Bitget Beginner's Guide — What Are Futures?

What is futures trading?

Crypto futures trading is a type of derivative investment product in which buyers and sellers agree to trade an underlying asset at a predetermined price on a specific future date. There are three types of futures products: delivery futures, perpetual futures, and options. Futures trading supports two-way trading—investors can go long (buy) if they expect the price to rise, or go short (sell) if they expect it to fall. These products can also be used for hedging or arbitrage strategies to manage risk.

The concept of crypto futures trading is inspired by traditional derivatives market. Take crude oil futures as an example. When two parties enter into a contract with an execution price of $80 per barrel, they form a binding agreement: the buyer has the right—and obligation—to purchase crude oil at that price on a specified future date, while the seller must deliver the oil at that price and receives the agreed payment. This mechanism of locking in a future price through a contract forms the foundation of modern derivatives trading.

In the digital asset space, a similar concept applies, except the underlying asset is cryptocurrency instead of a commodity. Most of the time, investors don't actually fulfill the contract's delivery terms. Instead, they trade the contract before expiry—or in the case of perpetual futures, enter and exit positions flexibly—to profit from price movements.

Features and risks of futures trading

Futures trading supports two-way trading, allowing investors to profit from both rising and falling markets by buying long or selling short. Unlike spot trading, futures trading operates on a margin system, which enables investors to control larger positions with only a portion of their capital through leverage. For example, with 10x leverage, a 1% price move can result in a 10% return. However, leverage is a double-edged sword that magnifies both potential gains and losses. Investors should carefully assess their risk tolerance and use leverage prudently.

Futures trading types

There are two main types of futures trading in the cryptocurrency industry: USDT-M/USDC-M Futures and Coin-M Futures. Bitget offers USDT-M perpetual futures, USDC-M perpetual futures, Coin-M perpetual futures, and Coin-M delivery futures—each suited to different kinds of traders.

• USDT-M and USDC-M perpetual futures are settled and denominated in stablecoins—USDT and USDC, respectively. These futures have no expiration date and are ideal for traders who value flexibility. Popular trading pairs include BTCUSDT and ETHUSDC. Futures values are calculated in fiat currency, transaction fees are based on funding rates, and position sizes are straightforward to understand.

• Coin-M Futures are denominated and settled in cryptocurrencies like BTC or ETH. They come in two types: perpetual futures, which have no expiry; and delivery futures, which settle on a fixed date (e.g., BTCUSD 0628).

To learn more, refer to: Bitget beginner's guide – USDT-M/USDC-M Futures and Coin-M Futures explained

How futures trading works

Investors deposit margin funds and use leverage to amplify their position size. They can then go long (buy) or short (sell) depending on price expectations and close their position at the right time to realize a profit or loss.

