Maximize Your Crypto Gains with Kernel DAO’s Innovative Protocol

In Brief Kernel DAO offers enhanced security and yields through innovative re-staking protocols. KERNEL coin serves as the backbone for governance and rewards within the ecosystem. The protocol integrates multiple blockchain networks for diversified investment opportunities.

Kernel DAO is a re-staking protocol operating on the BNB Chain. It aims to enhance the security and efficiency of staked assets like BNB and BTC. By supporting multiple blockchain networks and offering high-yield strategies, Kernel DAO has quickly emerged as a prominent protocol in the decentralized finance (DeFi) sector.

What is Kernel DAO and How Does It Work?

Kernel DAO is designed to boost the efficiency of staked assets through a next-generation re-staking protocol. Traditional staking models often limit the use of assets. Kernel DAO allows users to re-stake their assets, maintaining network security while providing access to better yield opportunities.

What is Kernel DAO?

What is Kernel DAO?

The protocol supports assets like BNB and BTC. Instead of remaining idle, these staked coins are utilized in various DeFi applications. Kernel DAO leverages shared security systems to provide higher returns while safeguarding investments.

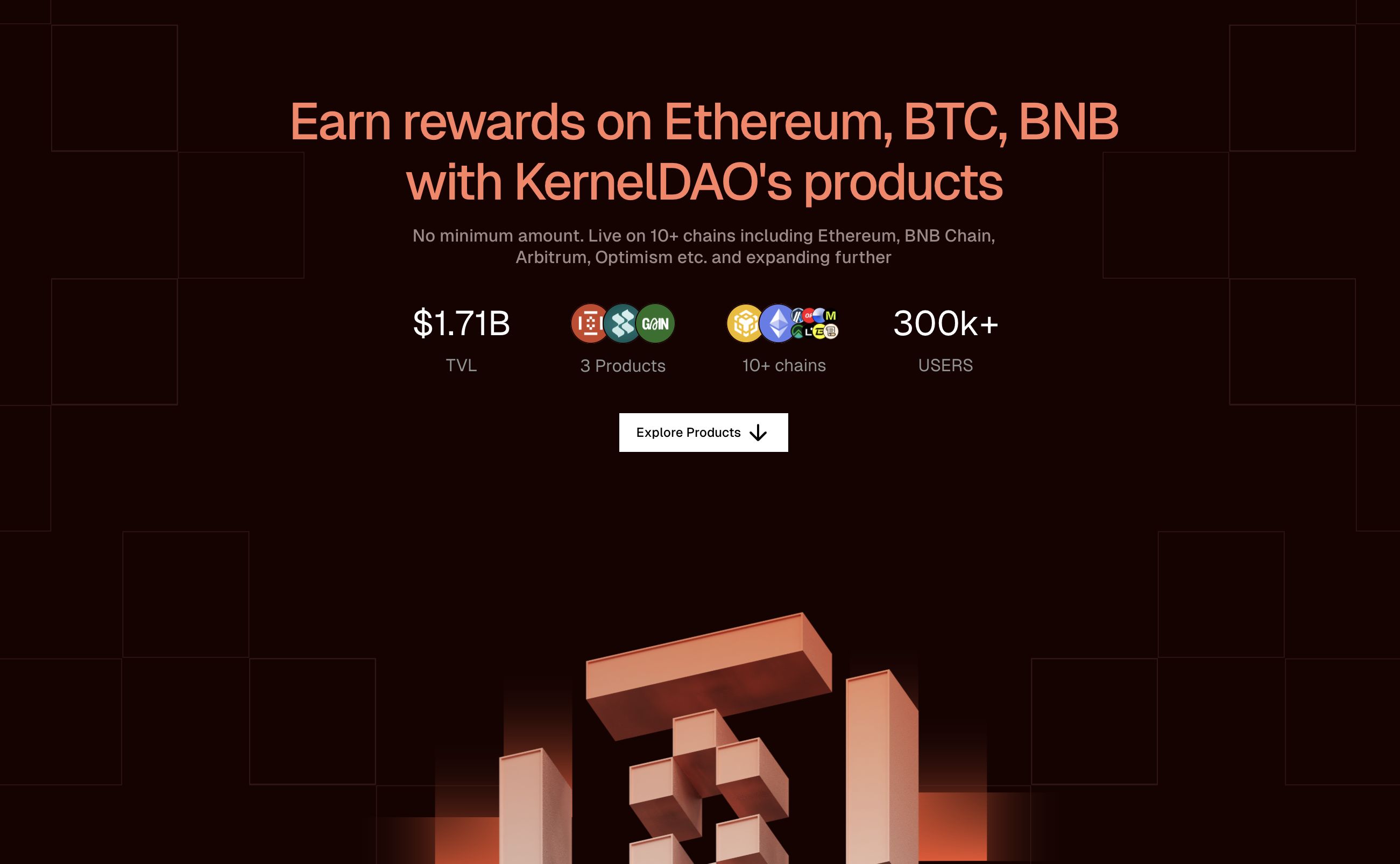

Kernel DAO integrates with over ten blockchain networks and boasts a total value locked (TVL) exceeding $1.71 billion, according to DeFiLlama. This level of adoption indicates a strong trust and reliability. It also reflects the growing demand for re-staking solutions in the cryptocurrency sector.

Key Products Offered by Kernel DAO

Kernel DAO focuses on three main products aimed at yield generation and asset security. These tools provide flexibility and transparency to users. The first product is the core Kernel Protocol, which enables users to re-stake coins like BNB and BTC. Through integration with various DeFi protocols, it offers enhanced yields without compromising security.

The second product is the Liquid Re-Staking Protocol. This solution supports the re-staking of yield-generating coins not only on the BNB Chain but also on Ethereum $1,577 and other networks. It grants access to over 50 DeFi services, allowing users to earn returns across different ecosystems without locking their assets.

