HBAR Price Faces Massive Volatility: Could It End 7-Week Downtrend?

Hedera's HBAR is showing signs of recovery as it attempts to break its 7-week downtrend, with traders eyeing the $0.2 target. Positive funding rates suggest a potential breakout if key resistance levels are breached.

Hedera’s HBAR token has been facing notable volatility in recent days, as its price continues to struggle against a downtrend that has persisted for several weeks.

Despite sharp losses, traders are hoping for a positive shift, with HBAR potentially aiming for $0.2 in the near future.

Hedera Traders Are Optimistic

HBAR’s Bollinger Bands are signaling increased volatility in the coming days. The bands are currently closing in, which typically precedes a squeeze followed by a significant price movement in either direction, depending on market conditions.

With the candlesticks positioned below the baseline, this suggests that the squeeze may lead to an upward price surge for HBAR. Should the squeeze result in bullish momentum, HBAR could see substantial gains.

HBAR Bollinger Bands. Source:

TradingView

HBAR Bollinger Bands. Source:

TradingView

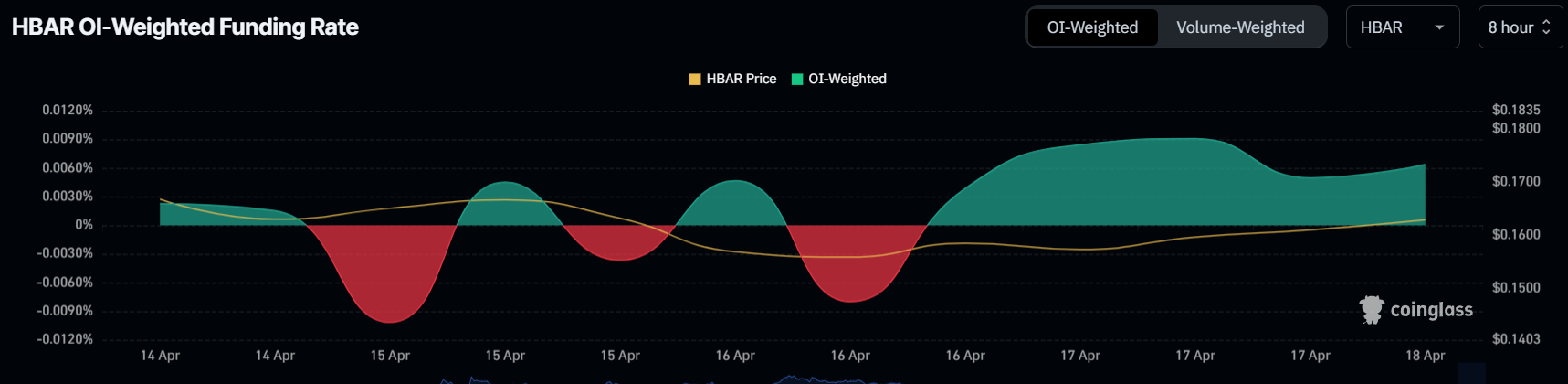

The overall market sentiment for HBAR remains positive, with recent funding rates indicating bullishness. For the last few days, the funding rate has been positive, showing that long contracts are dominating the market. This positive funding rate suggests that traders are optimistic about HBAR’s prospects and are betting on future price rises.

This optimism is a strong indicator that traders are positioning for a potential breakout. When long contracts outnumber short positions, it typically signals that investors are confident in the altcoin’s ability to recover.

HBAR Funding Rate. Source:

Coinglass

HBAR Funding Rate. Source:

Coinglass

HBAR Price Aims To Rally

HBAR is currently trading at $0.164, having faced a 7-week downtrend. The altcoin must breach the resistance at $0.177 and flip it into support to break free from its current bearish trend. Without this crucial step, further gains will remain elusive.

The aforementioned factors suggest that the $0.177 resistance level is key for HBAR’s recovery. If the token manages to secure this level of support, a rise to $0.197 could follow. This would be a crucial milestone, bringing the price closer to the $0.2 target.

HBAR Price Analysis. Source:

TradingView

HBAR Price Analysis. Source:

TradingView

However, if HBAR fails to breach the $0.165 resistance and slips through the $0.154 support, the altcoin could see a decline to $0.143 or even $0.133. Such a drop would invalidate the bullish outlook and push the token further away from its $0.2 target.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

LUNC Bulls Take Charge: Technicals Point to a Major Reversal and Moonshot Target

Dogwifhat (WIF) price jumps 60% as meme coin market rebounds, but pullback signs appear

BONK Seeks $0.00003257 Target Amid Rising Open Interest and Bullish Market Indicators

Bitwise Continues Altcoin ETF Efforts with NEAR Filing

Bitwise’s filing for a NEAR ETF could spark renewed interest in the blockchain, which has been quieter in 2025. However, its potential impact may be muted by increasing competition in the altcoin ETF space.