Bitget: Ranked top 4 in global daily trading volume!

BTC market share61.56%

New listings on Bitget: Pi Network

BTC/USDT$81632.81 (-2.03%)Fear and Greed Index34(Fear)

Altcoin season index:0(Bitcoin season)

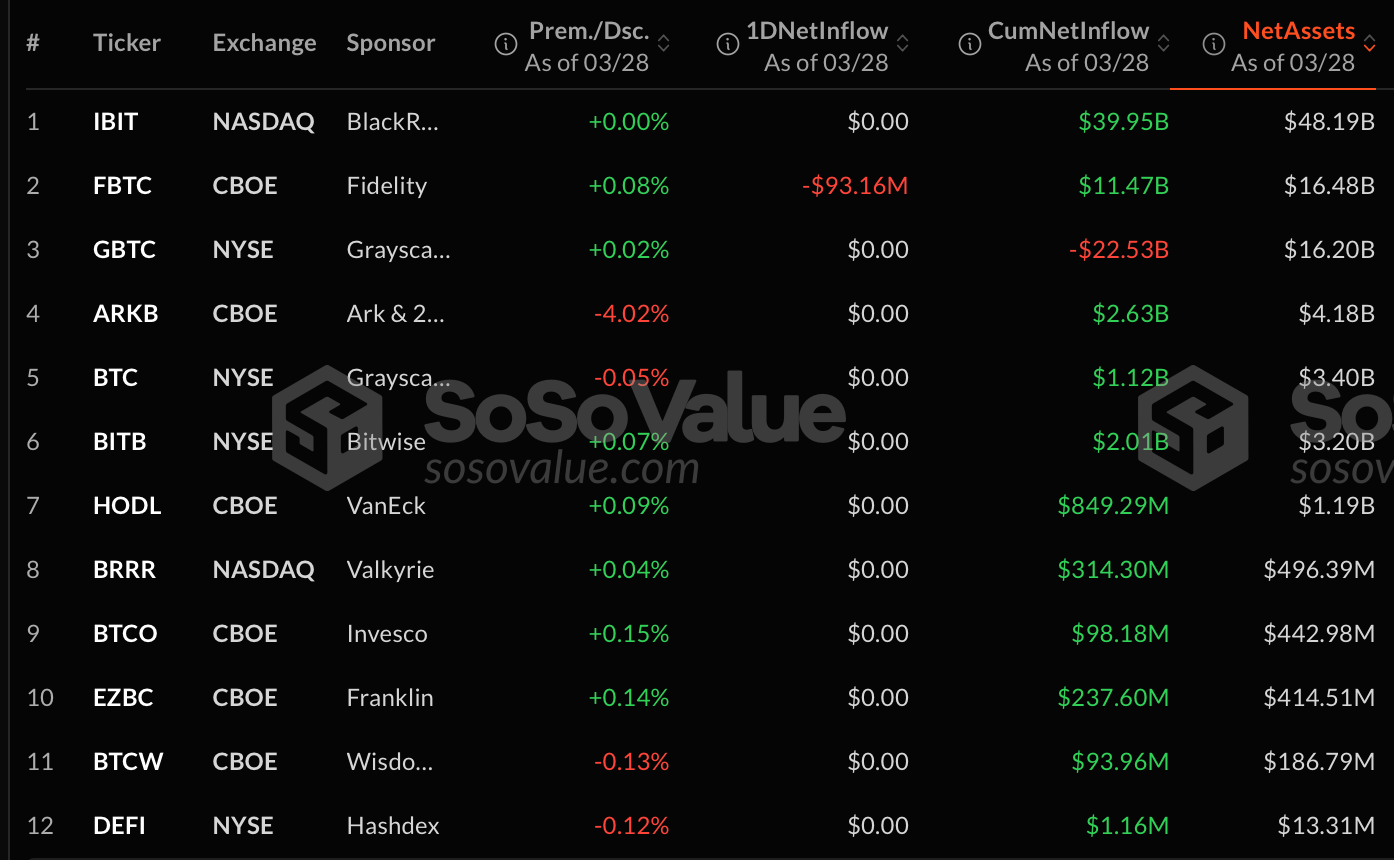

Coins listed in Pre-MarketPAWS,WCTTotal spot Bitcoin ETF netflow -$93.2M (1D); +$445.2M (7D).Welcome gift package for new users worth 6200 USDT.Claim now

Trade anytime, anywhere with the Bitget app. Download now

Bitget: Ranked top 4 in global daily trading volume!

