Bitget Daily Digest (April 16) | U.S. Treasury Secretary calls high tariffs unsustainable; Public companies ramp up crypto holdings

远山洞见2025/04/16 10:30

By:远山洞见

Today's preview

1. U.S. March retail sales (MoM): Previous: 0.20% | Forecast: 1.3%.

2. Bank of Canada interest rate decision (as of April 16): Previous: 2.75% | Forecast: 2.75%.

3. Arbitrum (ARB) is set to unlock approximately 92.65 million tokens today, representing 2.01% of the circulating supply, valued at around $28.5 million.

4. Ripple Labs has filed a request to set today as the deadline for submitting its court brief in the case with the SEC.

Key market highlights

1. U.S. Treasury Secretary Bessent acknowledged the difficulty of finalizing formal agreements with 14 major trade partners within the "90-day tariff postponement" period set by the Trump administration. He is pushing for a consensus framework that addresses key issues such as tariff reductions, subsidy limits, and monetary policy adjustments. Regarding China, Bessent emphasized the continued desire to reach a trade agreement that is "fundamentally different" from past deals. He believes that the current high tariffs are unsustainable, but noted that specific negotiation strategies remain in the hands of President Trump. Recent reports show that the U.K., Japan, Australia, South Korea, and India have been prioritized as top targets for the initial round of trade talks. As the U.S. moves to accelerate talks, this signals a faster pace in global trade negotiations.

2. Several public companies are increasing their Bitcoin holdings. Japanese firm Metaplanet has announced the issuance of $10 million in zero-coupon corporate bonds to acquire additional Bitcoin. Semler Scientific, a medical tech company listed on Nasdaq, has filed an S-3 statement with the SEC to issue $500 million in securities, with some funds allocated for purchasing Bitcoin. The company states that the funds raised will be used for general corporate purposes, including Bitcoin acquisition. Meanwhile, Japanese public company Value Creation has announced plans to buy an additional 100 million yen (approximately $700,000) worth of Bitcoin between April and August 2025. Its board views Bitcoin as a well-established asset with long-term growth potential. The company previously purchased 200 million yen worth of crypto assets.

3. U.S.-listed firm Janover has increased its Solana holdings by 80,567 SOL, valued at approximately $10.5 million, and has begun staking. This marks the third execution of its digital asset strategy, bringing its total holdings to 163,600 SOL, worth over $21.2 million. Janover previously raised $42 million from institutions like Pantera and Kraken, stating that SOL will serve as a core reserve asset. In addition to direct purchases, the company plans to run Solana validator nodes to earn long-term staking yields, underscoring its strong confidence in Solana's infrastructure and ecosystem.

4. The zkSync airdrop admin wallet was compromised, allowing the attacker to exploit the airdrop contract and illegally mint approximately 111 million ZK tokens—equivalent to about 0.45% of the total circulating supply. Around 66 million tokens were dumped on the market, causing the token price to plummet. In response, several centralized exchanges suspended ZKSync deposits and withdrawals. Although the project team stated that the incident was limited to the airdrop contract and did not affect the mainnet or user funds, the community remains unconvinced—raising suspicions of an inside job.

Market overview

1. $BTC sees a short-term pullback amid a broader market decline. Newly listed $WCT leads the losses, while established memecoin $AIDOGE posts unusual gains. Meanwhile, a hacker inflates $ZK's supply by 110 million tokens, briefly pushing its price down to $0.039.

2. Major U.S. stock indices closed lower, while European stocks gained over 1%. NVIDIA is expected to recognize a $5.5 billion impairment charge related to its H20 chip in Q1, causing its shares to drop over 6% in after-hours trading.

