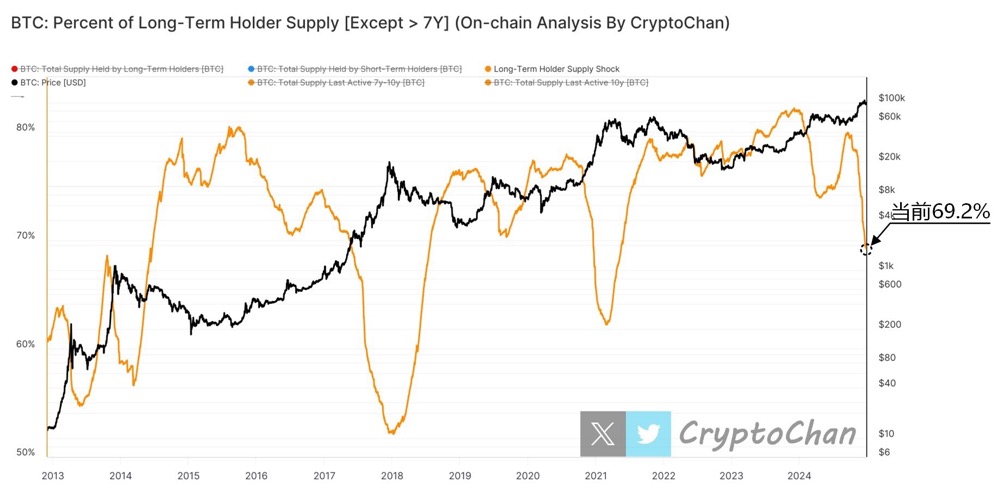

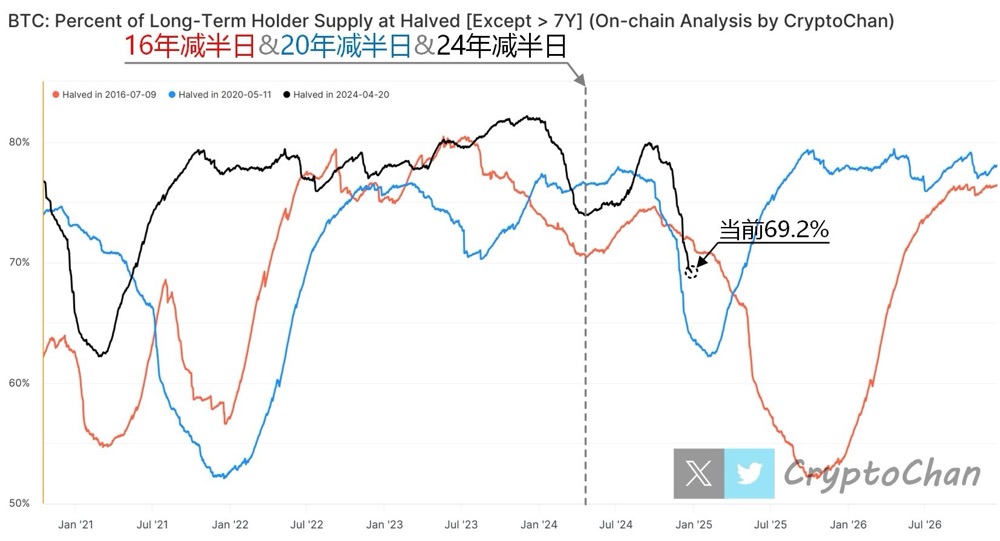

Bitcoin long-term holders account for 69.2%, on-chain signals indicate that the top of the bull market is gradually approaching

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

4 Best Cryptos to Buy Now: Web3 ai, Toncoin, Aave, Celestia Set to Explode

Compare June’s best cryptos to buy now as Web3 ai hits $7.1M, Toncoin eyes breakout, Aave gains strength, and Celestia preps major upgrades.2. Toncoin Approaches $3.28 Breakout Level3. Aave Climbs Above $249 as Volume Grows4. Celestia Bounces Back from $2.18Final Thoughts

TRUMP Memecoin: Eric Trump Announces Significant WLFI Investment Plan

Virtuals Protocol Might Struggle to Retain $2 – Here’s Why

Despite a recent 11% rise, Virtuals Protocol struggles with investor interest and resistance at $1.93. A breakthrough could target $2.00, but the trend remains uncertain.

SUI will Trigger a $96 Million Liquidation if Price Reaches This Level

SUI’s recent 12% surge could spark significant liquidations if it breaks $3.33, but negative momentum and resistance pose challenges to further gains. Watch for key price levels to determine direction.