Trump’s Embrace of DeFi: Exploring Potential Impacts on Ondo Finance and the Financial Landscape

-

In a climate of financial volatility and systemic mistrust, former President Trump is pivoting towards decentralized finance (DeFi) as a strategic response to “debanking.”

-

The embrace of DeFi aligns with a growing trend among financial leaders to explore less regulated alternatives in response to traditional banking challenges.

-

According to analysts at COINOTAG, “Trump’s ambition seems poised to intertwine with the burgeoning DeFi sector, potentially redefining financial landscapes.”

This article explores Trump’s shift towards decentralized finance amidst his financial troubles, analyzing the implications for the crypto landscape.

Trump’s Shift towards DeFi: A New Financial Frontier

In recent months, Donald Trump’s strategy has focused significantly on decentralized finance (DeFi), indicating a critical shift from traditional financial systems. This transition is primarily spurred by Trump’s experiences post-presidency, where he faced substantial barriers to accessing traditional banking services following widespread “debanking” efforts targeting him.

Understanding the Concept of Debanking

Debanking refers to the practice where financial institutions terminate relationships with clients, thereby restricting their access to banking services. Trump’s situation exemplifies this as several banks, including Deutsche Bank and Signature Bank, severed ties with him. This response, while politically charged, has broader implications in the financial sector, underscoring a growing trend towards distrust and the need for alternative financial mechanisms.

Trump’s DeFi Strategy: A Calculated Move

The former President’s quiet but strategic pivot towards DeFi platforms signifies not only a personal financial strategy but also a political maneuver aimed at reshaping the dialogue surrounding cryptocurrency regulations. Experts suggest that enhancing the appeal of DeFi stands to benefit his financial interests while revitalizing a segment of the economy he once championed.

DeFi as a Response to Regulatory Overreach

Amidst heightened regulation and financial scrutiny, DeFi offers an avenue for those ostracized by traditional banks to regain financial autonomy. Trump’s potential advocacy for DeFi aligns with supporters who believe that promoting decentralization can counteract perceived governmental interference in personal finance.

Investors’ Perspectives: Bullish Sentiments and Future Trends

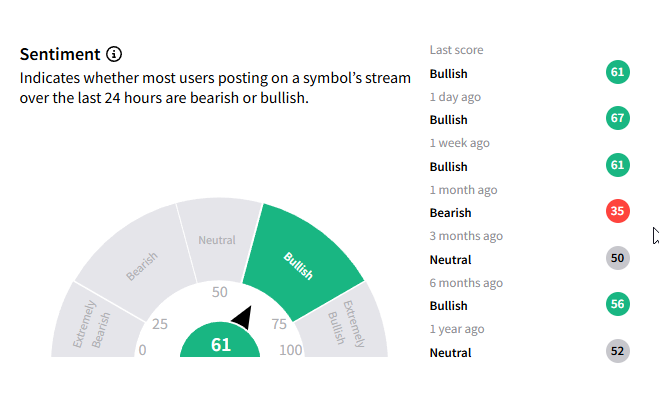

Despite the broader market uncertainties, sentiment surrounding platforms like Ondo Finance remains optimistic. Analysis from Stocktwits reveals a significant turnaround in sentiment towards Ondo Finance, transitioning from a bearish rating to a more positive outlook from investors.

This optimism is further evidenced by increased message volume within the Stocktwits community, hinting at a strong future trajectory despite market pressures.

Conclusion

As Trump navigates his complex post-presidency landscape, his inclination towards decentralized finance could reshape the financial industry’s future. The sustained growth of DeFi and early positive sentiments from investors suggest an inevitable shift away from traditional banking methodologies towards more resilient and innovative financial solutions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

PEPE Dips Slightly – But Whales Are Still Accumulating. Should You Follow?

Pepe's funding rate has risen strongly in the past couple of days, one of several signals that more gains are coming.

ARK Invest Sees Bitcoin Hitting $1.5M By 2030 On Rising Institutional Demand

ARK expects institutions to allocate up to 6.5% to Bitcoin and sees it capturing 60% of gold’s market value in its bullish scenario.

Fartcoin (FARTCOIN) Price Analysis: Smart Money Selling Flashes Warning Signs

Was $1.4K Ethereum’s ‘generational bottom?’ — Data sends mixed signals

Traders say ETH price fell to a “generational bottom,” but historical and network activity data suggest that this is not the case.