Public Companies Are Buying Bitcoin Again as BTC Nears $90,000

Metaplanet's $28.2 million Bitcoin purchase highlights growing confidence as the crypto market rebounds from tariff-induced chaos, but volatility persists.

Bitcoin is rebounding after tariff chaos, and public companies like Metaplanet are conducting major acquisitions. The firm bought $28.2 million worth of the asset, nearly a $2 million increase from last week.

However, despite this new confidence, Metaplanet’s stock has continued to perform shakily. The crypto market is showing cautious optimism, but that won’t immediately translate into major gains.

Bitcoin Rebounds as Metaplanet Increases Purchase Size

Although a few corporate Bitcoin whales briefly paused their big purchases recently, the markets are heating back up again. Metaplanet began buying the dip last week, and Bitcoin has been making steady progress since then. Today, its CEO, Simon Gerovich, announced a new purchase as BTC rebounds:

“Metaplanet has acquired 330 BTC for ~$28.2 million at ~$85,605 per bitcoin and has achieved BTC Yield of 119.3% YTD 2025. As of 4/21/2025, we hold 4855 $BTC acquired for ~$414.5 million at ~$85,386 per bitcoin,” he claimed.

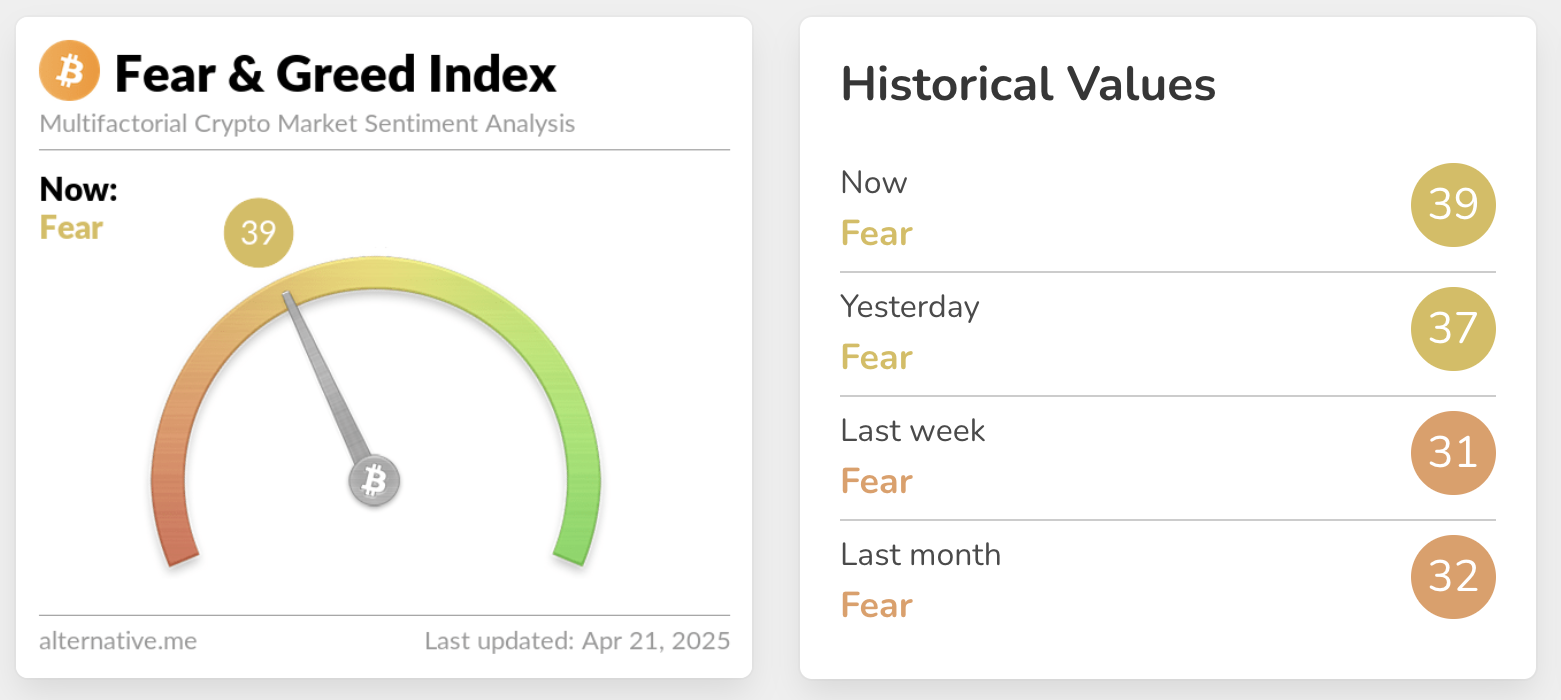

Trump’s tariff threats caused massive uncertainty and crypto liquidations in the last few weeks. However, since he announced a pause, crypto and industry-related stocks have been rallying. Whales like Metaplanet and MicroStrategy immediately began buying Bitcoin, and the whole market is rising. The Crypto Fear and Greed Index was recently in Extreme Fear but has since recovered greatly:

Crypto Fear and Greed Index. Source:

Alternative

Crypto Fear and Greed Index. Source:

Alternative

Still, markets are showing cautious optimism, not a full rally. A quick look at some major crypto-related stocks will paint a clearer picture.

MicroStrategy rose over 4% in the last five days and nearly 6% in the last month, but it’s a pillar of confidence in BTC. Metaplanet, a much smaller Bitcoin holder, only fell 1.89% in the last five days but over 20% in the last 30.

In other words, it can be difficult to cleanly connect Bitcoin’s recent successes with major holders like Metaplanet. Compare two prominent US-based crypto miners, Marathon and Riot.

The former recovered from its slump in early April, while the latter only continued to drop. Coinbase, too, has only made brief rallies on a trend of continual decline.

While Bitcoin’s adoption has surged dramatically over the past year, there’s still a lot of uncertainty about tariffs and recession. Metaplanet may be in shaky territory right now, but its confidence in Bitcoin can provide a long-term sense of stability.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SUI Token Surges as Analysts Highlight Promising Patterns and Predictions

In Brief SUI token demonstrates strong performance with significant recent price increases. Technical patterns suggest potential bullish trends and buying opportunities. Analysts project ambitious targets, including a possible rise to $10 or more.

STX Token Surges as New Financial Opportunities Emerge in the Stacks Ecosystem

In Brief The STX token has surged by 56%, reaching a two-month high. BitGo introduced sBTC to enhance Bitcoin's usability in decentralized finance. Liquidity in the Stacks ecosystem is increasing, attracting more users and developers.

U.S. stocks opened, S&P 500 rose 0.1%

Uniswap Web App Adds LP Rewards Function