Fully understand zkLink (ZKL): the solution to unify the multi-chain world

远山洞见2024/07/23 02:20

By:远山洞见

I. Project introduction

zkLink is a transaction-centric multi-chain L2 network with unified liquidity protected by ZK-Rollups. The dApp built on the zkLink L2 network utilizes seamless multi-chain liquidity to provide rapid deployment solutions for decentralized and non-custodial order books, AMM, derivatives, and NFT exchanges. ZkLink operates as a trustless, permissionless, and non-custodial interoperability protocol, aiming to connect different blockchains, eliminate differences between different tokens, and solve the problem of liquidity islands formed on isolated chains. Its main products include zkLink Nova and zkLink X.

zkLink Nova is a universal Layer 3 aggregation zkEVM network that mainly solves the liquidity fragmentation problem on Ethereum Layer 2 (L2). It allows seamless Ethereum-compatible decentralized application (DApp) deployment and ensures security and efficiency through zero-knowledge proof technology.

zkLink X is an application-specific extension engine built specifically for high-performance ZK applications. It provides highly customizable trading-specific zkVM Rollup, suitable for various application scenarios, including spot trading, derivative trading, and NFT trading. ZkLink X can aggregate liquidity on multiple chains, providing developers and users with unified liquidity and scalability.

II. Project highlights

1. Cross-chain liquidity aggregation: By using zero-knowledge proof technology, the liquidity of multiple blockchains is unified, solving the problems of asset dispersion and liquidity fragmentation.

2. zkLink Nova: A general aggregation Layer 3 zkEVM Rollup built on Ethereum and its Layer 2, supporting high throughput and fast transactions.

3. zkLink X: Provide customized multi-chain dApp development solutions, connect multiple chains, and achieve high-performance and low-cost application deployment.

4. Security: Adopting ZKPs technology to achieve multi-chain state synchronization and asset security, providing a decentralized and highly secure interoperability environment.

III. Market value expectations

ZkLink uses Zero-Knowledge Proof (ZKP) technology to aggregate multi-chain assets and liquidity, solving the problem of Ethereum Layer 2 ecosystem fragmentation. It supports Layer 2 networks with different technology stacks (such as OP Stack and ZK Stack) and diverse proof technologies (such as fraud proof and validity proof), simplifying the dApp development process. Through zkLink, users can achieve efficient and secure cross-chain asset transfer.

The future is destined to be an era of multi-chain coexistence, and zkLink will also become a key hub, connecting various components and systems of the L1 and L2 ecosystems. Therefore, with the prosperous development of L1 and L2, zkLink will also have more application space, and its market value will inevitably rise.

IV. Economic model

ZKL, the native token of zkLink, is planned to be released in 2024. ZKL will grant users access to zkLink's infrastructure services and grant token holders governance rights over the zkLink project. The planning functions of this asset include:

Pledge: Provers will pledge ZKL to enter the proof auction market of zkLink, where dApps request proof generation services. Provers can earn ZKL rewards by completing these tasks.

Payment Fee: ZKL will become the main payment token in the zkLink proof market. DApps utilizing zkLink infrastructure will pay ZKP generation service fees to provers in ZKL. In addition, specific applications using zkLink's rollup infrastructure will pay infrastructure fees to the project governance organization zkLink DAO in the form of ZKP. These DApps can also use ZKL to pay for specific in-app products.

Governance: Through the future zkLink DAO, ZKL token holders will exercise governance over the direction of zkLink's development.

