Binance research: Record US Treasury supply will affect crypto markets in 2025

By:By Hristina Vasileva

Share link:In this post: A total of $31T in US Treasury emissions are expected in 2025, including refinancing and new instruments. The crypto market may react negatively to higher US Treasury yields. RWA tokenization still makes use of short-term T-bills.

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Locked for new tokens.

APR up to 10%. Always on, always get airdrop.

Lock now!

You may also like

This week, the U.S. Bitcoin spot ETF had a cumulative net inflow of US$3.0629 billion

Cointime•2025/04/26 10:22

AAVE drops below $170

Cointime•2025/04/26 10:22

The total locked value of Ethereum Layer2 network is 31.21 billion US dollars, up 13.2% on the 7th

Cointime•2025/04/26 10:22

1inch team investment fund sold 70.76 WBTC again 30 minutes ago

Cointime•2025/04/26 10:22

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$94,169.91

-0.50%

Ethereum

ETH

$1,785.82

-0.11%

Tether USDt

USDT

$1

+0.02%

XRP

XRP

$2.2

-0.23%

BNB

BNB

$604.35

-0.24%

Solana

SOL

$148.75

-3.71%

USDC

USDC

$0.9999

-0.01%

Dogecoin

DOGE

$0.1817

-0.54%

Cardano

ADA

$0.7085

-1.57%

TRON

TRX

$0.2519

+3.33%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new Bitgetters!

Sign up now

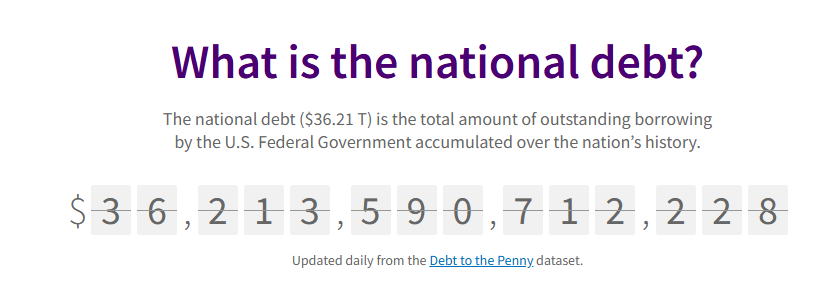

The US debt is over $36T, requiring new US Treasury issuance of over $31T in 2025. | Source: Fiscal Data

The US debt is over $36T, requiring new US Treasury issuance of over $31T in 2025. | Source: Fiscal Data