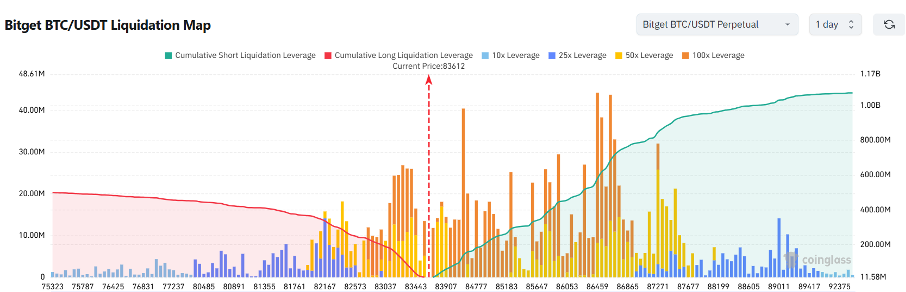

3. Currently standing at 83,612 USDT, Bitcoin is in a potential liquidation zone. A 1000-point drop to around 82,612 USDT could trigger

over $284 million in cumulative long-position liquidations. Conversely, a rise to 84,612 USDT could lead to

more than $112 million in cumulative short-position liquidations. With long liquidation volumes far surpassing short positions, it's advisable to manage leverage carefully to avoid large-scale liquidations.

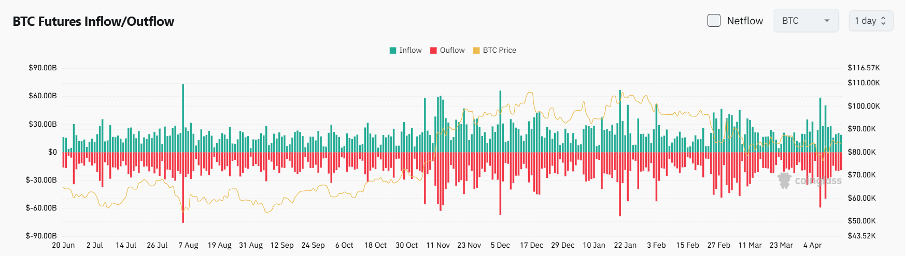

4. In the past 24 hours, BTC saw $2.04 billion in spot inflows and $2.03 billion in outflows, resulting in

a net inflow of $10 million.

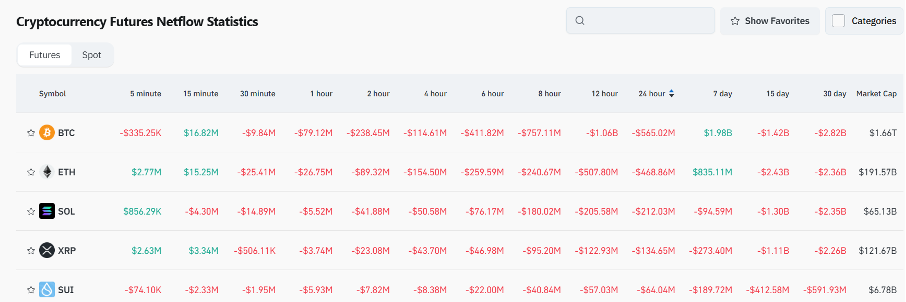

5. In the last 24 hours, $BTC, $ETH, $SOL, $XRP, and $SUI led in

net outflows in futures trading, signaling potential trading opportunities.

Institutional insights

CryptoQuant: BTC market risk remains elevated, with only 24% of the circulating supply currently at an unrealized loss.

Read the full article here:

https://cryptoquant.com

Greeks.live: Market participants remain cautious amid potential volatility, with some traders increasing their bearish positions.

Read the full article here:

https://x.com/BTC__options/status/1912125755863310543

Matrixport: Continuous stablecoin inflows signal market resilience and application growth

Read the full article here:

