Bitcoin ETFs See $591 Million Inflow Amidst Market Interest

- Bitcoin ETFs report $591 million inflow on April 28, 2025.

- BlackRock leads with significant inflows.

- Spot Bitcoin ETFs gain more investor confidence.

On April 28, 2025, Bitcoin ETFs experienced a net inflow of $591 million, demonstrating heightened institutional interest in the cryptocurrency sector.

The event underscores strong investor confidence in Bitcoin, highlighting the significant role of institutions in driving cryptocurrency market dynamics.

Institutional Investment Trends

The total net inflows of $591 million into Bitcoin ETFs on April 28 reveal a clear trend of increased institutional investment in digital assets. BlackRock‘s iShares Bitcoin Trust, led by CEO Larry Fink, saw one of its highest inflows at $970.9 million, reaffirming its leadership in cryptocurrency markets.

Bitcoin is notably benefiting from these market movements, showing a consistent rise in investor trust. While Ethereum (ETH) recorded inflows, its impact remains secondary. The emergence of significant Bitcoin ETF inflows points to a growing acceptance of these products among financial institutions.

Market Sentiment and Regulatory Scrutiny

These developments indicate a shift in market sentiment, with potential positive impacts on financial stability and investor confidence. Institutions appear prepared to integrate Bitcoin into their portfolios, reflecting a broader acceptance of cryptocurrencies in mainstream finance.

His leadership has positioned BlackRock as a major player in cryptocurrency investment vehicles. — Larry Fink, CEO, BlackRock

Such trends may lead to further regulatory scrutiny as inflows underscore the rising importance of cryptocurrencies in investment strategies. Institutional actions could alter market dynamics, leading to technological and financial shifts within the cryptocurrency ecosystem.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Circle hits $75 per share in first-day pop on NYSE

After upping its offer multiple times, Circle is finally trading on the NYSE

Circle ends NYSE debut up 167% from IPO price

The stablecoin issuer’s successful first day of trading is likely to spur more crypto IPOs, industry watchers say

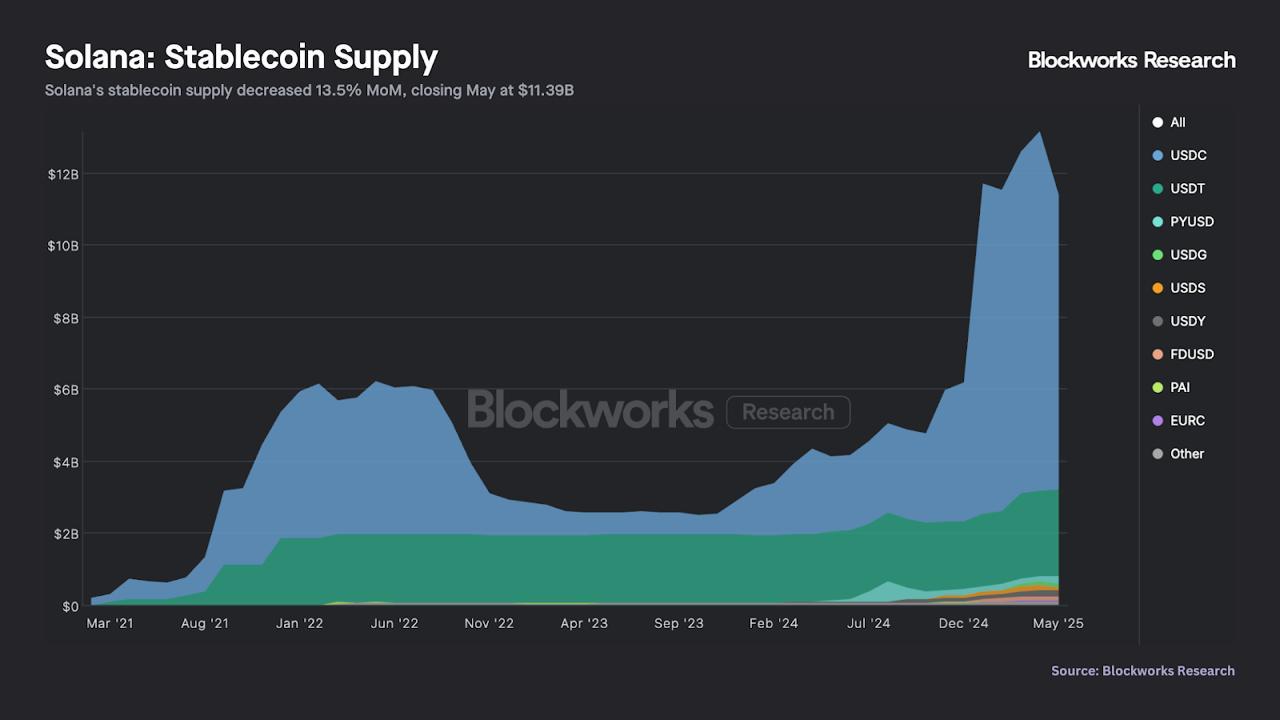

Solana stablecoin supply dip led by $1.8B USDC outflow

Solana’s USDC caught a boost after being paired with the TRUMP memecoin

UK Gold Miner Bluebird Ventures Embraces Bitcoin Treasury Strategy