News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (April 1) | Strategy buys another 22,048 BTC; Trump's "reciprocal tariffs" plan to be revealed2GameStop raises $1.5 billion in convertible notes for bitcoin buying spree3Tether bought 8,888 bitcoin in Q1, bringing its total holdings to $7.8 billion — the sixth largest in a single wallet

ONDO Whales Pull Back as Price Risks Dropping Below $0.70

ONDO struggles to recover after a sharp sell-off, with weak RSI recovery and declining whale accumulation pointing to continued pressure.

BeInCrypto·2025/03/29 10:00

President Trump’s Role in USD1 Stablecoin Prompts Regulatory Questions

US lawmakers are demanding clarity from the Federal Reserve and OCC on how they will safeguard regulatory integrity amid Trump and USD1 stablecoin ties.

BeInCrypto·2025/03/29 06:00

El Salvador’s Nayib Bukele May Meet Trump as Bitcoin Interests Align

The potential meeting, while not officially confirmed, comes amid increasing alignment between the two leaders on issues like border security and Bitcoin policy.

BeInCrypto·2025/03/29 03:28

Solana Rivals Poised for Massive Gains—Turn $100 Into $10K Before Q2 Ends

Cryptonewsland·2025/03/29 01:55

Movement (MOVE) Price Gains 27% as Accumulation Builds and Bullish Momentum Takes Over

Cryptonewsland·2025/03/29 01:55

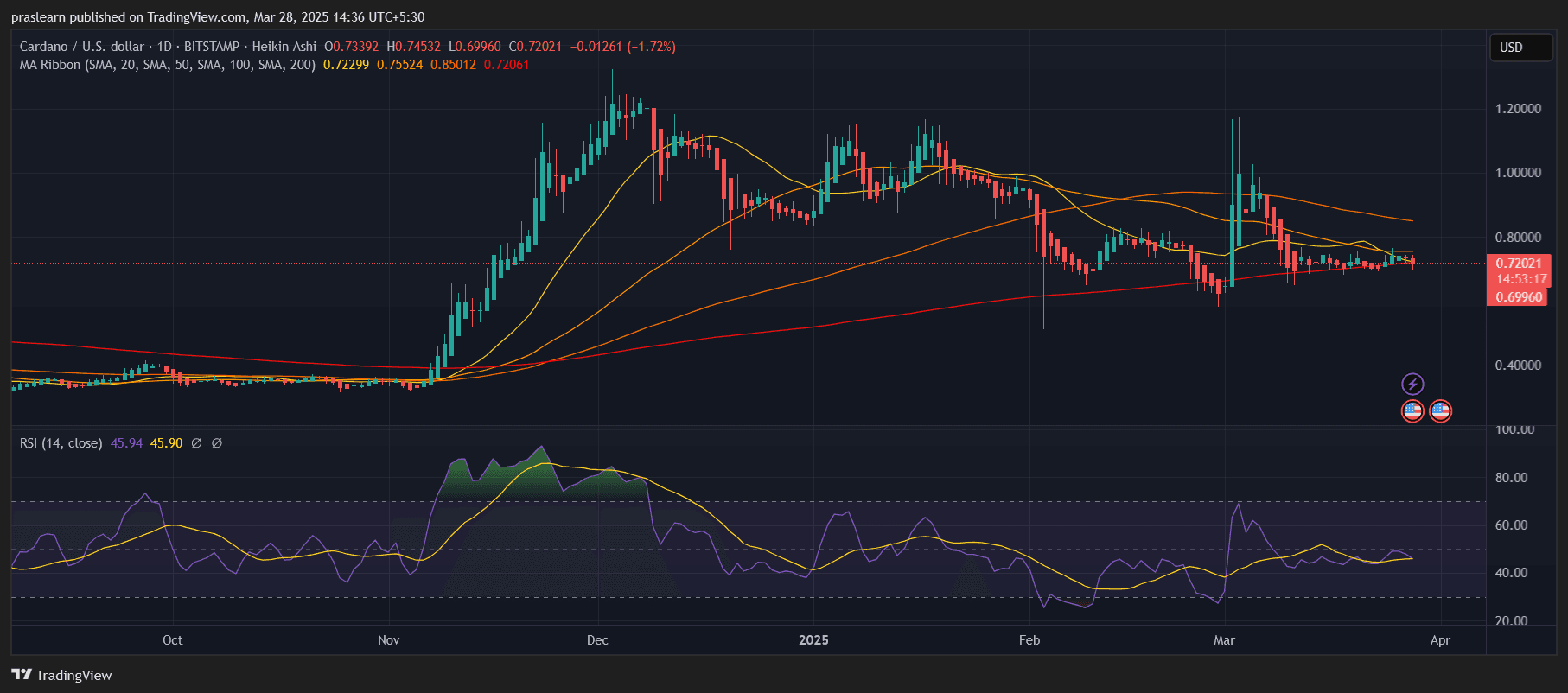

Cardano Aiming for $10? Big Move Coming?

