Stablecoins move more than Visa in Q1 2025, says Bitwise

- Stablecoins surpass Visa in transaction volume

- Tokenized assets jump to $19 billion

- DeFi attracts second-largest investment since 2022

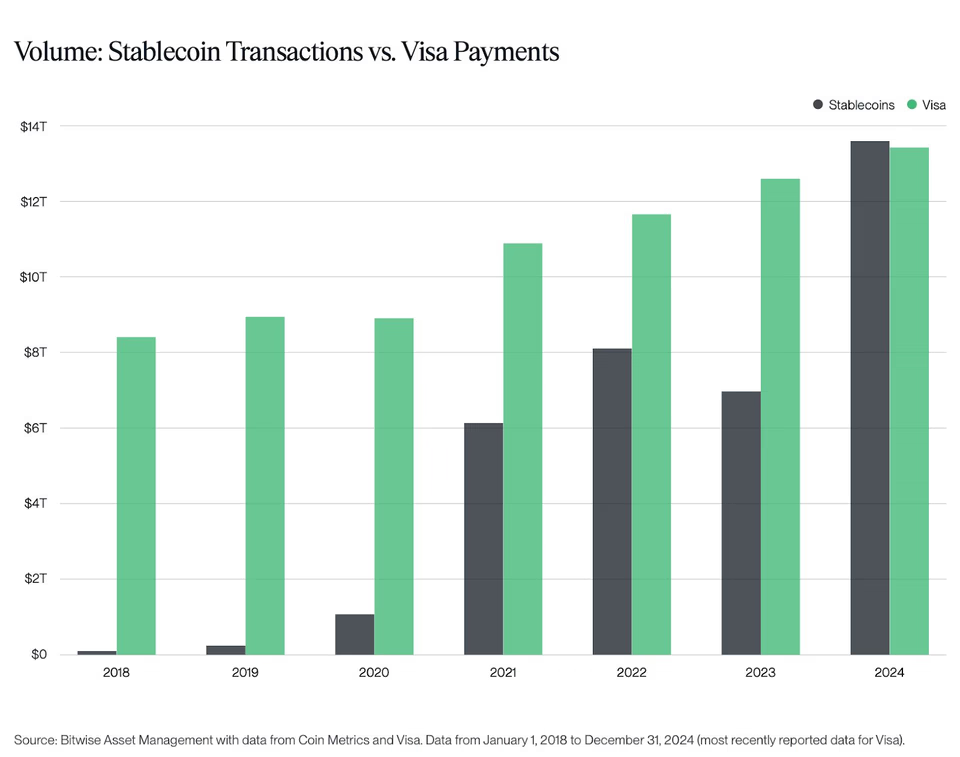

Bitwise's quarterly report revealed that the volume of transactions with stablecoins surpassed, for the first time, the operations carried out by Visa between January and March 2025. The data reflects the significant growth in the adoption of these digital assets in the global financial system, even amid a period of correction in cryptocurrency prices.

Matt Hougan, chief investment officer at Bitwise, noted that the quarter was “historically positive” from a policy and regulatory perspective. The election of a pro-crypto president in the United States and the filing of SEC lawsuits against the sector contributed to a more favorable environment for cryptocurrencies — with an emphasis on stablecoins.

Despite the post-election rally in market prices, fundamentals continue to strengthen. Stablecoin trading volume has increased by more than 30%, surpassing Visa’s number of transactions. In addition, assets under management (AUM) for these backed digital currencies reached a record $218 billion, up 13,5% from the previous quarter. Today, the market capitalization of stablecoins has reached $237 billion.

According to Hougan, “as big as you think stablecoin AUM will become, you’re probably thinking too small.” The statement raises the debate about the impact of the growing liquidity of stablecoins on the rest of the cryptocurrency market.

Another highlight of the report was the evolution of tokenized real-world assets (RWAs), which went from US$14 billion to US$19 billion, almost doubling compared to the US$9 billion recorded in the first quarter of 2024. The demand for tokenized US Treasury bonds, for example, jumped from US$2 billion to US$4,5 billion.

The DeFi sector also showed recovery in the first quarter, registering the largest contributions since 2022. Decentralized projects raised 18% of all venture funding, with highlights including World Liberty Financial, which raised US$590 million, and Ethena, with US$100 million directed to the creation of synthetic stablecoins with yield.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BlockDAG Drops Price Pre-Reveal as Fartcoin Gains Traction

XRP Price Target Debated; SHIB Burns and Unstaked Gains

TRON Surpasses Resistance, Unstaked Promises High ROI

Gora Network Expands DeFi Integrations and DAO Governance