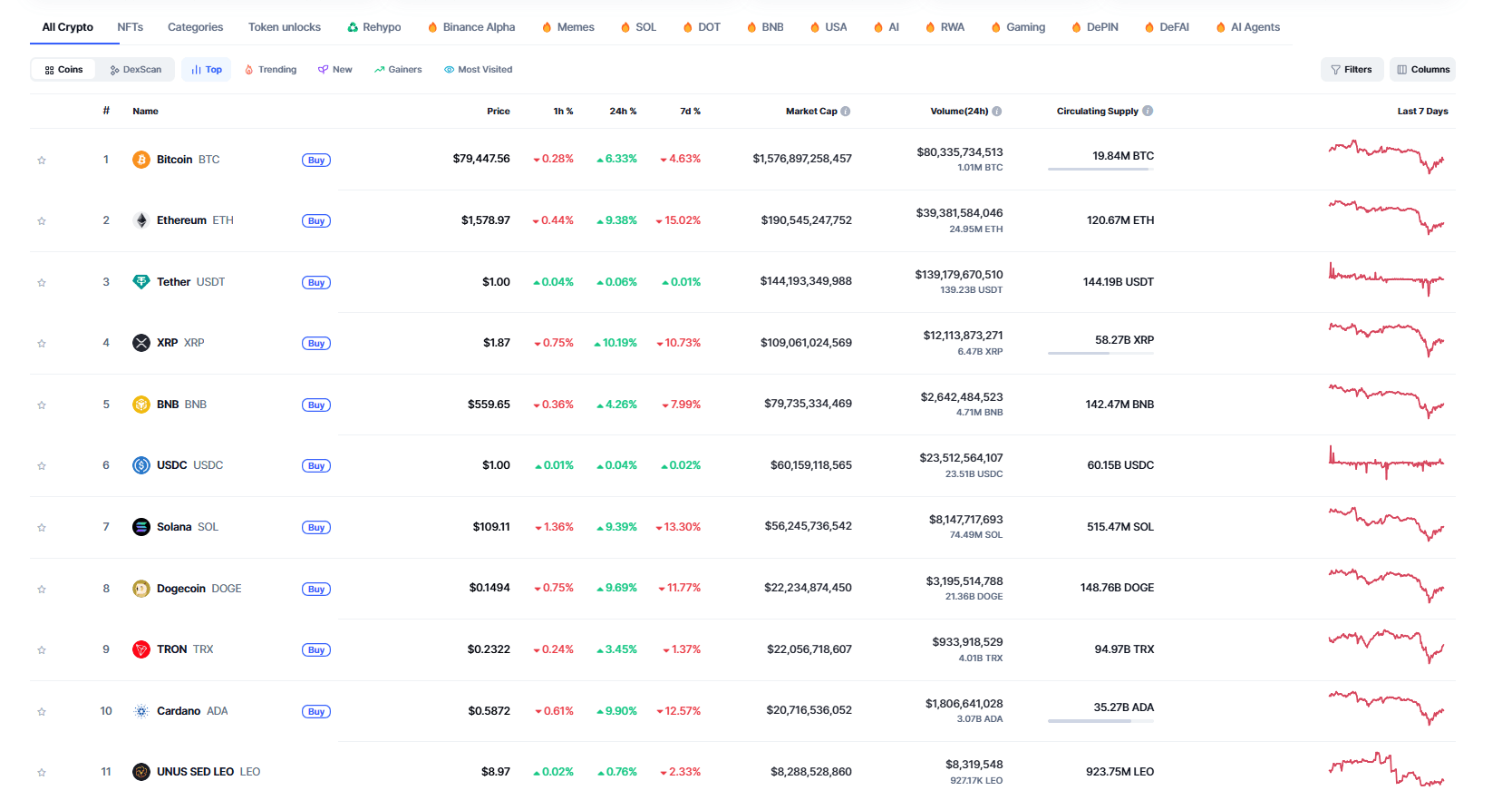

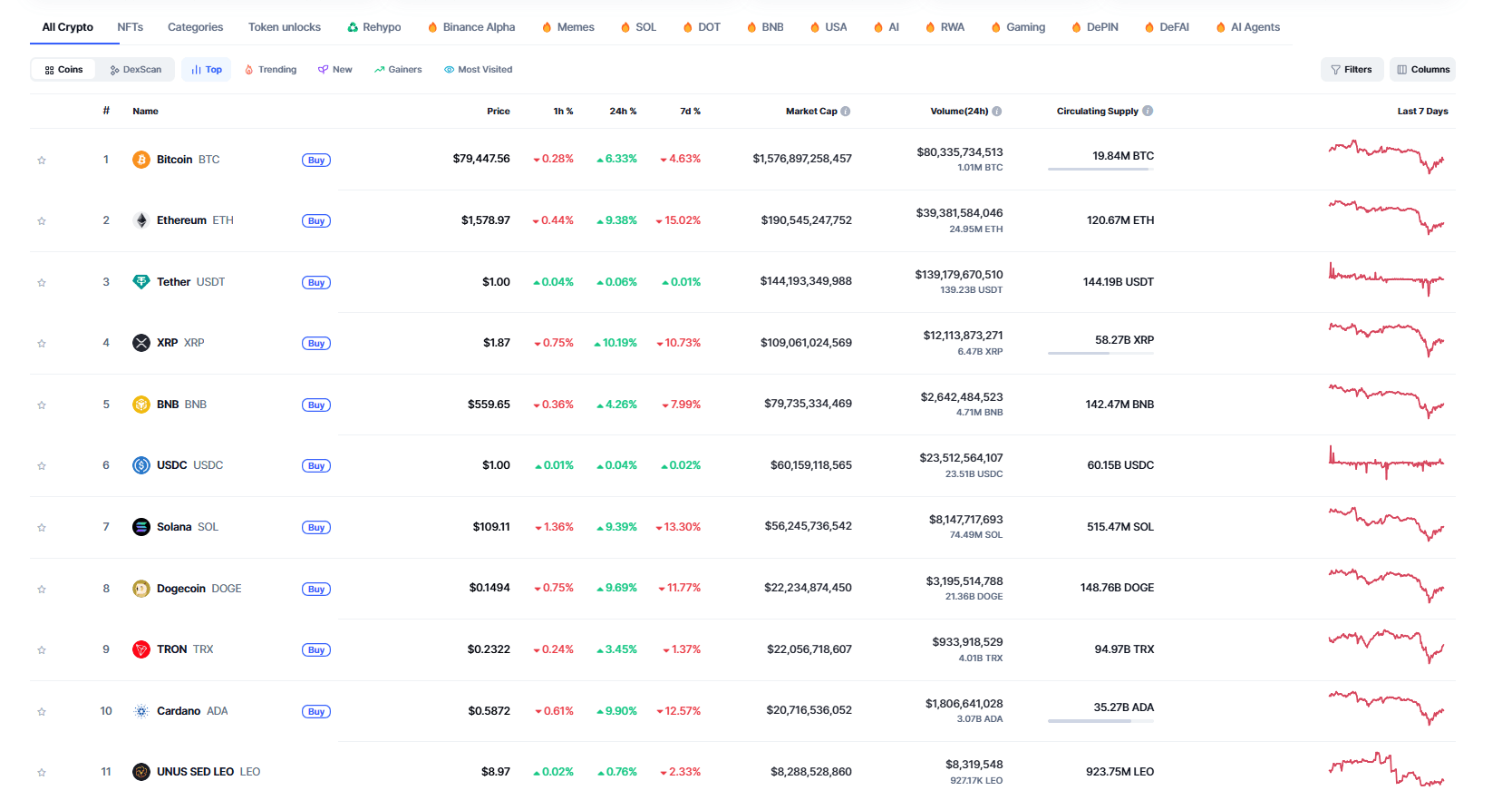

The cryptocurrency market is reeling from a sharp decline, with major coins shedding significant value in just a few days. As Bitcoin dropped below $76,000 and global crypto market capitalization plunged by over 10% to $2.52 trillion, investors are left wondering—is this a temporary dip or the start of a deeper correction?