Cryptoticker·2025/03/29 00:00

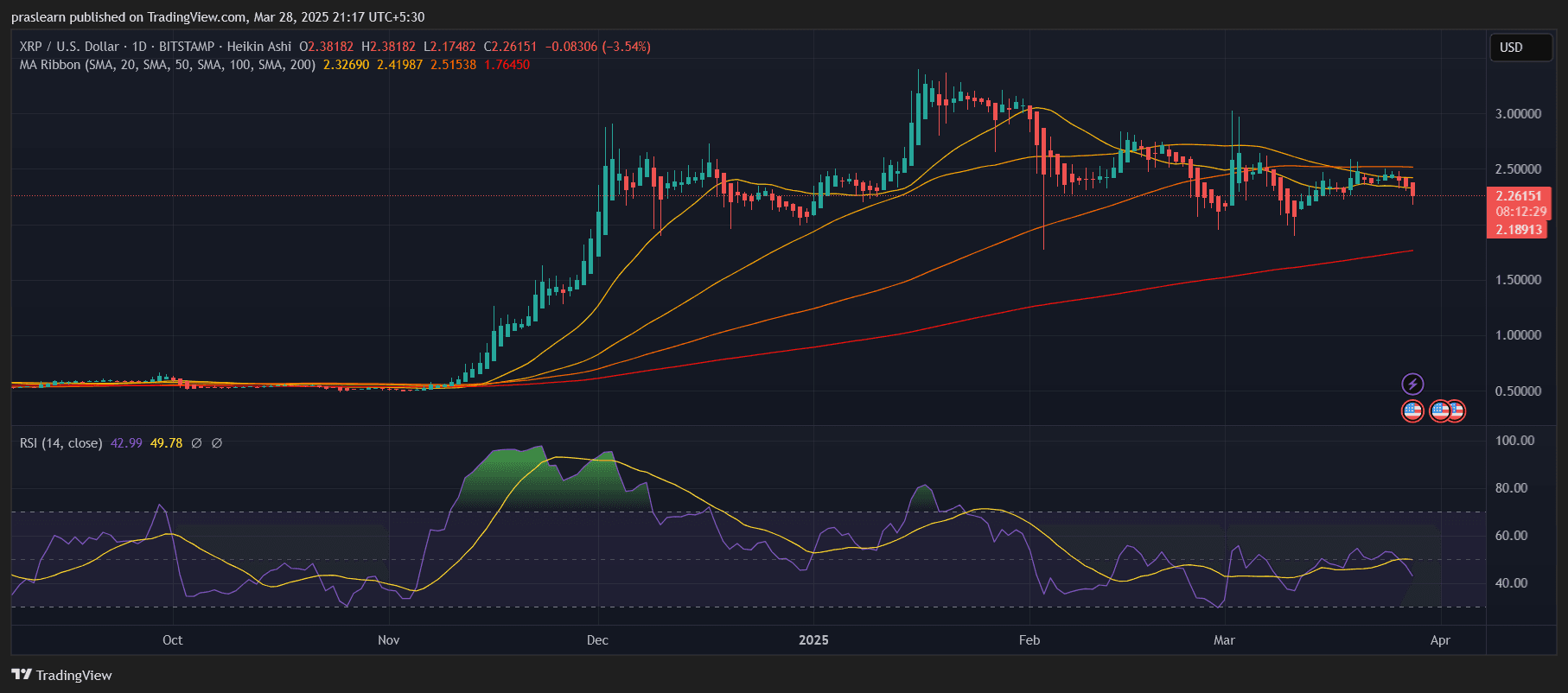

Will XRP Crash? Here’s What the Chart Is Warning Us About

Cryptoticker·2025/03/29 00:00

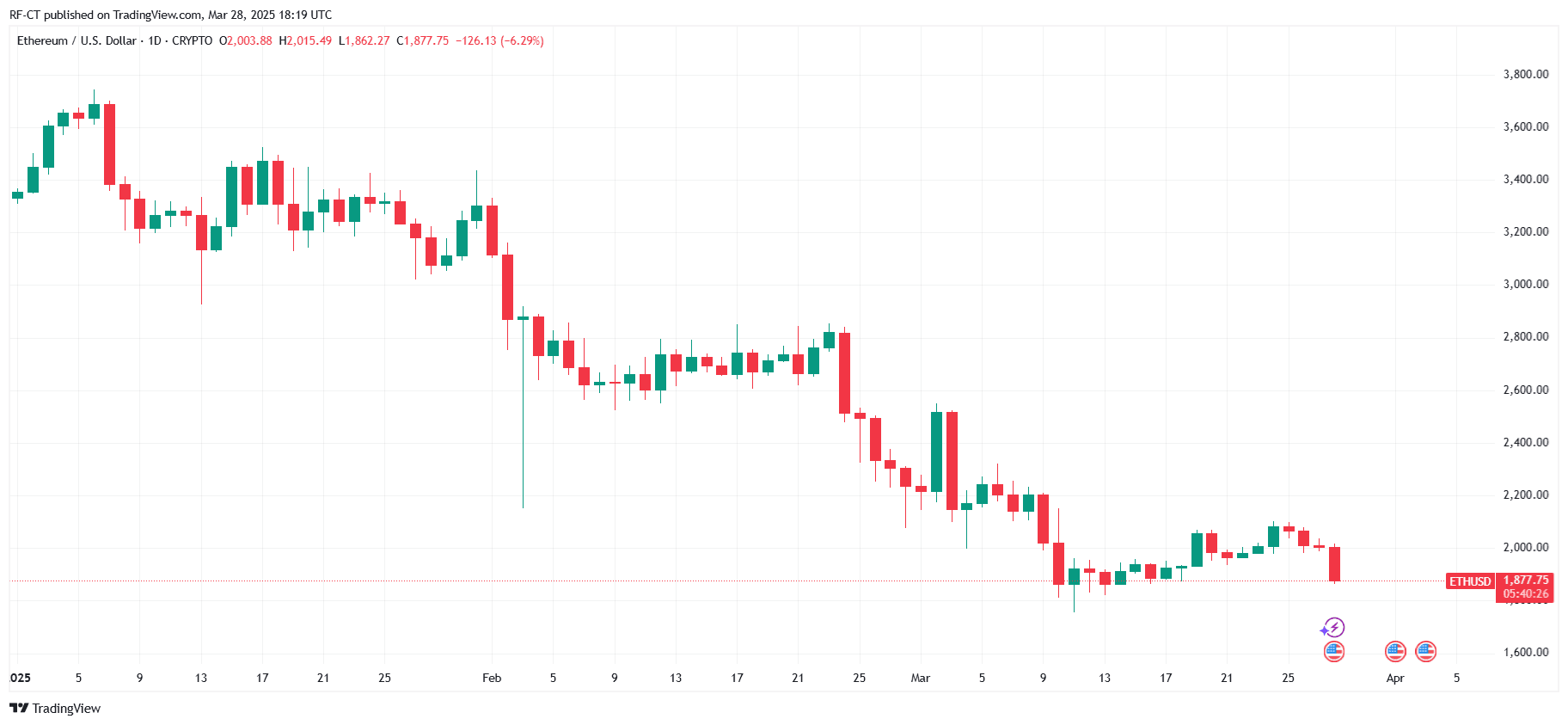

Ethereum Price Prediction 2025: Will ETH Hit $10K Soon as Whales Accumulate?

Cryptoticker·2025/03/29 00:00

Is XRP Following Kaspa’s (KAS) Bearish Trend? Price Action Suggests So

CoinsProbe·2025/03/28 23:55

Story (IP) Breaks Down from Symmetrical Triangle – What’s Next?

CoinsProbe·2025/03/28 23:55

Flash

- 06:42Sam Altman: We are currently facing computational bottlenecks, the new version of OpenAI may be delayed in releaseOpenAI founder Sam Altman announced that the new version of OpenAI may be delayed due to computational bottlenecks, and the service might sometimes slow down. Previously, Sam Altman stated on February 12th that he planned to launch GPT-4.5 and GPT-5 in the coming weeks or months. He also mentioned yesterday about releasing a "new open-source weight language model" with reasoning capabilities in the next few months. An open-source weight language model refers to a model that can be publicly used, downloaded, modified or deployed. Although it is not as open as a fully open source mode, it is a significant change compared to the completely closed GPT-3 and GPT-4. OpenAI partially opened up its GPT-2 model in February 2019 and completed full-scale opening up in November of the same year.

- 06:34BTC falls below 84000 US dollarsThe market shows that BTC has fallen below 84,000 US dollars, currently quoted at 83,987.99 US dollars. The 24-hour increase has narrowed to 1.25%. The market fluctuates significantly, please manage your risk well.

- 06:20Hong Kong listed company Zhongze Feng: Plans to invest no more than 10% of fund assets in virtual assetsChainCatcher News, according to the announcement by the Hong Kong Stock Exchange, Zhong Zefeng, a listed company in Hong Kong stocks, released its annual performance announcement for 2024. It disclosed that its subsidiary Atlantic Asset Management Co., Ltd. has been approved by the Hong Kong Securities Regulatory Commission to allow Zhong Zefeng's managed funds to invest no more than 10% of their assets under management (AUM) in virtual assets.