BTC market share61.56%

New listings on Bitget: Pi Network

BTC/USDT$81632.81 (-2.03%)Fear and Greed Index34(Fear)

Altcoin season index:0(Bitcoin season)

Coins listed in Pre-MarketPAWS,WCTTotal spot Bitcoin ETF netflow -$93.2M (1D); +$445.2M (7D).Welcome gift package for new users worth 6200 USDT.Claim now

Trade anytime, anywhere with the Bitget app. Download now

Bitget: Ranked top 4 in global daily trading volume!

BTC market share61.56%

New listings on Bitget: Pi Network

BTC/USDT$81632.81 (-2.03%)Fear and Greed Index34(Fear)

Altcoin season index:0(Bitcoin season)

Coins listed in Pre-MarketPAWS,WCTTotal spot Bitcoin ETF netflow -$93.2M (1D); +$445.2M (7D).Welcome gift package for new users worth 6200 USDT.Claim now

Trade anytime, anywhere with the Bitget app. Download now

Franklin Bitcoin ETF

EZBC

Learn more about Franklin Bitcoin ETF's (EZBC) price performance, volume, premium rate, inflows and outflows, and other key data indicators.

EZBC price today and history

$48.55 -1.93 (-3.82%)

1D

7D

1Y

Open price$49.53

Day's high$49.53

Close price$48.55

Day's low$48.4

YTD % change-13.18%

52-week high$62.83

1-year % change+19.35%

52-week low$28.72

The latest price of EZBC is $48.55 , with a change of -3.82% in the last 24 hours. The 52-week high for EZBC is $62.83 , and the 52-week low is $28.72 .

Today's EZBC premium/discount to NAV

Shares outstanding8.55M EZBC

BTC holdings4.75K BTC

NAV per share$48.48

BTC change (1D)

-221.68 BTC(-4.46%)

Premium/Discount+0.14%

BTC change (7D)

-186.71 BTC(-3.78%)

EZBC volume

Volume (EZBC)112.15K (EZBC)

10-day average volume (EZBC)966.97 (EZBC)

Volume (USD)$5.47M

10-day average volume (USD)$46.95K

EZBC net flow

| Time (UTC) | Net flow (USD) | Net flow (BTC) |

|---|---|---|

2025-03-28 | $0.00 | 0.00 BTC |

2025-03-27 | $0.00 | 0.00 BTC |

2025-03-26 | $0.00 | 0.00 BTC |

2025-03-25 | $0.00 | 0.00 BTC |

2025-03-24 | $0.00 | 0.00 BTC |

2025-03-21 | $0.00 | 0.00 BTC |

2025-03-20 | -$7.3M | -86.72 BTC |

2025-03-19 | $0.00 | 0.00 BTC |

2025-03-18 | $0.00 | 0.00 BTC |

2025-03-17 | $0.00 | 0.00 BTC |

2025-03-14~2024-01-11 | +$243.3M | +4.94K BTC |

Total | +$236M | +4.86K BTC |

What is Franklin Bitcoin ETF (EZBC)

Trading platform

BATS

Asset class

Spot

Assets under management

$414.51M

Expense ratio

0.19%

Issuer

--

Fund family

--

Inception date

--

ETF homepage

--

FAQ

What impact does the Franklin Bitcoin ETF have on the broader cryptocurrency market?

The Franklin Bitcoin ETF could increase investor interest and capital inflows into Bitcoin and the broader cryptocurrency market. Its approval may also set a precedent for other Bitcoin ETFs, potentially impacting market regulation and adoption.

Does the Franklin Bitcoin ETF track the price of Bitcoin accurately?

While the Franklin Bitcoin ETF aims to track Bitcoin's market performance, it may not mirror Bitcoin's price exactly due to the fund's use of futures contracts, which can lead to differences in performance.

How can one invest in the Franklin Bitcoin ETF?

Investors can buy shares of the Franklin Bitcoin ETF through a brokerage account, just like they would with any other publicly traded stock or ETF.

What fees are associated with the Franklin Bitcoin ETF?

The fees generally include a management fee and additional costs related to trading and maintaining the futures contracts. It's important for investors to review the ETF's prospectus for a detailed fee breakdown.

How does the Franklin Bitcoin ETF differ from other Bitcoin investment products?

