News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

Share link:In this post: According to the company, new Sora users can still create images using the service. OpenAI system got overwhelmed following the launch of a new image generation update for ChatGPT which spurred a flurry of Ghibli-style images. The strain has also affected the video generation capabilities for Sora.

Short-Term Investors Bear the Brunt as Bitcoin Price Dive Ignites Market-wide Panic

Assessing the Potential of Ethereum's NFT Prowess to Surpass Bitcoin's Market Dominance by 2025

Seasoned Bitcoin Holders Back in Accumulation Mode: A Deep Dive into the Value Days Destroyed Metric and its Implication for a Bullish Breakout

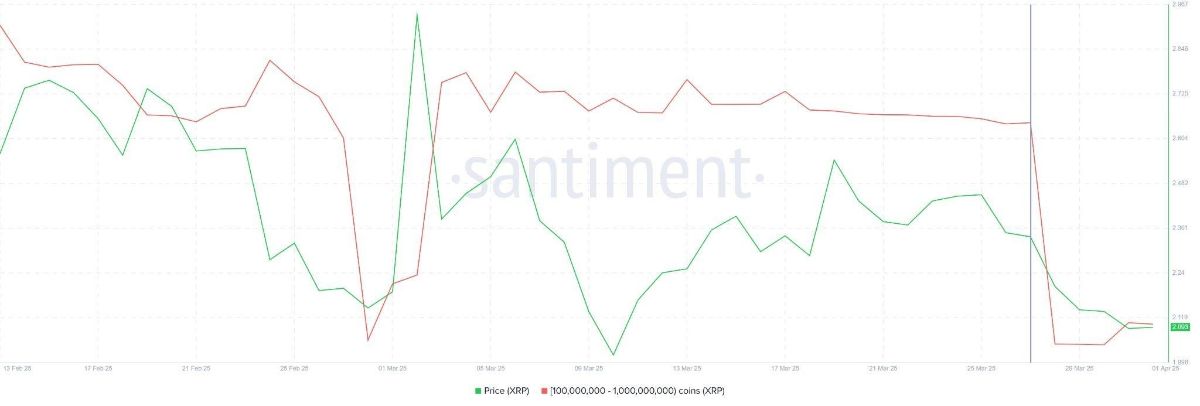

In Brief BERA could jump by 70% if it surpasses its resistance level. XRP's "head and shoulders" pattern raises concerns about its price movement. SUI may experience a further increase of 28% if positive momentum continues.

Quick Take The SEC and Gemini have filed a joint motion for a 60-day stay for their legal case to seek a resolution. The SEC has recently been dropping its lawsuit against crypto companies, including Coinbase and OpenSea.

XRP price has increased 7% to $2.17, with daily trading volume rising 18% to $4.22 billion.

- 02:05Circle, other companies considering postponing IPOs due to tariffsPANews reported on April 5 that according to WSJ, in the context of the trade war and a new round of tariff measures, many companies are considering postponing their initial public offerings (IPOs). These include social trading platform eToro Group, medical technology company Medline, virtual physical therapy company Hinge Health, financial technology company Chime, and crypto company Circle. Chime has decided to postpone the public submission of financial documents to regulators, thereby delaying its IPO process. Circle, which had been actively preparing for its listing, has now turned to cautiously wait and see the market trend.

- 01:57Arthur Hayes: Bitcoin price volatility may have decoupled from NasdaqAccording to ChainCatcher, Arthur Hayes posted on social media that Bitcoin holders need to learn to love tariffs. Bitcoin may have gotten rid of its correlation with Nasdaq and may become the purest early warning indicator of fiat currency liquidity.

- 01:55Yesterday, Grayscale GBTC had a net outflow of US$25.2 million, and ARKB had a net outflow of US$21.8 millionGolden Finance reported that according to Farside Investors' monitoring, Grayscale's GBTC had a net outflow of US$25.2 million yesterday, ARK's ARKB had a net outflow of US$21.8 million, and Bitwise's BITB had a net outflow of US$17.9 million.