Perpetual futures funding rate calculation

What are funding rates?

To ensure that the perpetual futures price reflects the underlying asset's spot market price, exchanges implement a funding rate mechanism. This system facilitates periodic cash payments between long and short position holders, driving the futures price toward the index price. When the funding rate is positive, long positions pay the funding fee to short positions. Conversely, when the funding rate is negative, short positions pay the funding fee to long positions. Note that Bitget does not charge any fees, as its role is simply to facilitate these payments between traders.

Generally, Bitget settles the funding fees every 8 hours, at 8:00 AM, 4:00 PM, and 12:00 AM (UTC+8) respectively. Some futures may settle the funding fees every 2 or 4 hours. The settlement frequency may be adjusted dynamically based on market conditions.

Funding rate calculation

Funding rate (F) = clamp{[average premium index (P) + clamp(interest rate (I) − average premium index (P), -0.05%, 0.05%)], min. funding rate, max. funding rate}

The funding rate consists of two components: interest rate and premium Index.

Bitget calculates the interest rate (I) and the average premium index (P) every minute, then calculates their weighted average based on every minute's data over an N-hour period. Closer to the settlement time, a higher weight is assigned to recent premium index values.

For a funding fee settlement interval of 8 hours, the average premium index (P) is calculated as follows: (Premium_index_1 × 1 + Premium_index_2 × 2 + ... + Premium_index_480 × 480) ÷ (1 + 2 + ... + 480).

Each hour corresponds to a 60-minute interval. For an 8-hour funding fee settlement interval, there are 480 data points (8 × 60). The weight follows an arithmetic progression (1, 2, 3, …, 480) with a common difference of 1.

The funding rate is calculated based on the N-hour interest rate and the premium/discount component. A +/- 0.05% damper is added.

N = funding fee settlement interval. If funding fees are settled every 8 hours, then N = 8. If funding fees are settled every hour, then N = 1.

So, if (I–P) falls within +/-0.05%, then F=P+(I–P)=I. In other words, the funding rate will be equal to the interest rate.

Interest rate (I)

Interest rate (I) = 0.03% ÷ funding fee interval

Funding fee duration = 24 ÷ funding fee settlement interval

Example: For BTCUSDT perpetual futures, assuming the funding fees are settled every 8 hours.

Funding fee duration = 24 ÷ funding fee settlement interval = 24 ÷ 8 = 3 hours

Interest rate = 0.03% ÷ funding fee interval = 0.03% ÷ 3 = 0.01%.

Minimum and maximum funding rates

Maximum funding rate = 0.75 × maintenance margin ratio

Minimum funding rate = –0.75 × maintenance margin ratio

The default value is 0.75, which may vary between 0.01–2.

The maximum funding rate is calculated based on the maintenance margin ratio at the highest leverage.

Premium index (P)

There may be a significant difference between the perpetual futures price and the mark price. On such occasions, a premium index will be used to adjust the next funding rate to bring it in line with the price at which the futures contract is currently trading.

Premium index (P) = [Max (0, impact bid price − index price) − Max (0, index price − impact ask price)] ÷ index price

