Is Cosmos (ATOM) Gearing Up for a Comeback? Solana’s Fractal Points to Yes!

Date: Mon, April 07, 2025 | 05:10 AM GMT

The crypto market is reeling from what many are calling the worst single-day drop of 2025 so far. Triggered by a fresh wave of global uncertainty—fueled by a tariff war initiated by U.S. President Donald Trump targeting 185 nations—risk assets across the board are in retreat.

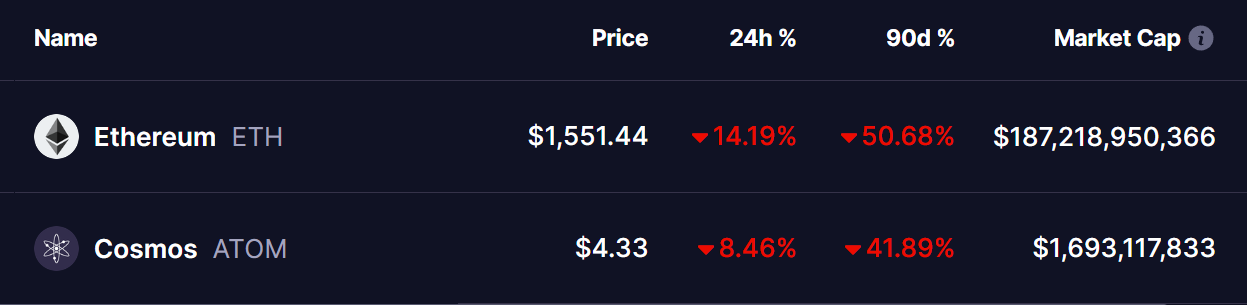

Bitcoin (BTC) has plunged 8%, while Ethereum (ETH) has fared even worse, losing over 14% in just 24 hours. This macro-induced selloff has sent altcoins tumbling as well.

Among them, Cosmos (ATOM) is down over 9% today, extending its 90-day correction to a painful 41%. However, beneath the surface of this selloff, a surprisingly optimistic pattern is emerging—one that strongly mirrors Solana’s (SOL) late 2024 breakout structure.

Source: Coinmarketcap

Source: Coinmarketcap

ATOM Chart Mirrors SOL’s Past Price Behavior

Looking at the daily chart, ATOM has been forming a classic inverse head and shoulders pattern, a well-known bullish reversal setup. This pattern is also strikingly similar to what Solana (SOL) formed in late 2024 before its impressive rally to over $250.

SOL’s Breakout: Back in October 2024, Solana broke out of a multi-month inverse head and shoulders pattern, facing rejection at the neckline a few times before decisively clearing it. Once it broke through the resistance and the 50-day moving average, SOL soared nearly 60% in just a matter of weeks.

ATOM’s Current Setup: ATOM is now following an almost identical structure. After bouncing off its second shoulder, it’s making a run toward the neckline resistance just above the $5 mark. It’s also testing its 50-day moving average, just as Solana did prior to its breakout.

Should ATOM break above the neckline resistance with strong volume, a bullish reversal could unfold—potentially targeting the $5.80 to $6.40 range in the short term. This would mirror SOL’s breakout trajectory and give bulls a much-needed win in the current bearish climate.

What’s Next for ATOM?

While macroeconomic headwinds remain strong, technical setups like this can often front-run sentiment shifts—especially when driven by historical price patterns.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

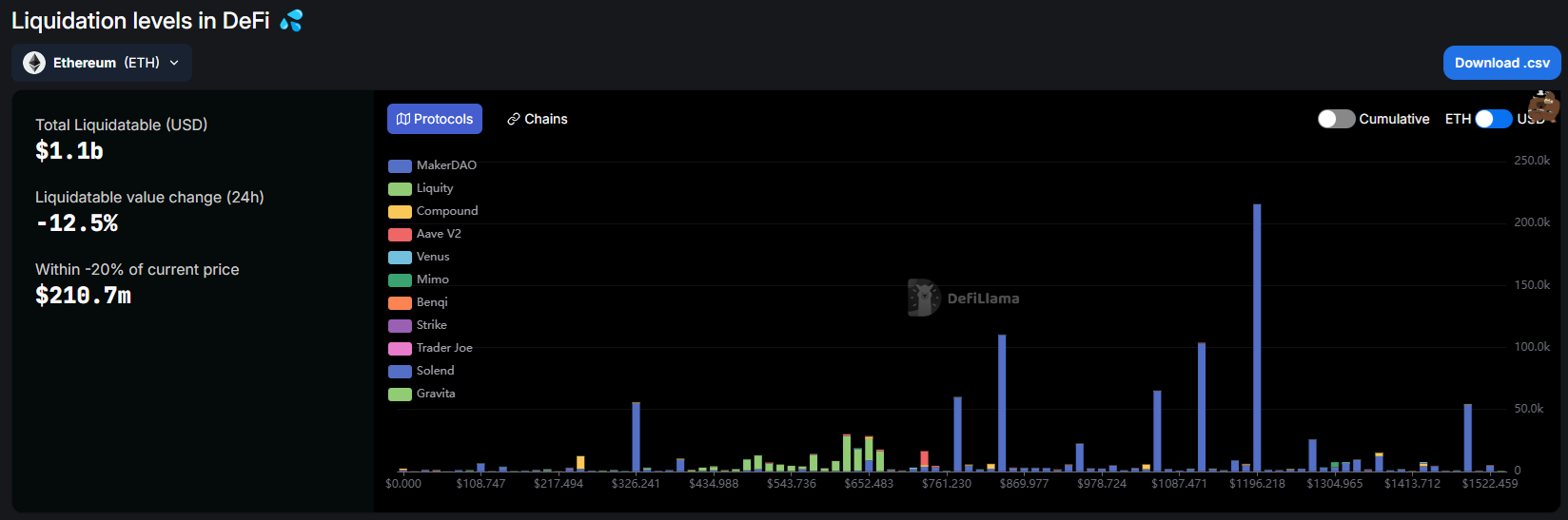

Ethereum (ETH) crashed on selling and liquidation pressure, but whales are still buying the dip

Share link:In this post: Whales panic-sold ETH, in addition to the series of liquidations. One whale on Maker added collateral to push the liquidation price down to $912.02. The Seven Siblings whale started buying again at around $1,700, signaling the local low may be near.

The 50X Hyperliquid whale is back with new leveraged long on Ethereum (ETH)

Share link:In this post: The popular Hyperliquid whale is active again with a new 20X leveraged long on Ethereum. The position started at $1,459, suggesting ETH may bounce without reaching the liquidation price. Hyperliquid remains relatively stable, despite recent ETH position liquidations and the JELLY token price manipulation.

Dogecoin’s support under threat amid rising liquidation pressure

Solana price falls below $100 as $200M unlock nears