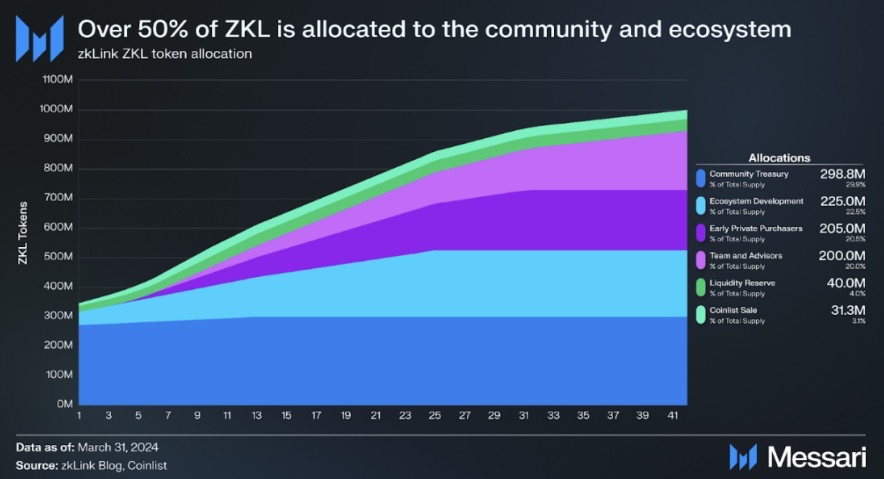

The total supply of zkLink is 1 billion $ZKL tokens, which will be distributed as follows:

Community Rewards (10%): 50% unlocked at TGE for early adopter rewards, 50% for future rewards.

Community Treasury Reserve (15.875%): Specific usage determined by DAO governance.

Community development incentives and bug bounty (4%): 30% will be unlocked at TGE, and the remaining part will be unlocked linearly on a monthly basis within one year.

Liquidity reserve (4%): 50% is unlocked in TGE, and the remaining part is unlocked linearly on a monthly basis within one year, maintaining a neutral token balance.

Ecosystem development (22.5%): 20% is unlocked in TGE, and the remaining part is unlocked linearly on a monthly basis within two years.

Founding team and advisors (20%): Six-month lock-up period, followed by monthly linear unlocking for three years.

Pre-seed round (8%): Five-month lock-up period, followed by a linear unlocking period of 27 months.

Seed round (7.8%): Four-month lock-up period, followed by monthly linear unlocking within 27 months.

Private placement round (4.7%): Three-month lock-up period, followed by monthly linear unlocking within 27 months.

CoinList sales (3.125%): 30% will be unlocked on TGE, and the remaining part will be unlocked linearly on a monthly basis within nine months.

V. Team and financing

The team of the zkLink project is led by founder Vincent Yang.

In terms of financing, zkLink raised $4.68 million through CoinList community sales in January this year, and completed a $10 million strategic financing in May last year, with participation from Coinbase Ventures, SIG, and BigBrain Holdings.

To date, zkLink's total financing has reached $23.18 million and will further develop the Nova agreement.

The investors of zkLink are more strategic partners, not only providing funds and manpower, but also investing more resources to deepen cooperation with zkLink.

VI. Risk Warning

1. The cryptocurrency market is volatile, and large price fluctuations may lead to investment losses. Therefore, cautious decisions should be made and market risks should be fully understood.

2. ZkLink relies on zero-knowledge proof technology, which may have potential technical vulnerabilities or implementation difficulties, affecting system security and stability.

VII. Official link

Website:

https://zk.link/

Twitter:

https://x.com/zkLink_Official

Telegram:

https://t.me/zkLinkorg

1

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Locked for new tokens.

APR up to 10%. Always on, always get airdrop.

Lock now!

You may also like

BTC Weekly Candle Closes at $80K After Bounce From 74.4K Support

CryptoNewsNet•2025/04/12 16:55

Hedera price targets $0.19 after brief 1% spike

Coinjournal•2025/04/12 16:00

Dogecoin price set for 364% rally as RSI breakout pattern emerges

Coinjournal•2025/04/12 16:00

Grayscale expands altcoin list to 40 in April 2025 update, adds Dogecoin and PYTH trusts

Coinjournal•2025/04/12 16:00

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$83,958.04

-0.92%

Ethereum

ETH

$1,582.59

-4.07%

Tether USDt

USDT

$0.9996

-0.01%

XRP

XRP

$2.15

-0.06%

BNB

BNB

$584.77

-2.41%

Solana

SOL

$128.51

-1.27%

USDC

USDC

$0.9999

-0.00%

Dogecoin

DOGE

$0.1628

-1.79%

TRON

TRX

$0.2480

-0.54%

Cardano

ADA

$0.6431

-3.02%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new Bitgetters!

Sign up now