The Franklin Bitcoin ETF differs in its management style, fee structure, and investment strategy. It may focus on Bitcoin futures, whereas other products might involve direct Bitcoin holdings or blockchain technology investments.

What are the risks associated with the Franklin Bitcoin ETF?

The risks include the inherent volatility of Bitcoin, potential regulatory changes, and the risks associated with futures contracts, such as contango and backwardation that can affect returns.

What are the benefits of investing in the Franklin Bitcoin ETF?

Investing in the Franklin Bitcoin ETF offers benefits such as regulatory oversight, simpler portfolio management, tax efficiency, and the ability to invest in Bitcoin without needing a digital wallet.

Is the Franklin Bitcoin ETF officially approved by the SEC?

As of the latest update, the Franklin Bitcoin ETF's approval status can vary. It requires approval from the Securities and Exchange Commission (SEC), which has historically been cautious about approving Bitcoin ETFs.

How does the Franklin Bitcoin ETF work?

The Franklin Bitcoin ETF works by investing in Bitcoin futures contracts rather than holding the actual cryptocurrency. This allows investors to gain exposure to Bitcoin's price movements through a regulated financial product.

What is the Franklin Bitcoin ETF?

The Franklin Bitcoin ETF is an exchange-traded fund that aims to provide investors with exposure to Bitcoin without having to directly purchase the cryptocurrency. It is managed by Franklin Templeton, an investment management company.

Franklin Bitcoin ETF news

Data: Bitcoin spot ETF had a net inflow of 196 million USD last week, with BlackRock's Bitcoin ETF IBIT leading the way with a weekly net inflow of 172 million USD

Bitget2025-03-31

Bitcoin ETFs Snap 10-Day Streak: $93M Flees as Fidelity’s FBTC Takes the Hit

Bitcoin.com2025-03-29

This week, the net inflow of Bitcoin ETFs in the United States was 196.4 million US dollars, while Ethereum ETFs saw a net outflow of 8.7 million US dollars

Bitget2025-03-29

This week, the US spot Bitcoin ETF had a net inflow of $196.4 million, and the spot Ethereum ETF had a net outflow of $8.7 million

Cointime2025-03-29

The US spot Bitcoin ETF had a net outflow of 93.16 million USD yesterday

Bitget2025-03-29

US spot Bitcoin ETF had a net outflow of $93.16 million yesterday

Cointime2025-03-29

Alternative ETFs

| Symbol/ETF name | Asset class | Volume (USD | Share) | Assets under management | Expense ratio |

|---|---|---|---|---|

IBIT iShares Bitcoin Trust | Spot In progress | $1.81B 37.75M IBIT | $48.24B | 0.25% |

FBTC Fidelity Wise Origin Bitcoin Fund | Spot In progress | $163.18M 2.22M FBTC | $16.48B | 0.25% |

GBTC Grayscale Bitcoin Trust ETF | Spot In progress | $102.78M 1.54M GBTC | $16.2B | 1.5% |

BITO ProShares Bitcoin ETF | Futures In progress | $84.77M 4.53M BITO | $2.76B | -- |

ARKB ARK 21Shares Bitcoin ETF | Spot In progress | $56.51M 672.55K ARKB | $4.18B | 0.21% |

BITB Bitwise Bitcoin ETF | Spot In progress | $24.43M 533.87K BITB | $3.2B | 0.2% |

BTC Grayscale Bitcoin Mini Trust ETF | Spot In progress | $22.8M 607.39K BTC | $4.05B | 0.15% |

Prefer buying cryptocurrencies directly? You can trade all major cryptocurrencies on Bitget.

Bitget—The world's leading crypto exchange

Looking to buy or sell cryptocurrencies like Bitcoin? Choose Bitget, the cryptocurrency exchange offering top-tier liquidity, an exceptional user experience, and unmatched security!

Bitget app

Trade anytime, anywhere with the Bitget app. Join over 30 million users trading and connecting on our platform.

Cryptocurrency investments, including buying Bitcoin online via Bitget, are subject to market risk. Bitget provides easy and convenient ways for you to buy Bitcoin, and we strive to fully inform our users about each cryptocurrency we offer on the exchange. However, we are not responsible for the results that may arise from your Bitcoin purchase. This page and any information included are not an endorsement of any particular cryptocurrency. Any price and other information on this page is collected from the public internet and cannot be considered as an offer from Bitget.