Lorenzo Protocol Ecosystem Roundup — March 2025

Welcome to the March edition of our ecosystem roundup! This is your quick, monthly update on all key happenings across the Lorenzo Protocol ecosystem.

Let’s explore what’s new!

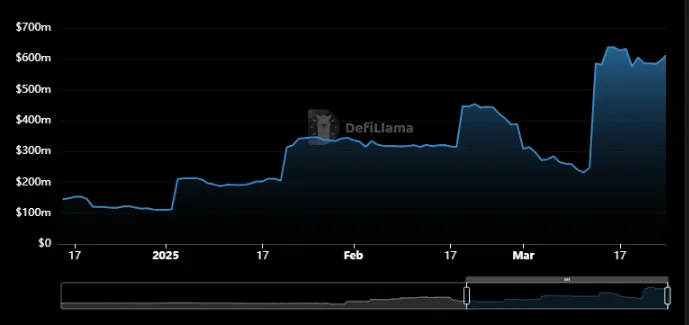

Lorenzo Hits $600M In TVL

We’ve officially crossed a major milestone — Lorenzo has now exceeded $600 million in Total Value Locked, with our latest all-time high reaching $637M, according to DeFiLlama.

This achievement is a testament to the trust our community has placed in us — and the momentum is only building.

Track our growth in real-time: Lorenzo on DeFiLlama

We’re just getting started. Let’s keep climbing!

enzoBTC and stBTC Go Live On Hemi Mainnet

We were excited to support our friends and partners at Hemi for their mainnet launch, with our enzoBTC and stBTC tokens going live on the chain for day 1 of launch.

Please note: The contracts are live, but functionality for the tokens are still to come. Stay tuned for future updates on activating your liquidity with Hemi!

Quietly Building

For team Lorenzo, March has been a month of quiet, intense work across all divisions.

We’re targeting significant expansion, new milestones, and exciting launches.

To everyone supporting us in the Lorenzo Nation, we thank you.

Final preparations are underway…

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

HYPE Surpasses TRX in Fee Generation; Questions Arise About Long-Term Dominance

INIT is live! Bullish or bearish? Join to share 3,432 INIT!

XRP Network Explodes with 67% Growth—Here’s What It Means for the Price

VIPBitget VIP Weekly Research Insights

In 2025, the stablecoin market shows strong signs of growth. Research indicates that the market cap of USD-pegged stablecoins has surged 46% year-over-year, with total trading volume reaching $27.6 trillion, surpassing the combined volume of Visa and Mastercard transactions in 2024. The average circulating supply is also up 28% from the previous year, reflecting sustained market demand. Once used primarily for crypto trading and DeFi collateral, stablecoins are now expanding into cross-border payments and real-world asset management, reinforcing their growing importance in the global financial system. More banks and enterprises are starting to issue their own stablecoins. Standard Chartered launched an HKD-backed stablecoin, and PayPal issued PYUSD. The CEO of Bank of America has expressed interest in launching a stablecoin once regulations permit (via CNBC). Fidelity is developing its own USD stablecoin, while JPMorgan Chase and Bank of America plan to follow suit when market conditions stabilize. Meanwhile, World Liberty Financial (backed by the Trump family) has introduced USD1, backed by assets such as government bonds and cash.