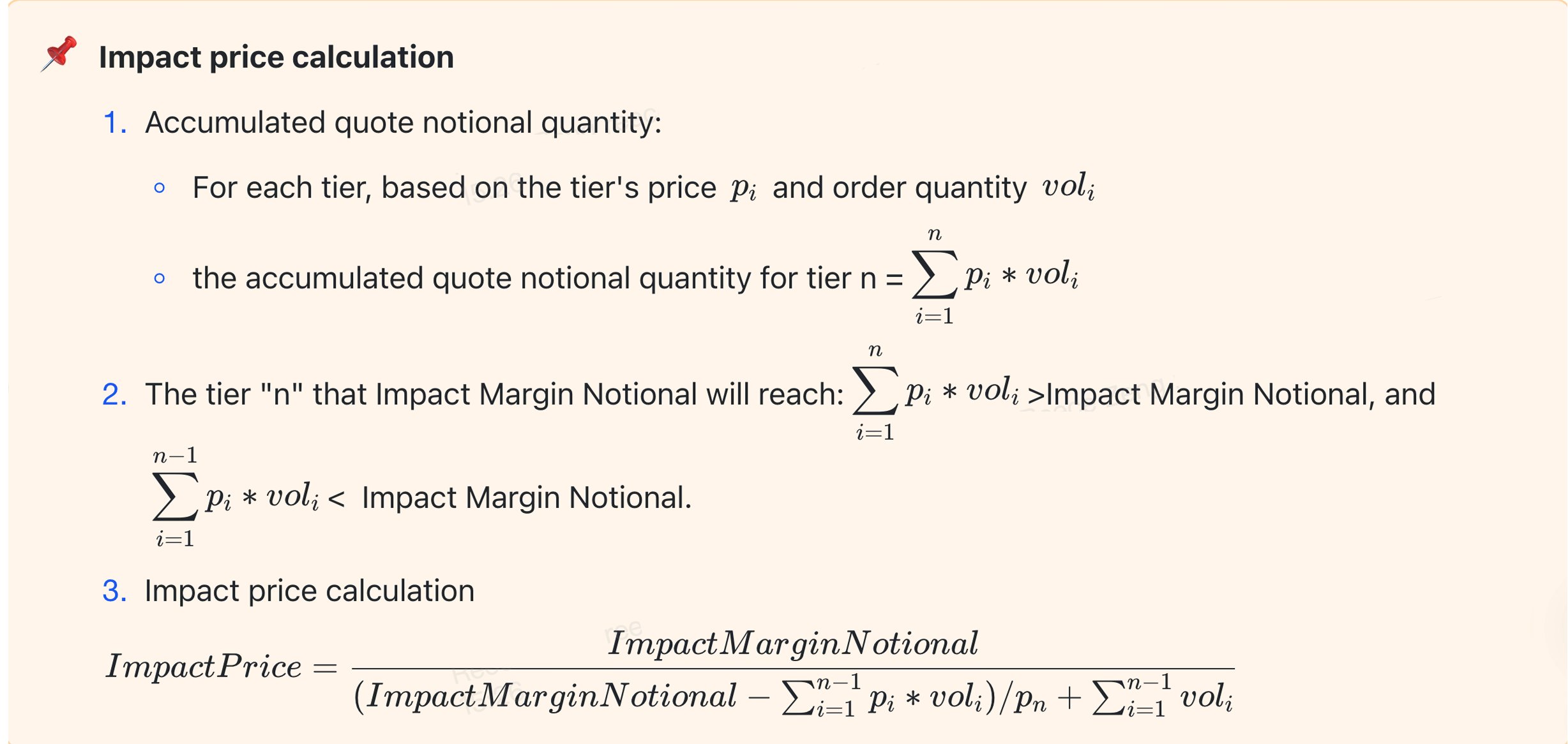

Impact bid price is the average fill price to execute the Impact Margin Notional on the bid side.

Impact ask price is the average fill price to execute the Impact Margin Notional on the ask side.

Impact Margin Notional is the possible futures position size based on a fixed-value margin, used to calculate the impact bid/ask price and the depth of the order book. The specific calculation is as follows:

For example, if the minimum maintenance margin rate of BTCUSDT perpetual futures is 0.5%, Impact Margin Notional for BTCUSDT = 200 USDT ÷ 0.5% = 40,000 USDT.

Funding fee calculation

Funding fee = position value × funding rate = futures position size × index price × funding rate

Note: The system calculates the funding fee at settlement based on position value. The fee is deducted from the paying user and transferred to the recipient. However, if the paying user's positions are liquidated or if there is insufficient margin in isolated margin mode, the recipient may not receive the full amount.

Share