1. Select futures trading type and direction

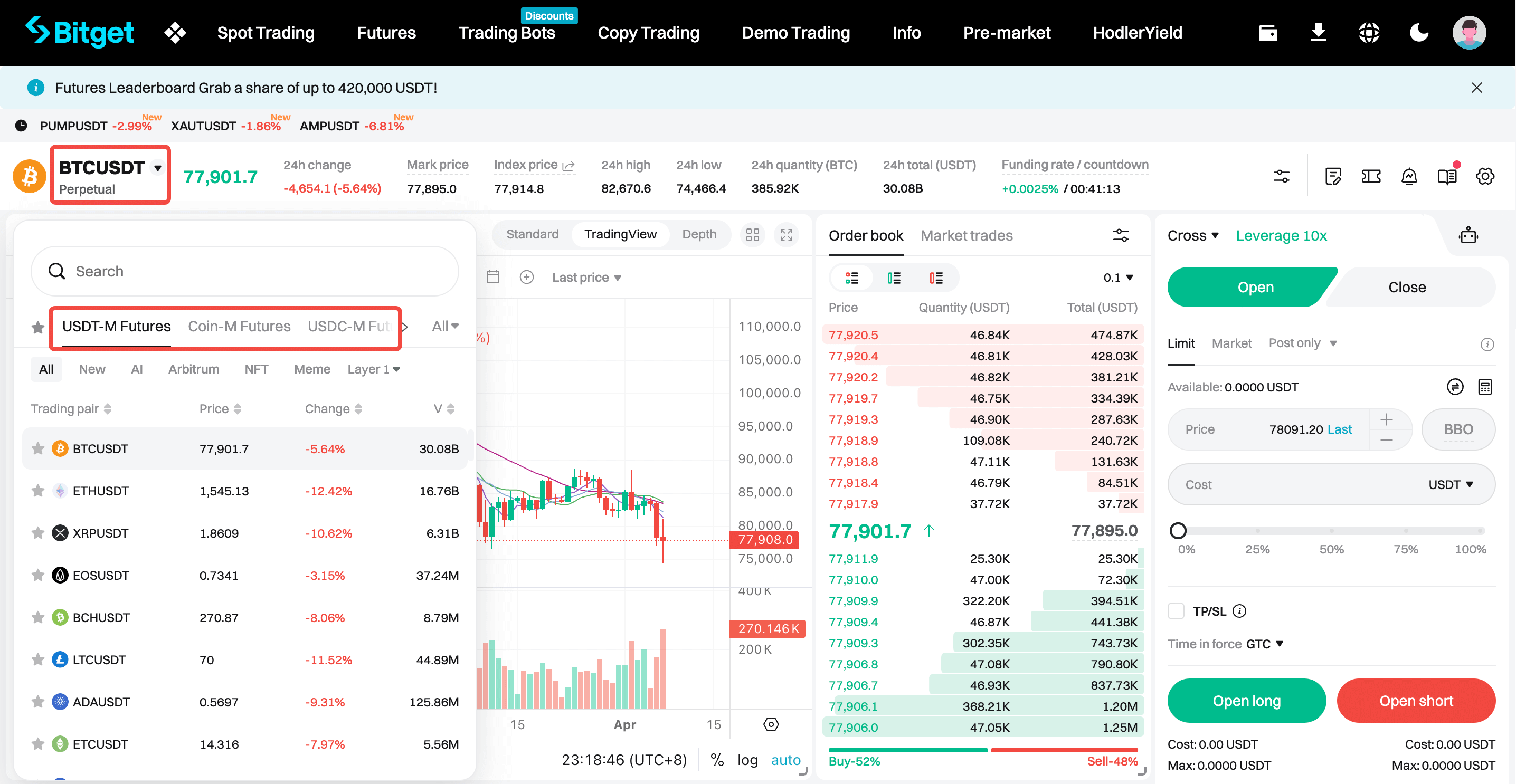

• Futures types: USDT-M Futures, USDC-M Futures, or Coin-M Futures (perpetual or delivery-based)

• Trading direction:

○ Long (buy): Open a position when expecting the price to rise.

○ Short (sell): Open a position when expecting the price to fall.

2. Set leverage and place an order

• Choose your leverage (e.g. 5x, 10x, 20x). Higher leverage increases both risk and returns.

• Enter the price and quantity. The system will automatically calculate the required margin.

• Order type:

○ Limit order: Executes at your specified price.

○ Market order: Executes immediately at the best available price.

○ Condition order: Executes only when preset conditions are met.

3. Select margin mode

• Cross margin: All positions share the same margin balance. This mode is suitable for hedging strategies but carries the risk of all positions being liquidated.

• Isolated margin: Each position uses its own margin, isolating risk and making it easier to manage the exposure of individual trades.

(Margin modes can be switched when no positions are open.)

4. Position management and risk control

• Real-time monitoring: Keep an eye on unrealized PnL, margin ratio, and other key metrics.

• Adjust your positions:

○ Set TP/SL: Automatically close positions at preset profit or loss levels.

