Crypto Startup Paying Out Life Insurance in BTC Raises $40 Million

The company previously raised $20.5 million in a seed round from a number of investors including OpenAI CEO Sam Altman.

Crypto startup Meanwhile closed a $40 million Series A to scale its Bitcoin (BTC) -denominated life insurance product.

The raise was led by Framework Ventures and Fulgur Ventures with participation from Wences Casares, the founder of crypto bank Xapo , according to the company’s tweet.

The team will use the new capital for global geographical expansion, as well as for developing new product lines.

Co-founder and CEO Zac Townsend added that the company will use the funds to ensure that the products are compliant with regulations in each jurisdiction as they expand.

Notably, the round values Meanwhile at $190 million, according to Fortune. This is almost double the value following the funding round in 2022.

Previously, the company raised $20.5 million in a seed round from a number of investors including OpenAI CEO Sam Altman. Other investors included Parker Conrad, Hunter Horsley, Michael Sidgmore, Laura Spiekerman, Lauren Kolodny, Sam Blond, and more.

Meanwhile is based in Bermuda and regulated by the Bermuda Monetary Authority .

‘Bitcoin is Very Attractive’ Says Life Insurance Startup CEO

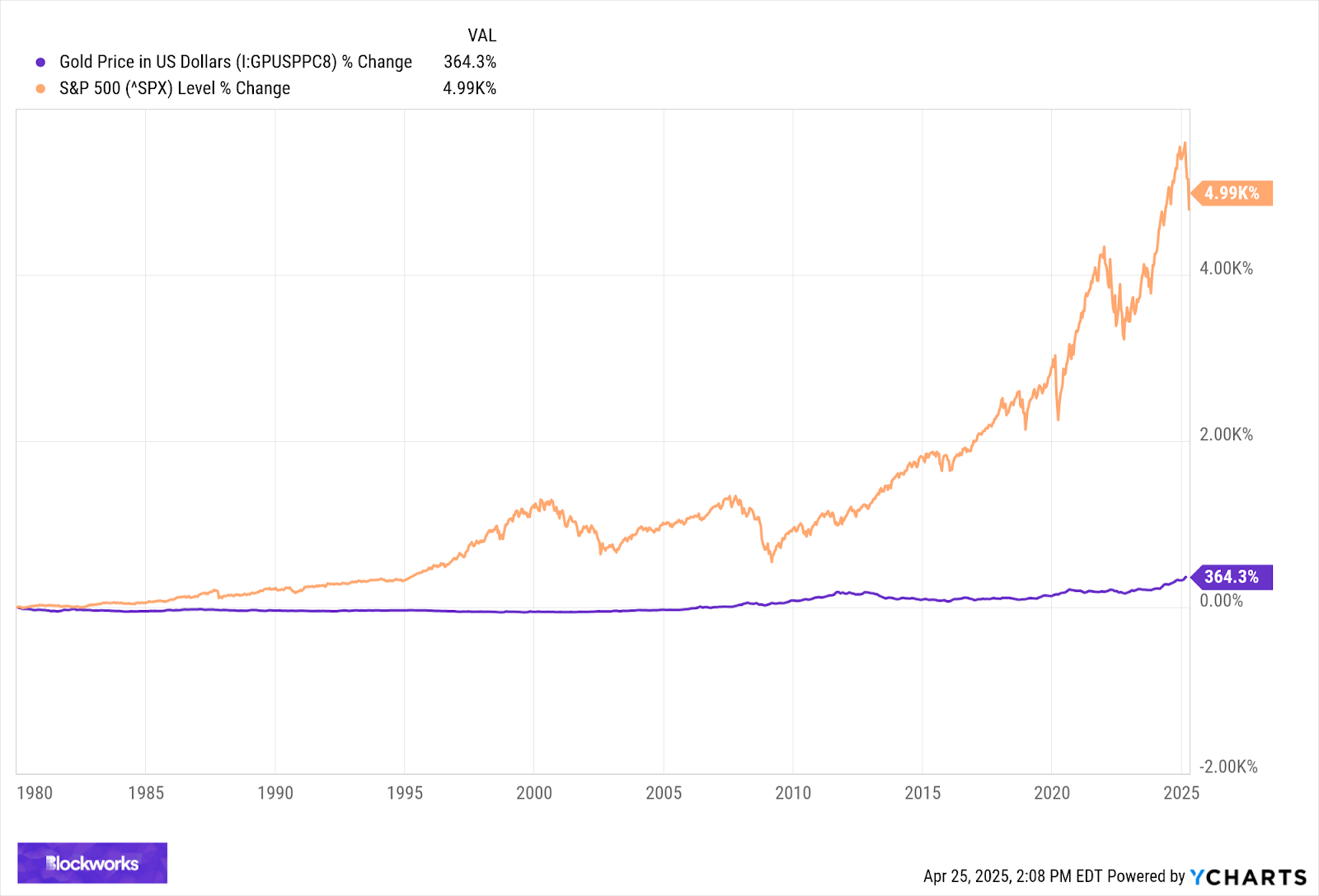

Townsend told Fortune that BTC can be unpredictable in the short-term, but that it has historically provided returns in the long-term.

At the time of writing, Bitcoin trades at $84,554. It’s unchanged over the past day and the past month.

The coin appreciated 13% in a week and 31% in a year. It hit its all-time high of $108,786 in January 2025, dropping 22% since.

Cryptonews reported in December 2023 that the Gradient Ventures-backed Meanwhile Group unveiled a new private credit fund denominated in BTC. The fund aimed to provide investors with a “conservative” yield in BTC and lend funds in BTC to institutional counterparties.

At the time, the company said that Meanwhile Advisors, the group’s subsidiary, targeted a 5% yield for the Meanwhile BTC Private Credit Fund term.

Furthermore, the company launched Meanwhile Insurance for US customers earlier in 2023. They accept premiums and pay benefits in BTC only. The goal is to minimise the risk of inflation and maximize returns.

This life insurance is similar to a typical one. The policyholder pays a monthly premium, but they pay in BTC from the crypto wallet, not in funds from a bank. The family receives the Bitcoin once the policyholder passes away.

At the same time, Meanwhile generates revenue by lending out clients’ BTC to large financial institutions, including crypto exchanges and market makers, for up to two years. It expects to see a 3% return on these loans to pay out clients and fund expenses.

Per Fortune, Townsend argued that “life insurance is integral to any functioning society.” It provides financial protection for the policyholder’s family.

“It may feel like the dollar is not as sure a store of value as it might have been in the past,” Townsend told Fortune. “So the idea of storing some value for your kids… in this global, censorship-resistant, decentralized, uncontrollable currency in Bitcoin is very attractive.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget Builders stories: The journey to becoming a top builder

Friday charts: The Marvin Minsky moment is here

Have markets been obsessing over the wrong Minsky?

Charles Hoskinson Reveals Exciting Plans for Lace Wallet’s XRP Functionality

In Brief Charles Hoskinson announces XRP functionality for Lace wallet. Integration aims to enhance multi-chain support and user experience. Upcoming NIGHT token distribution includes XRP holders.