Coin-related

Price calculator

Price history

Price prediction

Technical analysis

Coin buying guide

Crypto category

Profit calculator

Fuel Network priceFUEL

Fuel Network (FUEL) has been listed in the Innovation and Layer 2 Zone, you can quickly sell or buy FUEL. Spot Trading Link: FUEL/USDT.

Activity 1: PoolX — Lock FUEL to share 3,200,000 FUEL; Activity 2: CandyBomb – Trade to share 1,250,000 FUEL; Activity 3: Subscribe to FUEL Earn products and enjoy up to 30% APR; Activity 4: Social Giveaway - 250,000 FUEL Up for Grabs; Activity 5: Community Giveaway - Win Your Share of 250,000 FUEL; more details!

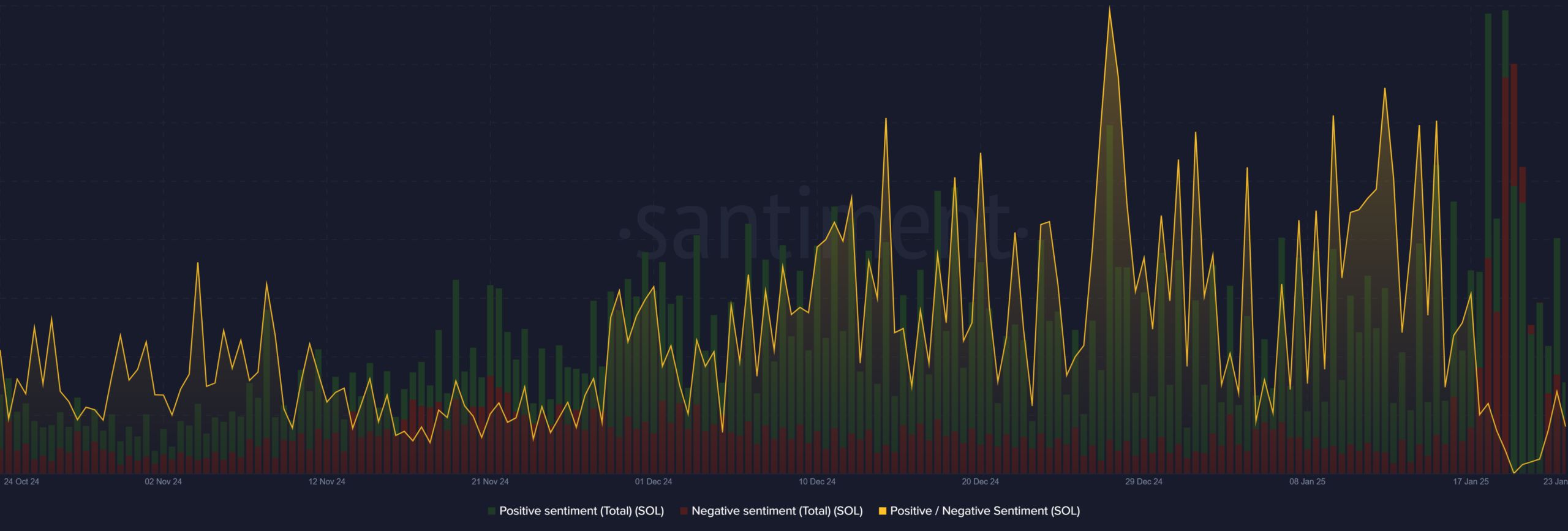

How do you feel about Fuel Network today?

Price of Fuel Network today

What is the highest price of FUEL?

What is the lowest price of FUEL?

Fuel Network price prediction

What will the price of FUEL be in 2026?

What will the price of FUEL be in 2031?

Fuel Network price history (USD)

Lowest price

Lowest price Highest price

Highest price

Fuel Network market information

Fuel Network's market cap history

Fuel Network market

Fuel Network holdings

Fuel Network holdings distribution matrix

Fuel Network holdings by concentration

Fuel Network addresses by time held

Fuel Network ratings

About Fuel Network (FUEL)

What Is Fuel Network?

Fuel Network is an Ethereum Layer-2 rollup designed to address the scalability and efficiency challenges of blockchain technology. The network was co-founded by John Adler and Nick Dodson, two pioneers in blockchain technology. By decoupling execution from consensus, Fuel Network introduces a modular execution layer that enhances transaction throughput, lowers fees, and simplifies the development of decentralized applications (dApps). Originally launched as one of the first optimistic rollups on Ethereum in late 2020, Fuel has evolved into a high-performance solution for scaling blockchain applications across various industries, including DeFi, gaming, and prediction markets.