○ Manual close: Partially or fully close your position at any time.

• Add margin: If your margin ratio drops too low, you'll need to add margin to avoid liquidation.

5. Delivery (delivery futures only)

• Delivery futures that aren't closed by the expiration date will be automatically settled at the delivery price (such as the BTC index price). Profit and loss will be calculated accordingly.

6. Fund settlement

• After closing or delivery, profits or losses are settled to your futures account balance. You can withdraw these funds or continue trading.

Take BTC futures as an example:

Initial condition

• User A's capital: 10,000 USDT

• BTC price: 50,000 USDT

• Leverage: 10x

• Futures position: 2 BTC (worth 100,000 USDT)

○ Actual required margin = futures value ÷ leverage = 10,000 USDT (same as the user's principal).

Market movement

• Bitcoin rises by 20% → 60,000 USDT

• New position value: 2 BTC × $60,000 = 120,000 USDT

Position closure

1. Proceeds from closing the position: 120,000 USDT

2. Net profit = 120,000 – 100,000 = 20,000 USDT

3. ROI = profit ÷ principal = 20,000 ÷ 10,000 = 200%

Outcome:

By using leverage, User A achieved a 200% return from a 20% increase in BTC's price (from $50,000 to $60,000).

How to access Bitget Futures

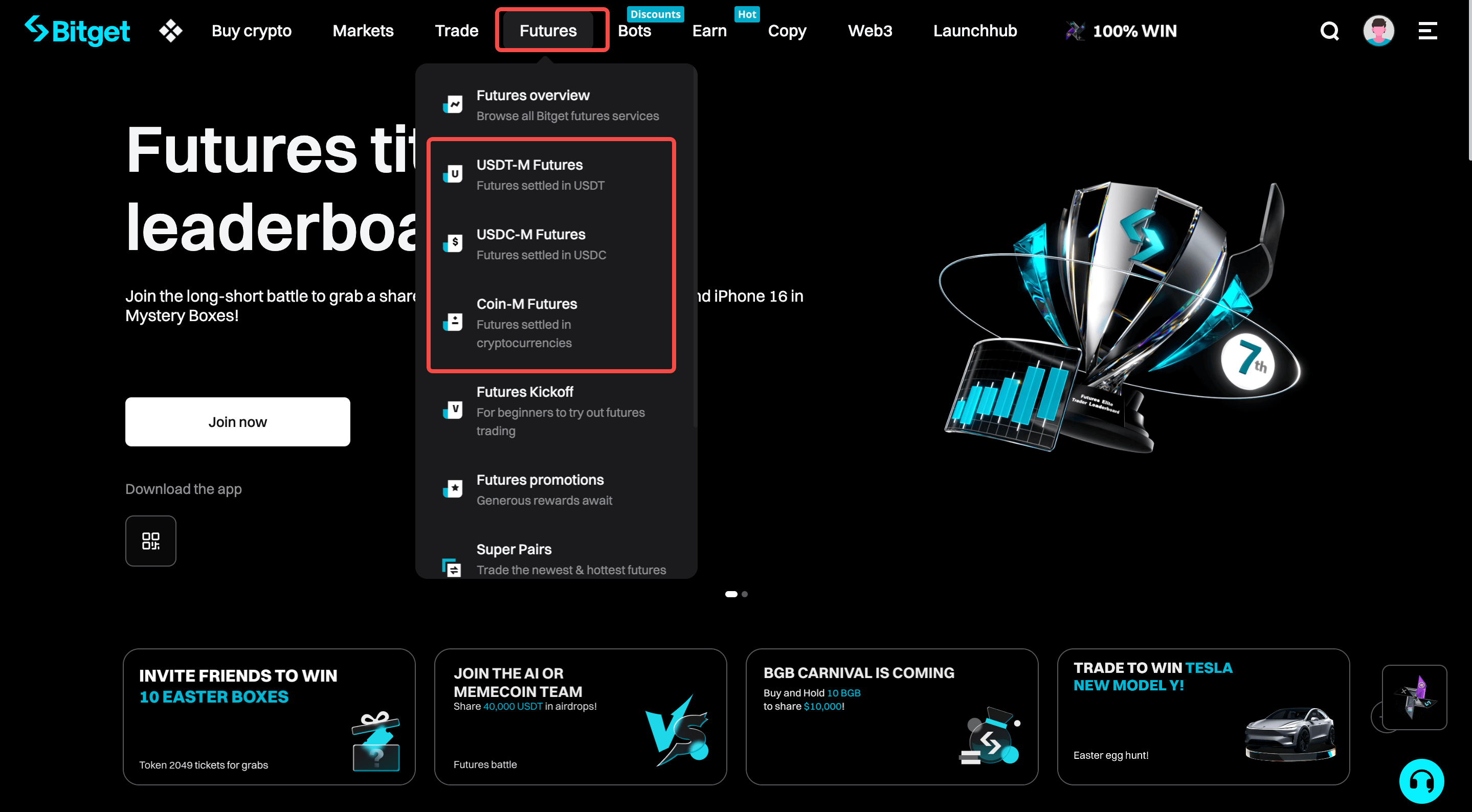

• Website

1. Visit the Bitget homepage, click Futures in the top navigation bar, and select USDT-M Futures, USDC-M Futures, or Coin-M Futures.