Crypto Market Crash April 2025

Crypto Market Crash April 2025

BlackRock CEO Larry Fink Warns: Another 20% Drop Possible

Larry Fink, the CEO of the world’s largest asset manager, BlackRock, has weighed in on the broader market turmoil. In a recent interview, Fink warned that equity markets could still fall by another 20%, suggesting the U.S. may already be in a recession. This cautionary outlook reverberated through financial circles, casting a shadow over both traditional and crypto markets.

While Fink did mention this might be a buying opportunity for some, his overall tone suggests caution. Factors such as mounting trade tariffs, tightening liquidity, and uncertain macroeconomic conditions could push risk-on assets like cryptocurrencies even lower.

Top Crypto Losers This Week

The current market downturn hit both large and mid-cap cryptocurrencies. Among the top 20 tokens, the biggest losers included :

- Pi Network (PI): Down 36%, trading around $0.52

- Bittensor (TAO): Dropped 15.61%, now at $184.12

- Worldcoin (WLD): Fell 14.32%, to $0.6274

- Lido DAO (LDO): Down 14.09%, priced at $0.7036

Even Bitcoin and Ethereum weren't spared, falling over 7% and 6% respectively, dragging the entire market sentiment with them.

Will the Crypto Market Recover?

Whether the crypto market recovers soon depends on several macro and internal market factors:

1. Macro Conditions

If the U.S. economy is indeed entering or already in a recession, as Fink suggests, we could see further downside across all asset classes. Cryptocurrencies, which are considered high-risk investments, typically suffer first in such scenarios.

2. Regulatory Landscape

Ongoing scrutiny from regulators worldwide is contributing to investor uncertainty. Any aggressive moves—especially from U.S. institutions—could delay recovery.

3. Halving and Cycles

Bitcoin’s next halving, expected in 2028, is historically followed by bull runs. However, with current uncertainty, the usual cycle dynamics might take longer to play out.

4. Retail vs Institutional Sentiment

Retail investors are showing signs of panic-selling, while institutions remain cautiously observant. If institutional players view this as a discounted entry point, it could stabilize the market and even prompt a recovery.

Possible Scenarios Ahead

🟢 Optimistic Scenario:

Market sentiment rebounds as inflation stabilizes and investor confidence grows. Altcoins recover , and Bitcoin regains traction above $80,000 , leading a slow but steady recovery phase.

🟠 Neutral Scenario:

The market remains in a consolidation range, with minimal volatility. Prices hover near current levels as investors wait for clearer signals from the Fed or broader economic indicators.

🔴 Bearish Scenario:

Worsening macroeconomic data and further Fed tightening could lead to another crash, possibly matching Fink’s predicted 20% drop in traditional assets—which may correlate with another 10–15% drop in crypto markets.

Final Thoughts

The current crypto crash is a stark reminder of the market's volatility. With Larry Fink’s warning about a broader market recession and a possible 20% drop, investors must tread carefully. While some may see this as a prime buying opportunity, others may prefer to wait for further clarity.

One thing is clear: 2025 will be a defining year for crypto markets, shaped by macroeconomic shifts, institutional behavior, and global regulations.

Crypto Market Crash: Recovery or More Losses Ahead?

The cryptocurrency market is reeling from a sharp decline, with major coins shedding significant value in just a few days. As Bitcoin dropped below $76,000 and global crypto market capitalization plunged by over 10% to $2.52 trillion, investors are left wondering—is this a temporary dip or the start of a deeper correction?

Crypto Market Crash April 2025

Crypto Market Crash April 2025

BlackRock CEO Larry Fink Warns: Another 20% Drop Possible

Larry Fink, the CEO of the world’s largest asset manager, BlackRock, has weighed in on the broader market turmoil. In a recent interview, Fink warned that equity markets could still fall by another 20%, suggesting the U.S. may already be in a recession. This cautionary outlook reverberated through financial circles, casting a shadow over both traditional and crypto markets.

