U.S. BITCOIN Act of 2025: Strategic Bitcoin Reserve Gains Majority Support in Congress

U.S. Moves Toward Bitcoin Accumulation

The United States is on the verge of making a groundbreaking shift in digital asset policy. The BITCOIN Act of 2025 (S.954), introduced in the 119th Congress (2025–2026), proposes the establishment of a Strategic Bitcoin Reserve —a first-of-its-kind national strategy for accumulating Bitcoin . With strong bipartisan support and momentum building, this act could reshape the role of Bitcoin in national economic and geopolitical strategy .

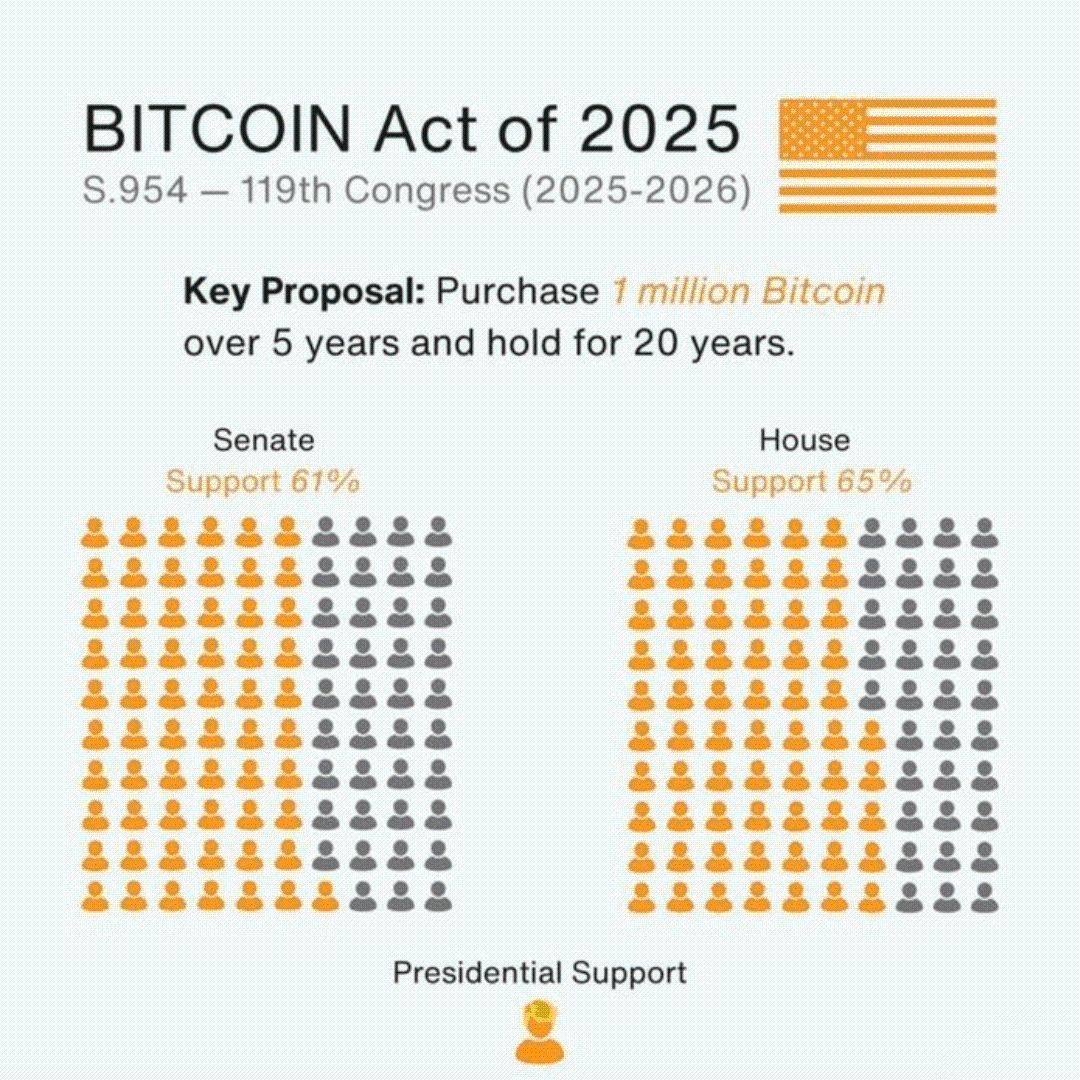

Political Landscape: Majority Support Secured

According to recent data from Stand With Crypto, the bill has gained substantial traction:

✅ 61% of U.S. Senators (61 out of 100) support the legislation.

✅ 65% of the House of Representatives (285 out of 435) are in favor.

✅ The President has officially expressed support, further solidifying the bill’s viability.

With this level of cross-party consensus, the BITCOIN Act of 2025 is one of the most widely supported crypto initiatives in U.S. history.

What the BITCOIN Act Proposes

At the core of the bill is a Key Proposal:

The U.S. government will purchase 1 million Bitcoin over five years and hold it for 20 years.

This initiative would establish a Strategic Bitcoin Reserve, mirroring the logic behind the U.S. Strategic Petroleum Reserve but applied to digital assets. The aim is to position Bitcoin as a long-term store of value and national economic hedge, especially in the face of rising global inflation and fiat currency devaluation.

Why This Matters: A Historic Accumulation Event

If enacted, this bill could lead to one of the largest Bitcoin accumulation events in history, possibly triggering a domino effect among other nations . The idea of nation-state accumulation is central to what's known as Bitcoin game theory —once one major country starts stockpiling BTC, others are incentivized to follow to avoid being left behind.

This could:

- Increase Bitcoin’s scarcity dramatically.