https://x.com/Matrixport_CN/status/1912060317611516265

News updates

1. Trump may consider banning stock trading by members of Congress.

2. The Trump administration faces lawsuit in U.S. International Trade Court over tariffs.

3. U.S. Republicans contemplate a 40% tax rate on millionaires to offset tax cut costs.

4. Trump's second son was invited to TOKEN2049 Conference in Dubai.

Project updates

1. MANTRA co-founder will release OM volatility event analysis report and OM buyback and burn plan.

2. Jupiter launches Jupiter Pro for professional investors.

3. Solana completes SIMD-0207 upgrade proposal, increasing block capacity by 4%.

4. In the past 24 hours, Solana's DEX transaction volume surpasses Ethereum, reaching $2.509 billion.

5. GPS team buys back 177 million tokens worth $3.07 million.

6. ApeCoin: NFT staking rewards are now live on ApeChain; no rewards for old site staking.

7. BNB Chain: Upcoming Lorentz mainnet hard fork upgrade.

8. KiloEx is monitoring hacker activities, offering 10% funds retention as white hat bounty.

9. Ethereum foundation member: ERC-7786 to improve cross-chain messaging, with discussion scheduled for April 16.

10. Phantom faces lawsuit over Wiener Doge memecoin theft incident.

Highlights on X

1. Murphy: Key support zone revealed in SOL chip structure, rebound pressure at higher levels.

The current SOL chip structure (i.e., position distribution based on holding levels) shows an "olive-shaped" distribution: dense in the middle and sparse at the ends, indicating increased volatility when prices move away from the core chip zone. Data shows that about 30% of chips concentrate between $118–$144, recognized as the most traded area and strongest support. Chips from $195 – $292 account for less than 9%, signaling strong selling pressure crushing any price advances into this region. Compared to BTC's dual-anchor structure, SOL relies more heavily on a single support band; holding this level may help sustain the current consolidation phase.

2. Phyrex: Trump's trade tensions impacting U.S. stocks and BTC, $83,000 identified as key BTC bottom.

Amid escalating U.S.-China tariff tensions and Trump's tough rhetoric, market fear drives U.S. stocks and BTC down. The VIX has risen above 30, reflecting heightened sensitivity to tax policy and U.S.-China relations. On-chain data shows significant BTC turnover between $93,000 – $98,000, likely as exchange transfers. The key trading band has now shifted down to $84,500, with support forming around $83,000. Overall, BTC is likely to remain range-bound and weakly volatile while awaiting clear macroeconomic signals.

3. @Chris_Defi: Soros's astrology suggests possible U.S. stock market crash window

in

2026-2027

From a Chinese metaphysics perspective, Soros's "Shang Guan Jia Sha" pattern, favoring metal and fire — aligns with historic bearish positions (e.g., shorting the pound in 1992, targeting Asian currencies in 1997), both of which occurred in metal-fire years. The forthcoming fire years — 2026 (Bing Wu) and 2027 (Ding Wei) — pose probable systemic shorting phases, focusing on May, June, August, and September, months marked by fire-metal overlap. The 2025 Tesla target may be mere prelude, with the true storm in 2026-2027, amid U.S. stock market highs and economic downturns further inflating the bubble.

4. @liping007: The fate of super memecoins: Zero or cross-cycle?

Super memecoins are inherently products of Bitcoin bull markets, relying on broader market sentiment to gain traction. As they enter high-intensity PvP (player-versus-player) phases, most memes crash to zero, with only a few surviving across cycles. Currently, market funds are not absolutely scarce but lack rationale for bets — without market signals, no one wants to make the wrong move. In this climate, retail investors are marginalized, and the power over super memes is shifting toward manipulation by dominant players. Whether it's Pepe or Fartcoin, this route is fraught with peril.

6

3

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Locked for new tokens.

APR up to 10%. Always on, always get airdrop.

Lock now!

You may also like

Bitcoin ETFs Experience Influx Amid Positive Sentiment Shift in Crypto Market

Coinotag•2025/04/26 11:55

Pi Network Price Consolidation Holds Key to Possible Breakout Above $0.68

Coinotag•2025/04/26 11:55

ARK Invest’s Bitcoin Forecast: Exploring Potential Paths to $2.4 Million Amid Adoption Concerns

Coinotag•2025/04/26 11:55

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$94,293.15

-0.85%

Ethereum

ETH

$1,800.16

-0.61%

Tether USDt

USDT

$1

-0.02%

XRP

XRP

$2.2

-0.19%

BNB

BNB

$608.17

+0.23%

Solana

SOL

$149.28

-2.44%

USDC

USDC

$1.0000

+0.00%

Dogecoin

DOGE

$0.1825

+0.15%

Cardano

ADA

$0.7092

-1.60%

TRON

TRX

$0.2510

+2.93%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new Bitgetters!

Sign up now