Arbitrum RWA Market Soars 1,000X—Why Is ARB Still Falling?

- Arbitrum has expanded its real-world asset market from under $200K to over $200 million by 2024.

- The DAO distributed 85 million ARB tokens to provide investment in stable and income-generating assets.

Arbitrum has experienced an impressive number of tokenized real-world assets (RWAs), which in 2024 was around $200,000 and now is above $200 million. This marks an over 1000x increase and demonstrates the firm’s growing importance to DeFi.

Early 2024 saw merely $100-200K worth of RWA on @arbitrum

Today? We've crossed $200M – representing a staggering 1000-fold increase in less than a year

Is the $ARB STEP program working?👇 pic.twitter.com/BXEhGPv0rw

— The Learning Pill 💊 (@thelearningpill) April 15, 2025

This is attributed to the second phase of the DAO’s Stable Treasury Endowment Program (STEP). In this regard, 85 million ARB tokens will be allocated to RWAs. In February, it distributed another $35 million in additional ARB for cost-generating use cases such as tokenized treasuries, among others. The strategy is mainly focused on minimizing the risk of treasury in cryptocurrencies.

Arbitrum currently holds 97% of its RWA in U.S. Treasuries, and Franklin Templeton’s BENJI product possesses 36% of the market. Second on the list is SPIKO, which tokenized European treasuries, accounting for 18% of the total. According to data, Arbitrum has over 18 active RWA products offering bonds, equities, and real estate services.

“The ecosystem continues to expand, with DinariGlobal recently entering the arena offering 1:1 backed traditional assets via their innovative dShares platform,” The Learning Pill noted.

Token Unlocks Weigh on ARB Price Action

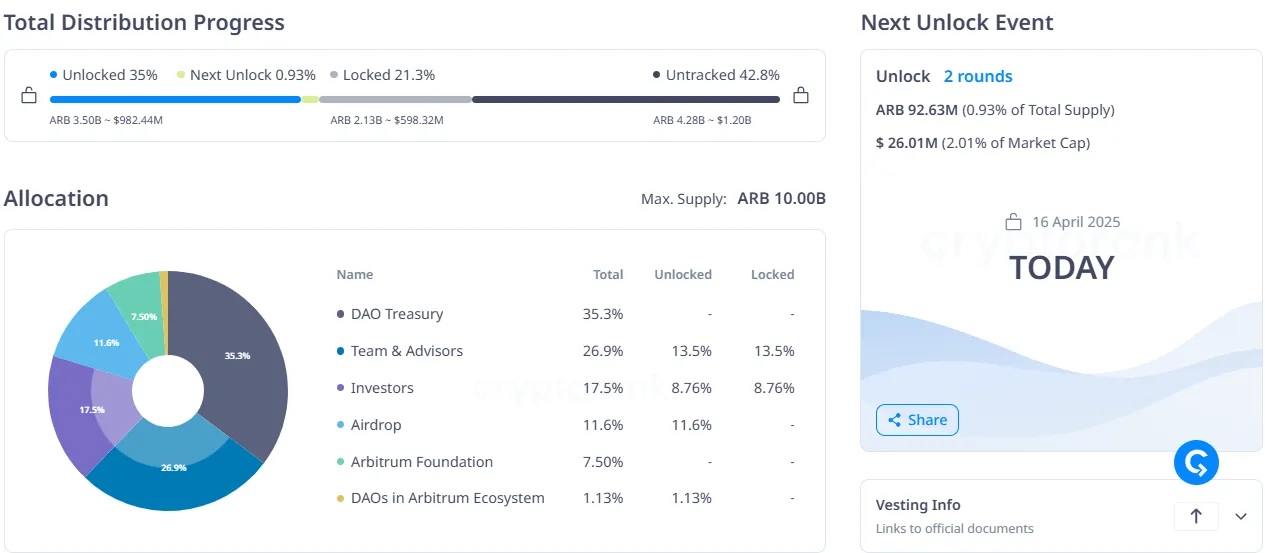

However, as for ARB, it’s down 88% of its all-time high, which still has a downside potential ahead of the token unlock. Over 92 million ARB tokens are expected to be released, thus increasing the effect of dilution. As of now, 46% of ARB’s total supply is still locked, meaning that the unlock event may cause high volatility in the market.

In the technical analysis, ARB is at $0.2796 and it has shown only a slight upward trend. The RSI stands near 37.81, just above the neutral 36.42 moving average, suggesting weak buying pressure. However, while the MACD histogram is still below the midway mark but trending upwards, the formation indicates that a reversal is underway but not quite an active one yet.

The current level is still below the $0.30 level of resistance, and more accumulation largely depends on how well the market adapts to these new tokens. The value locked in the DAO in the RWA space has not created a direct tangible value for the ARB holders, adding another dimension to the risk factor.

Institutional Adoption of Tokenized Assets

Apart from Arbitrum, the overall RWA space is quite reserved, but there is steady expansion. The total tokenized RWAs across all chains are more than $11.1 billion, according to DeFiLlama. In addition, RWAs have increased by 2.5 folds in one year. Among them are the tokenized U.S. Treasury and blockchain asset gold, which BlackRock’s BUIDL fund is said to have more than $2.3 billion in assets today.

Ethereum remains predominant in this segment, accounting for 79% of all tokenized RWAs. However, Arbitrum is emerging as an even cheaper solution that seeks to provide more DeFi instruments. The network now holds over $4.7 billion of stablecoins and over $214 million of RWAs.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Pyth Network (PYTH) To Rise Further? Key Harmonic Pattern Signaling an Upside Move

Sonic (S) To Continue Rebound? Key Harmonic Pattern Signaling an Upside Move

LUNC Bulls Take Charge: Technicals Point to a Major Reversal and Moonshot Target

Dogwifhat (WIF) price jumps 60% as meme coin market rebounds, but pullback signs appear