While Fink did mention this might be a buying opportunity for some, his overall tone suggests caution. Factors such as mounting trade tariffs, tightening liquidity, and uncertain macroeconomic conditions could push risk-on assets like cryptocurrencies even lower.

Top Crypto Losers This Week

The current market downturn hit both large and mid-cap cryptocurrencies. Among the top 20 tokens, the biggest losers included :

- Pi Network (PI): Down 36%, trading around $0.52

- Bittensor (TAO): Dropped 15.61%, now at $184.12

- Worldcoin (WLD): Fell 14.32%, to $0.6274

- Lido DAO (LDO): Down 14.09%, priced at $0.7036

Even Bitcoin and Ethereum weren't spared, falling over 7% and 6% respectively, dragging the entire market sentiment with them.

Will the Crypto Market Recover?

Whether the crypto market recovers soon depends on several macro and internal market factors:

1. Macro Conditions

If the U.S. economy is indeed entering or already in a recession, as Fink suggests, we could see further downside across all asset classes. Cryptocurrencies, which are considered high-risk investments, typically suffer first in such scenarios.

2. Regulatory Landscape

Ongoing scrutiny from regulators worldwide is contributing to investor uncertainty. Any aggressive moves—especially from U.S. institutions—could delay recovery.

3. Halving and Cycles

Bitcoin’s next halving, expected in 2028, is historically followed by bull runs. However, with current uncertainty, the usual cycle dynamics might take longer to play out.

4. Retail vs Institutional Sentiment

Retail investors are showing signs of panic-selling, while institutions remain cautiously observant. If institutional players view this as a discounted entry point, it could stabilize the market and even prompt a recovery.

Possible Scenarios Ahead

🟢 Optimistic Scenario:

Market sentiment rebounds as inflation stabilizes and investor confidence grows. Altcoins recover , and Bitcoin regains traction above $80,000 , leading a slow but steady recovery phase.

🟠 Neutral Scenario:

The market remains in a consolidation range, with minimal volatility. Prices hover near current levels as investors wait for clearer signals from the Fed or broader economic indicators.

🔴 Bearish Scenario:

Worsening macroeconomic data and further Fed tightening could lead to another crash, possibly matching Fink’s predicted 20% drop in traditional assets—which may correlate with another 10–15% drop in crypto markets.

Final Thoughts

The current crypto crash is a stark reminder of the market's volatility. With Larry Fink’s warning about a broader market recession and a possible 20% drop, investors must tread carefully. While some may see this as a prime buying opportunity, others may prefer to wait for further clarity.

One thing is clear: 2025 will be a defining year for crypto markets, shaped by macroeconomic shifts, institutional behavior, and global regulations.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Gitcoin’s Strategic Shift: Embracing a New Era with Focused Goals

In Brief Gitcoin shuts down Gitcoin Labs due to financial burdens. Focus shifts to strengthening the Gitcoin Grants program for future sustainability. Funding for the Gitcoin Grants Program is secured until approximately 2029.

Solana Sets Sights on Dominating Ethereum with Strong Performance

In Brief Solana shows strong potential for outperforming Ethereum in the near term. Analysts highlight critical support levels for both Solana and Ethereum. Traders should remain cautious amidst market volatility while seizing potential opportunities.

PEPE Coin’s Promising Path to Recovery Captivates Enthusiasts

In Brief PEPE coin shows signs of recovery similar to Dogecoin and Shiba Inu. Analysts predict potential price doubling for PEPE in the near term. Bitcoin's stability supports altcoin confidence amidst market volatility.

Cardano Empowers Users with XRP Transactions via Lace Wallet

In Brief Cardano users can now perform XRP transactions through Lace Wallet. The Midnight Network is introducing new airdrop opportunities for XRP holders. Market reactions indicate cautious optimism for Cardano and XRP prices.