2. After selecting the futures type, choose the trading pair you want to trade on the futures trading page.

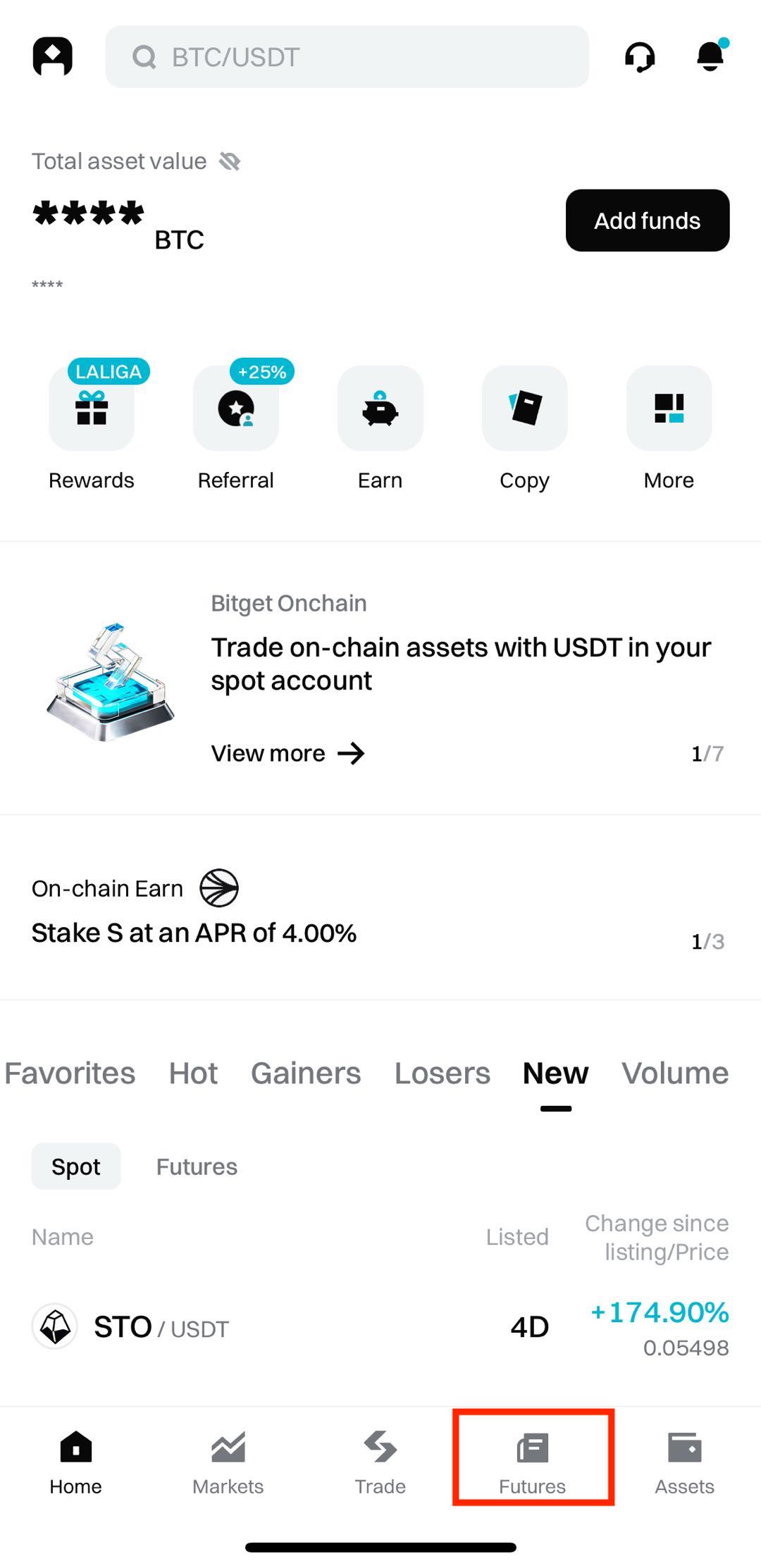

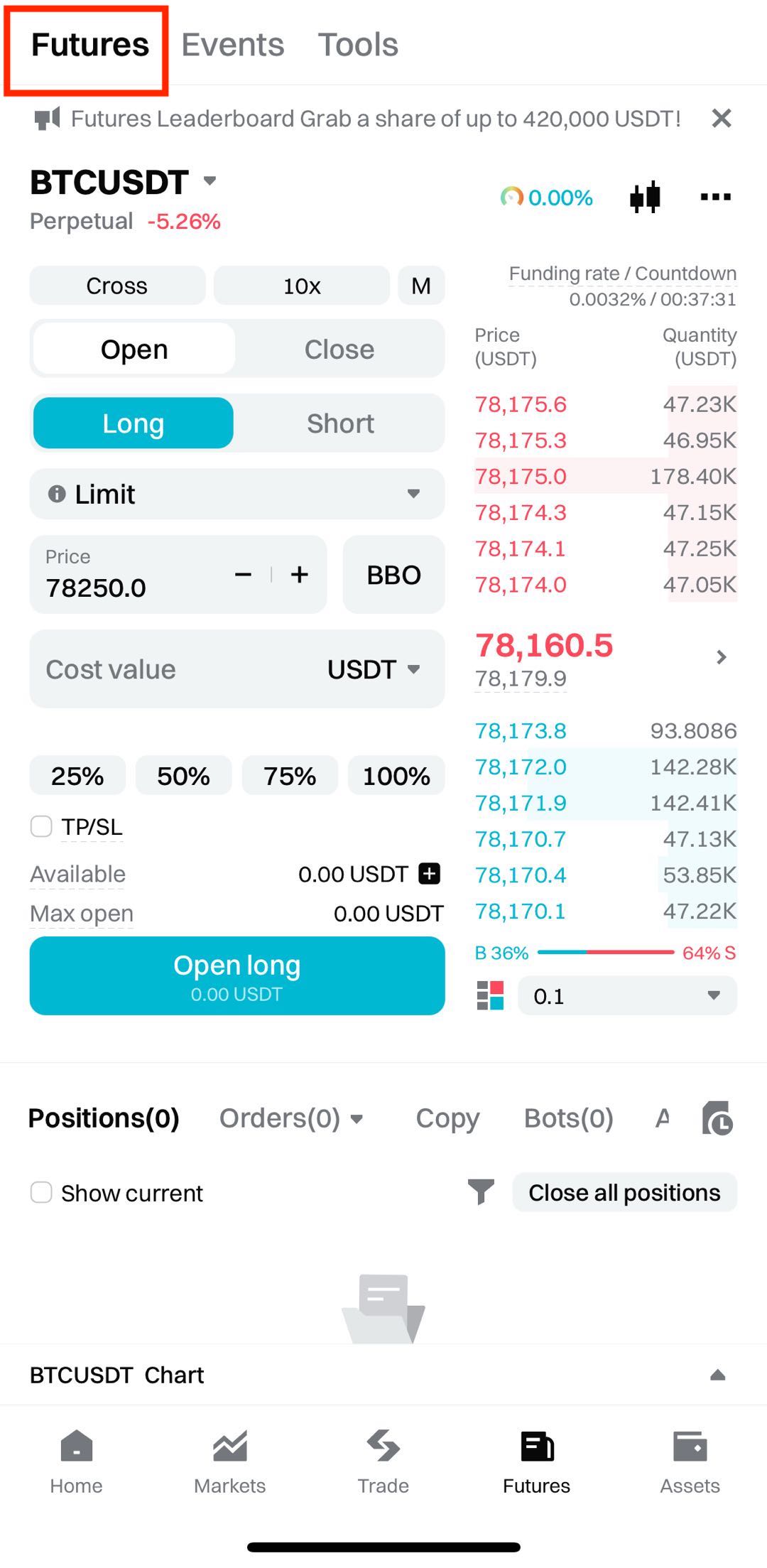

• App

1. Open the Bitget app and tap Futures in the bottom navigation bar.

2. Select the trading pair and futures type you want to trade.

Pros and cons of futures trading

Pros

1. Two-way trading for flexible strategies

○ Futures support both long (buy) and short (sell) positions, allowing traders to profit in both bull and bear markets. The more volatile the market, the more opportunities there are.

2. Leverage amplifies returns and improves capital efficiency

○ Bitget supports up to 125x leverage (varies by coin), allowing traders to control large positions with relatively small principal.

○ For example, with 10x leverage, a 10% price increase can double your principal—whereas spot trading would require a 100% gain to achieve the same return.

