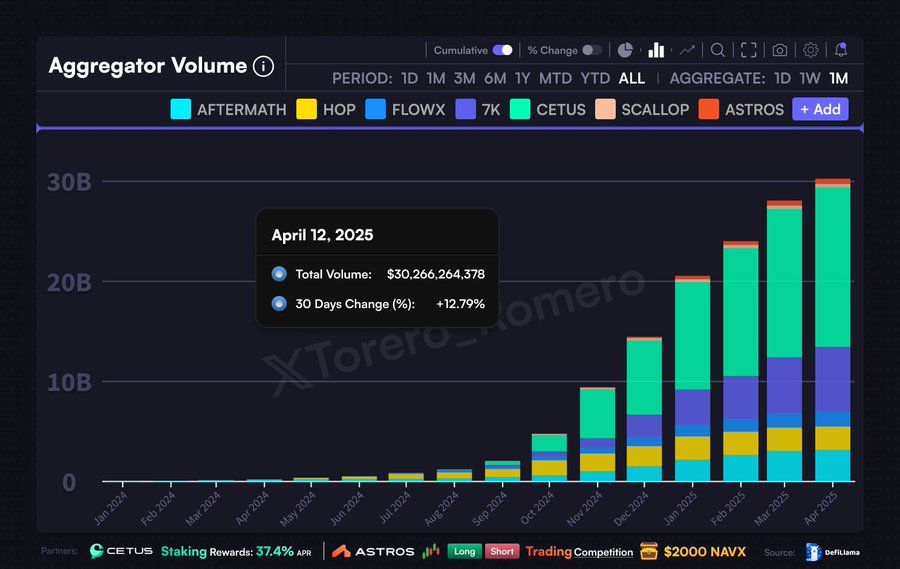

SUI Aggregator Volume Soars to $30B, Bullish Breakout Looming?

SUI’s aggregator volume surged to $30B, indicating growing adoption. A breakout above $2.40 could trigger a strong bullish rally. Rising transaction volumes signal increased user activity on $SUI.

SUI has reached a total aggregator volume of $30 billion, signaling a significant increase in interest within the network.

SUI’s volume has increased by 12.79% over the previous month, which signals an upward trend in user involvement.

A rising aggregator volume generally signifies higher confidence from market participants and suggests a growing confidence in the asset’s long-term value.

Source| X

Source| X

This uptick in volume has been accompanied by a steady price increase, suggesting that more people are actively trading and using SUI.

Increased market participation typically leads to heightened liquidity, which can result in larger price movements in the near term.

Falling Channel Structure and Bullish Breakout Potential

SUI is currently trading inside a falling channel. This price structure has a series of lower highs, lower lows. But market analyst CW8900 says it could be what precedes a breakout.

Source| X

Source| X

The price of SUI has been at the upper edge of this descending channel which in the past served as resistance.

A recent bounce from the lower trendline indicates that the support is still strong and that price should go up.

If SUI breaks above the upper trendline successfully, it may instigate a bullish breakout and propel the price towards the $2.40 level.

This key resistance can serve as the launchpad for the new rally and the next target to be above $3.00.

Furthermore, the consolidation keeps intact and this confirms the potential of this breakout.

The chance of significant price move will go higher as the price approaches nearer between the two trendlines.

Because of a sharp move in the broken breakout direction, there is a potential of strong upward momentum if a breakout takes place from the falling channel.

Key Indicators and Volume Analysis: Confirmation of Uptrend

The Relative Strength Index (RSI). RSI is currently at 47.29 levels and indicates that the SUI is neither oversold nor overbought.

By keeping the market with a neutral position, indicating that Sui has the potential to surge if the market sentiment remains positive.

A RSI rise above 50 will further confirm the momentum, it can lift the buying pressure.

1-Day

SUI Trading Chart| Source: Trading View

1-Day

SUI Trading Chart| Source: Trading View

Positive signs are also being shown by Cumulative Volume Delta (CVD). Given that, the CVD value of 278.29K is good value for buying, it means that buying volume covers the recent bull run.

Price increases and this growing volume for a breakout work hand in hand. If SUI can move past this resistance at $2.40 and is accompanied by increasing volume, it may indicate the continuation of the bullish trend.

Strength is also indicated by the MACD. The MACD line is above the signal line and the MACD histogram is above zero. Meaning that the bulls are in control of the market.

Open Interest and Market Sentiment: Bullish Outlook for SUI

However, on -chain data from Sui also shows steady increase in daily transactions.

Starting in the beginning of 2025 transaction volumes have drifted up, and some impressive spikes have taken place in early and late March.

These spikes indicate a growing level of user activity on the $SUI network. SUI’s open interest stands at $322.3 million, with a recent increase of 2.95% in the past 24 hours.

This suggests growing confidence in the market, as more traders open positions. A rise in open interest often comes at a time of greater market liquidity, which can lead to increased volatility.

With more traders coming into the market, price volatility can be expected to increase as key levels like the $2.40 resistance would be considered.

Strong market participation will allow the breakout to rally and the price can pull into the $3.00 to $5.00 area.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin ETFs Experience Influx Amid Positive Sentiment Shift in Crypto Market

Pi Network Price Consolidation Holds Key to Possible Breakout Above $0.68

ARK Invest’s Bitcoin Forecast: Exploring Potential Paths to $2.4 Million Amid Adoption Concerns