Dogecoin price set for 364% rally as RSI breakout pattern emerges

- Dogecoin has dropped 13.8% over the past two weeks.

- Key support at $0.14 must hold to sustain a bullish setup.

- Resistance at $0.15 and $0.16 remains a key hurdle.

Dogecoin (DOGE) may be on the cusp of a major breakout, with a new chart pattern forming on its 3-day candles that closely resembles previous rallies.

If the setup holds, it could trigger a 364% surge, lifting Dogecoin’s price to around $0.67 from its current range near $0.14–$0.15.

Source: CoinMarketCap

However, recent price movements have shown notable volatility, and any breakdown below key support may reverse short-term bullishness, especially in light of broader market weakness.

Dogecoin price: RSI breakout hints at sharp upside

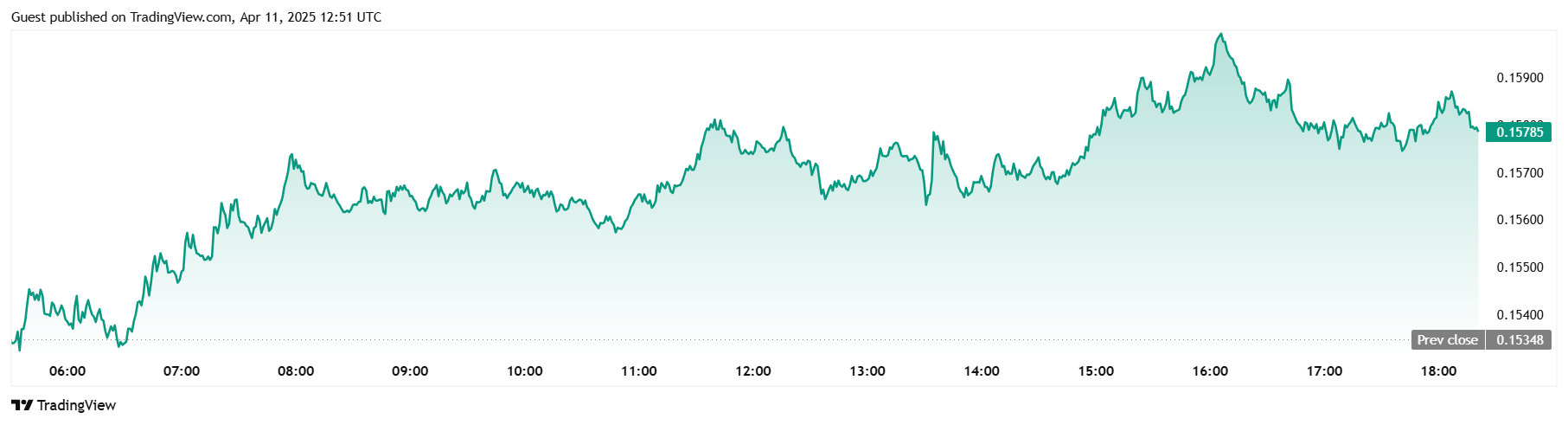

Between 5 and 7 April, Dogecoin fell to $0.13 before briefly rebounding.

The token traded at $0.14 on 10 April and has since hovered around $0.15.

Despite the narrow range, Dogecoin is down 5.8% over the past week, 13.8% over two weeks, and 6.9% over 30 days.

Recent technical formations point to a breakout in RSI (Relative Strength Index) resistance and a price action pattern that mirrors previous pre-rally periods.

Historical support has flipped to resistance, and bullish divergence patterns have emerged—both of which have previously preceded major upward moves in past bull cycles.

In February, Dogecoin fell over 70% from highs near $0.67 to around $0.2.

Current chart indicators show similar structural elements to earlier phases that led to rallies, suggesting a possible recovery if momentum continues building.

Support at $0.14 underpins bullish case

Dogecoin has shown relative strength during broader crypto market losses.

On a day when the global crypto market dropped 4.4%, Dogecoin registered a modest 0.11% gain.

This slight decoupling points to underlying resilience and buyer activity at current price levels.

Ongoing whale accumulation and a minor recovery in daily trading volume have supported the coin’s stability.

However, macroeconomic concerns, including shifts in Donald Trump’s trade policy direction, continue to weigh on the broader market and may influence investor confidence and risk appetite.

A sustained drop below $0.14 would likely invalidate recent recovery signals and may trigger a deeper correction.

Resistance at $0.15–$0.16 remains a hurdle

Immediate resistance remains at $0.15 and $0.16. Without a rise in trading volume, Dogecoin may struggle to break through.

A confirmed move beyond $0.16 would likely pave the way for further gains, with $0.20 as the next key resistance.

Price consolidation near current levels, followed by a sharp move upward, would confirm the breakout scenario.

Any failure to breach these resistance levels may extend the consolidation phase and delay the next leg up.

Long-term target at $0.67 remains conditional

While the technical structure hints at a move toward $0.67, several conditions need to align.

These include strong buyer interest, macroeconomic stability, and confirmation across multiple timeframes using volume and momentum indicators.

Previous price surges from similar setups show that rallies of this magnitude are possible but not guaranteed.

For now, Dogecoin remains range-bound, with indicators suggesting the coming weeks may determine its next major move.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC Weekly Candle Closes at $80K After Bounce From 74.4K Support

Hedera price targets $0.19 after brief 1% spike

Grayscale expands altcoin list to 40 in April 2025 update, adds Dogecoin and PYTH trusts

JasmyCoin soars nearly 20%: what’s driving the surge?