3. Hedging to manage downside risk

○ Miners, institutions, and long-term holders can use futures to hedge against spot market downturns, helping reduce losses caused by volatility.

4. Diverse trading pairs and strong liquidity

○ Bitget offers a broad selection of futures for both major cryptocurrencies and altcoins. Deep order books and low slippage contribute to a smoother trading experience.

Cons

1. Leverage magnifies losses and carries high liquidation risk

○ Leverage is a double-edged sword. A 5% drop in price with a 20x leverage can wipe out your principal, even if the market later recovers.

○ Liquidation mechanism: If your margin ratio falls below the maintenance level, the system will automatically liquidate your position, resulting in the loss of your entire margin.

2. Volatile markets make emotional discipline difficult

○ Leveraged trading amplifies the psychological stress caused by large price swings. It can lead to FOMO (fear of missing out) or panic selling, resulting in irrational decisions.

3. Complex mechanics require strict risk control

○ Futures trading requires a strong grasp of margin calculations, liquidation rules, and funding rates. Beginners are especially prone to losses due to operational mistakes.

○ Frequent trading may also result in accumulated fees that reduce overall profitability.

4. Extreme market conditions may trigger unexpected liquidation

○ In highly volatile markets, prices may briefly experience sharp deviations (abnormal price movements), potentially triggering liquidation—even if your overall market direction is correct.

Related articles

1. Bitget beginner's guide — How to make your first futures trade

3. Bitget beginner's guide — Key futures trading terms and their application scenarios

Share