Bitcoin Strengthens Amid Positive Sentiment; Could a Rally to $100K Be Possible?

-

Bitcoin’s recent rally has reignited conversations around the $100,000 milestone, fueled by a blend of positive market indicators and investor sentiment.

-

With ongoing discussions around cryptocurrency ETFs and macroeconomic conditions, analysts are keenly observing Bitcoin’s price movements and market reactions.

-

As noted by market strategist Lingling Jiang, “We’re witnessing the alignment of both structural and narrative factors driving this upward trend of the movement of Bitcoin.”

Bitcoin’s recent rally brings optimism around the $100K milestone, thanks to ETF inflows and favorable market conditions. Will it hold?

Is a rally to $100K back on the cards?

The cryptocurrency market is buzzing with speculation about Bitcoin potentially hitting the $100,000 mark again. With its price fluctuating around the $90,000 range this week, investors are left questioning whether this bullish momentum can sustain itself. Crypto experts highlight the growing interest in Bitcoin ETFs and increased trading volumes that could indicate a broader acceptance and deeper market engagement.

Understanding the Market Drivers

Key market drivers contributing to the current bullish sentiment include a resurgence of spot Bitcoin ETF inflows, with data showing net inflows of approximately $84.17 million as of late March. This influx is significant because it demonstrates renewed interest from traditional investors, indicating a shift from speculative trading back to fundamental investment strategies.

Moreover, Bitcoin’s performance has been closely linked to macroeconomic factors, including evolving U.S. trade policies and market liquidity. As stated by Ben Yorke from WOO, the reaction to recent tariff discussions signifies a cautious yet optimistic economic outlook that benefits Bitcoin.

Technical Analysis: Bitcoin’s Price Trends

Current price analysis reveals that Bitcoin is trading just below significant resistance levels. The asset has maintained positions above its 20-day and 200-day moving averages, which are often seen as key indicators of bullish trends. However, it faces resistance at approximately $90,000, aligned with its descending trendline.

Independent market analyst Scott Melker emphasizes the importance of monitoring Bitcoin’s relative strength index (RSI). He notes that the RSI has shown a “clear bullish trend,” marked by higher lows and higher highs, which could suggest sustained upward momentum if trading volumes remain robust.

Market Sentiment and Future Outlook

Current market sentiment appears cautiously optimistic, as many traders are adjusting their strategies in anticipation of potential rallies. Institutional investors are showing increased interest, reflected in the steady rise of Bitcoin futures open interest. With a combination of structural improvements in the market, such as higher ETF inflows and stablecoin utilization, many analysts see favorable conditions for Bitcoin’s price trajectory.

As Jiang aptly points out, the market is finding stability not just through price action but via the collective confidence shown by long-term investors. Their accumulation patterns suggest that many are considering Bitcoin as a hedge amid broader economic uncertainties, further stabilizing its groundwork for future growth.

Conclusion

In summary, Bitcoin’s recent performance, characterized by renewed strength and positive sentiment, indicates a potential move towards the coveted $100,000 mark. While technical indicators and market data suggest a bullish phase, the key for Bitcoin will be sustaining these momentum factors without disruption. Traders and investors alike should remain vigilant, monitoring market developments for clear indicators of future price action.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

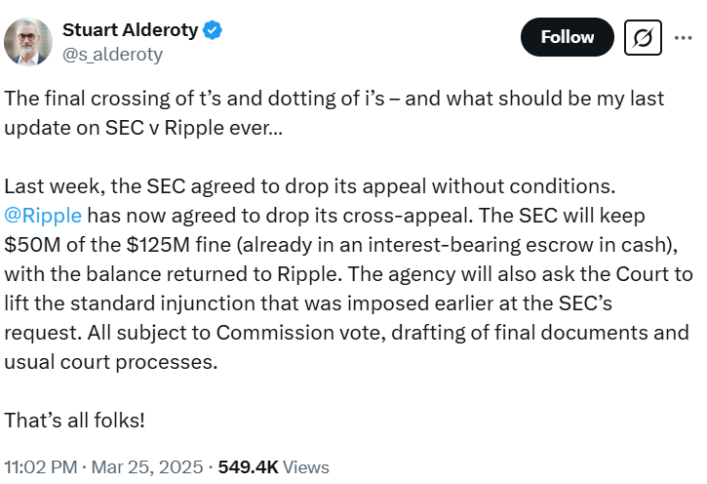

SEC vs Ripple Case Dropped Forever! Case settled for $50M

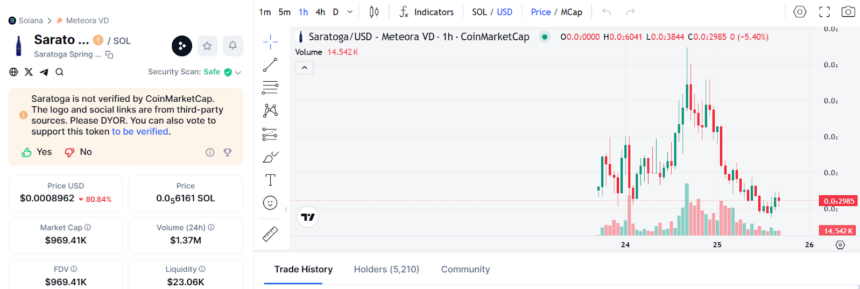

4AM Fitness Influencer Inspires Morning Routine Memecoin

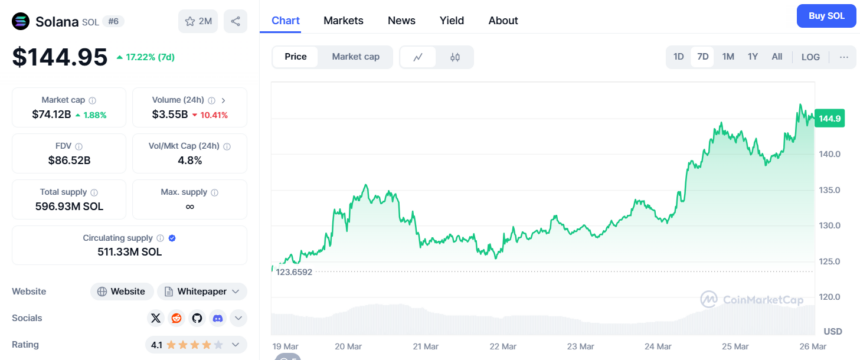

Fidelity Files For Spot Solana ETF with Cboe; SOL Price Pumps to $146