4 Key Catalysts That Could Spark a Crypto Comeback in Q2 2025

- Both Bitcoin and Ether declined in Q1, while most cryptocurrencies are expected to grow in Q2 due to improved global liquidity.

- The market sentiment is shifting to the bulls, and analysts expect Bitcoin to reach $200,000 by the end of the year.

The crypto market completed one of the worst first quarters in history, although experts believe in a strong recovery. Even though Bitcoin and Ether declined in double digits in Q1 2025, which is usually their best quarter, there are some macro and market indications for a better Q2.

Bitcoin declined by 11.82% in Q1, and Ether dropped by a massive 45.41%, as per the data compiled by CoinGlass. Bitcoin, on average, in Q1 gained by 51.2%, while ETH rose by 77.4% on average. However, Bitwise CIO Matt Hougan opined that it was arguably the “best worst quarter in crypto’s history,” as many significant events occurred amid short-term challenges.

Central Bank Easing and Liquidity Expansion Favor Crypto

One strong catalyst that is expected to persist in Q2 is the unwinding of monetary tightening around the world. The ease and expansion of money supply M2 by central banks have always preceded digital assets, hence the current signals by these institutions. For three days in a row, M2 in global economies remained at an all-time high, a rather rare pattern with certain consequences, as Colin Talks Crypto said on April 14.

Global M2 Money Supply vs Bitcoin

— Colin Talks Crypto 🪙 (@ColinTCrypto) April 13, 2025

🔹 CONTINUES TO BE BULLISH. Global M2 has remained at an ATH for 3 days in a row. This is a fantastic sign for what it signals will be coming into risk assets in ~108 days. (See upper-right corner of chart)

🔹 DIP BUYING OPPORTUNITY? Global… pic.twitter.com/boDw1YYt1F

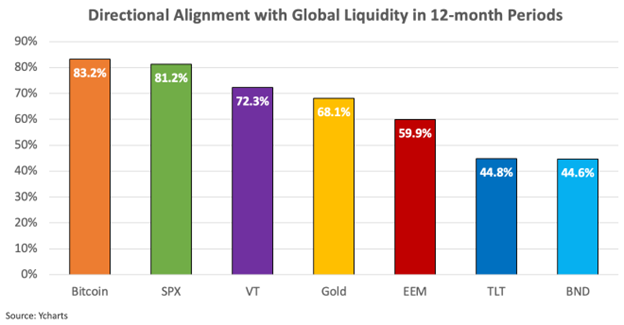

Crypto analyst Lyn Alden has previously pointed out that Bitcoin moves in alignment with the global M2 about 83% of the time. Pav Hundal of Swyftx has also noted the expansion of global liquidity as a driving force in the crypto market rallies.

Source: Lyn Alden

Coinbase also contributes to the predominantly bearish macro stance, stating that when confidence returns, the turn could be sharp. “When the sentiment finally resets, it’s likely to happen rather quickly,” the exchange stated.

Regulatory Clarity and Stablecoin Growth Strengthen the Bull Case

Hougan claimed that there have been improved regulatory measures in the United States, which he saw as another boost. He described the increase in pro-regulations as a “clean sweep” and said that biologists are just starting to realize the long-term effects of regulatory certainty. This regulatory certainty thus holds the potential to release private capital as well as institutional interest.

Concurrently, stablecoins are regaining bullish momentum. The total value locked in stablecoins reached a record level of over $218 million in the first quarter of this year. Hougan said this implies that more people are using cryptocurrency and that the markets are also expanding in the DeFi and related industries.

There also seems to be an improving confidence amongst traders. Santiment’s social media sentiment climbed into the bullish zone on April 16 with a score of 1.973. Social media posts from key accounts such as Jan3 and popular traders known as Ted are positive. Ted emphasized the liquidity cycle: “Global money supply is going up, and eventually, this liquidity will go into Bitcoin.”

Political factors like war and revolution could also be a factor in the rise of Bitcoin. The report explained that economic instability, as caused by trade tariffs launched by the United States president, Donald Trump, after he assumed power, is forcing investors worldwide to recalibrate their portfolios.

Still, Hougan is optimistic about the bull outlook at the end of the year. Earlier on in December, Bitwise had forecasted that Bitcoin would be valued at $200,000 by the end of the year. “I still think that’s in play,” he reaffirmed.

Recommended for you:

- Buy Bitcoin Guide

- Bitcoin Wallet Tutorial

- Check 24-hour Bitcoin Price

- More Bitcoin News

- What is Bitcoin?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BlockDAG Drops Price Pre-Reveal as Fartcoin Gains Traction

XRP Price Target Debated; SHIB Burns and Unstaked Gains

TRON Surpasses Resistance, Unstaked Promises High ROI

Gora Network Expands DeFi Integrations and DAO Governance