The third main product is Automated Yield Farming. It includes yield pools with no minimum investment requirement. Users can receive multiple AirDrops and rewards without the necessity of locking assets. This system enables users to maximize earnings by selecting various yield strategies.

Security Measures and Insurance Integration

Kernel DAO prioritizes security throughout the protocol. The re-staking model ensures effective use of assets without increasing risk. The protocol operates with a shared security structure, allowing users to redistribute their staked assets across different applications. This enhances economic safety while improving overall asset efficiency.

Kernel DAO collaborates with over 15 distributed validator networks. These partnerships enhance security and increase the reliability of staking operations. Validators provide additional layers of protection.

In the second stage of development, Kernel DAO plans to offer insurance services. Users will be able to stake KERNEL coin to insure re-staked assets like rsETH. Additionally, slashing protection mechanisms will be implemented to prevent losses and enhance user trust in the protocol.

What is KERNEL Coin? Tokenomics and Use Cases

KERNEL is the native coin of the Kernel DAO ecosystem. It supports governance, rewards, and security mechanisms across the protocol. The total supply of KERNEL is 1 billion coins, with 16.23% (approximately 162 million) currently in circulation. A significant portion of the coin supply is allocated for community incentives, with 55% designated for rewards and 5% for ecosystem growth.

KERNEL Coin

KERNEL Coin

Private sales and the project team will receive 10% of the supply. The remaining coins will be distributed through AirDrops and future initiatives. This structure aims to ensure a balanced token economy and support long-term growth.

KERNEL coin is also used for governance within the protocol. Coin holders can vote on proposals and contribute to the direction of the protocol. Additionally, staking KERNEL enhances the security of re-staked assets and provides extra AirDrop rewards. A significant portion of protocol revenue is allocated for buying back and burning KERNEL coins, reducing supply and increasing the coin’s value.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

U.S. stocks opened, S&P 500 rose 0.1%

Uniswap Web App Adds LP Rewards Function

A trader made over $1 million in profits from trading 88 Meme coins in the past 7 days