- Drive institutional and global investor demand .

- Propel Bitcoin into new all-time highs.

- Redefine Bitcoin's role from digital gold to digital national reserve.

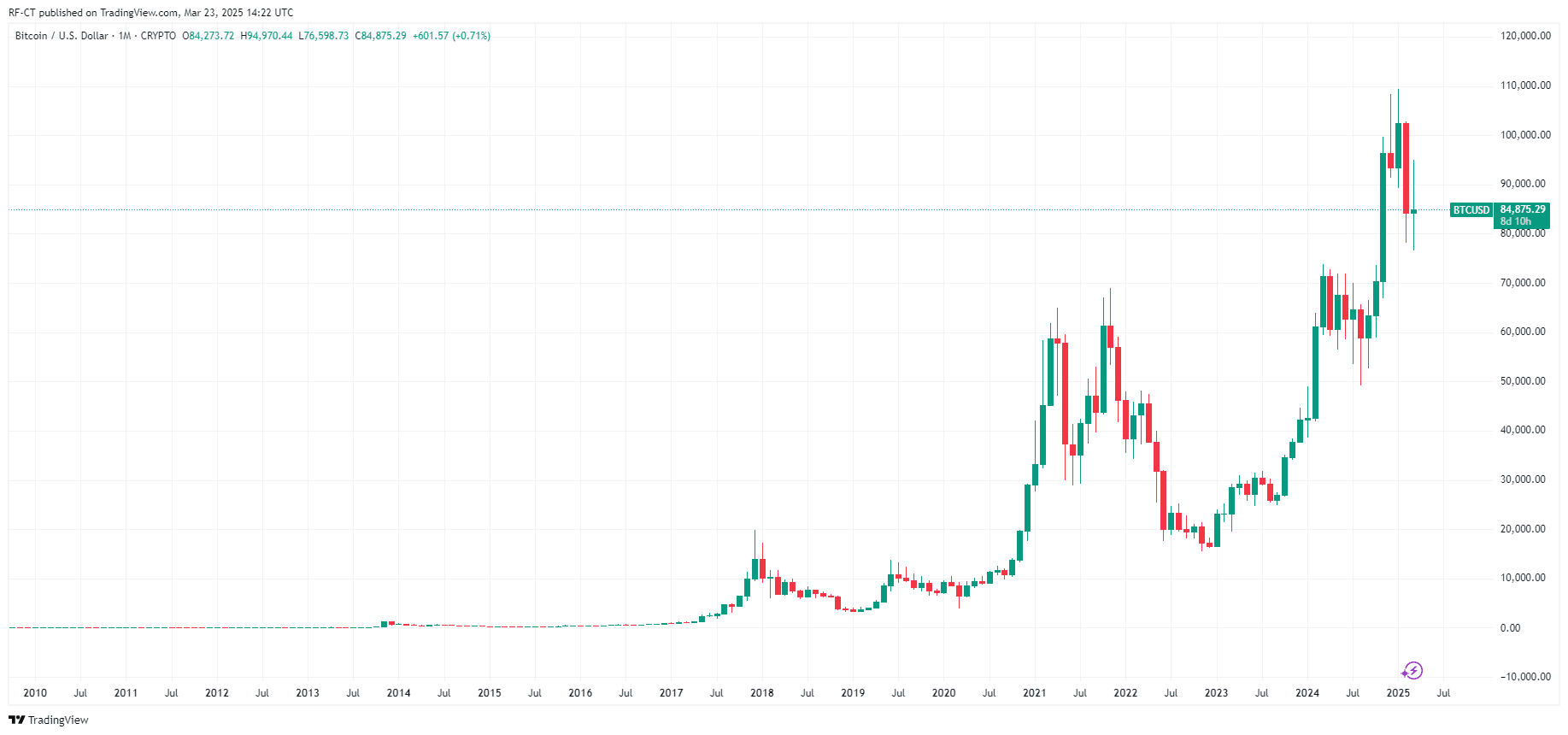

By TradingView - BTCUSD_2025-03-23 (All)

By TradingView - BTCUSD_2025-03-23 (All)

Strategic Implications: Geopolitics Meets Crypto

With the U.S. leading the charge, this move could pressure other global economies to react swiftly. The formation of a Strategic Bitcoin Reserve would make Bitcoin a geopolitical asset , not just a speculative investment.

Countries that are slow to adapt could face strategic disadvantages in wealth preservation, monetary policy, and economic independence. Meanwhile, nations that follow suit may benefit from early-stage accumulation and increased global influence.

Is This the Start of a New Financial Era?

The BITCOIN Act of 2025 is more than a bill—it's a declaration. A declaration that Bitcoin is no longer just a fringe asset but a strategic reserve capable of shaping the future of finance and geopolitics. As bipartisan support builds and the proposal inches closer to becoming law, investors and institutions are watching closely.

Are you ready for what comes next in the Bitcoin revolution ?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Analysts Project BlockDAG to Reach $1 Soon! SOL Price Dips 58% While XRP Shows Rally

See how Solana faces a sharp 58% decline, XRP gains bullish momentum, and BlockDAG earns expert confidence with a $1 price forecast in 2025. Is BDAG the top crypto to watch now?XRP Price Predictions: Analysts Expect Significant GrowthSolana News: SOL Suffers from Memecoin Activity DeclineBlockDAG Set for $1 Target in 2025—Key Growth Catalysts Explained

XRP: Analyst predicts explosive rise and $10 target by 2030 after Ripple vs SEC resolution

Ether Faces Potential Decline Toward $1,200 Amid Diminished Activity and Bearish Chart Patterns

Bitcoin Strengthens Amid Positive Sentiment; Could a Rally to $100K Be Possible?