Fuel Network's primary goal is to provide a seamless experience for developers and users by improving blockchain performance without compromising security or decentralization. Its unique architecture empowers developers to create scalable and efficient applications on Ethereum, while users benefit from faster transactions and reduced costs.

How Fuel Network Works

Fuel Network leverages a modular design, separating the execution layer from the data availability and consensus layers. This innovative approach optimizes blockchain performance while maintaining security and decentralization.

1. FuelVM (Virtual Machine)

The Fuel Virtual Machine (FuelVM) is at the heart of the network, designed to process transactions with unparalleled efficiency. Unlike traditional blockchain virtual machines, FuelVM utilizes a UTXO (Unspent Transaction Output) model, which enables parallel transaction execution. This model avoids bottlenecks by allowing multiple transactions to be processed simultaneously, significantly increasing throughput.

2. Sway Programming Language

To support developers, Fuel Network offers Sway, a purpose-built programming language optimized for blockchain development. Sway combines the best aspects of Solidity and Rust, providing a clean syntax and robust features for creating efficient and secure smart contracts. The Fuel Orchestrator (Forc) further simplifies development by offering tools to deploy and manage dApps effectively.

3. Fraud Proofs

Fraud proofs ensure the integrity of the network by enabling verification of transaction validity. This mechanism provides an added layer of security for users and ensures trustless interactions within the blockchain ecosystem.

4. Parallel Execution

Fuel's UTXO model and access list system allow for concurrent processing of transactions. By identifying dependencies between transactions, Fuel enables simultaneous execution, reducing latency and maximizing resource utilization.

5. Decentralized Sequencing

Fuel employs a decentralized sequencer model, allowing users to stake $FUEL tokens to secure the network. This ensures fair transaction ordering, reduces censorship risks, and enhances overall network resilience.

What Is FUEL Token?

The Fuel Network token (FUEL) is the native cryptocurrency of the Fuel ecosystem, supporting its modular execution layer and decentralized operations. FUEL is used to secure the network through staking, pay for essential resources like data availability and block inclusion, and enable gas-free transactions for users. By facilitating these functions, FUEL plays a crucial role in the network's economic model, aiming to create a more streamlined and efficient blockchain experience.

FUEL also enables application-specific sequencing, allowing developers to influence how transactions are ordered on the network. This feature supports custom transaction flows and provides rewards for staking the token. With a total supply of 10 billion tokens, FUEL has over 51% allocated for community incentives, ecosystem development, and research. This distribution aligns with the network's goal of fostering a decentralized and scalable blockchain infrastructure.

Conclusion

Fuel Network offers a modular approach to scaling blockchain technology, addressing key challenges in efficiency, cost, and usability. By leveraging innovative features such as parallel transaction execution, decentralized sequencing, and a developer-friendly programming environment, it provides a flexible infrastructure for decentralized applications across various sectors. The Fuel token plays a central role in powering the ecosystem, supporting network operations, and enabling application-specific functionalities. With its focus on scalability and decentralization, Fuel Network aims to contribute to the ongoing evolution of blockchain technology.

FUEL to local currency

- 1

- 2

- 3

- 4

- 5

How to buy Fuel Network(FUEL)

Create Your Free Bitget Account

Verify Your Account

Convert Fuel Network to FUEL

Trade FUEL perpetual futures

After having successfully signed up on Bitget and purchased USDT or FUEL tokens, you can start trading derivatives, including FUEL futures and margin trading to increase your income.

The current price of FUEL is $0.008044, with a 24h price change of -1.15%. Traders can profit by either going long or short onFUEL futures.

Join FUEL copy trading by following elite traders.

Fuel Network news

IDO Platform, Buy Now and Earn Later

New listings on Bitget

Buy more

FAQ

What is the current price of Fuel Network?

What is the 24 hour trading volume of Fuel Network?

What is the all-time high of Fuel Network?

Can I buy Fuel Network on Bitget?

Can I get a steady income from investing in Fuel Network?

Where can I buy Fuel Network with the lowest fee?

Where can I buy Fuel Network (FUEL)?

Video section — quick verification, quick trading

Bitget Insights

Related assets