Ethereum Inverse ETF Soars 247% in 2025

ProShares UltraShort Ether ETF (ETHD) gains 247% YTD, capitalizing on Ethereum's price slump.💼 How the Ethereum Inverse ETF Works📊 Why Investors Are Turning to Inverse ETFs

- ETHD delivers -2x Ethereum’s daily performance.

- It’s the best-performing ETF of 2025 so far.

- Ethereum’s decline fuels investor interest in inverse products.

As Ethereum struggles in 2025, traders are finding big opportunities—just not where you’d expect. The ProShares UltraShort Ether ETF (ETHD), which bets against Ethereum’s price, is now the top-performing ETF of the year with a staggering 247% year-to-date return.

ETHD is designed to return twice the opposite (-2x) of Ethereum’s daily price movement. So when Ethereum drops by 5%, ETHD rises by about 10%. This setup makes it an attractive choice for short-term traders looking to profit from ETH ’s downside volatility.

💼 How the Ethereum Inverse ETF Works

The ETHD ETF doesn’t hold Ethereum directly. Instead, it uses derivatives and short positions to track the inverse of Ethereum’s daily returns. The “UltraShort” strategy amplifies this inverse exposure to -2x, meaning it’s a high-risk, high-reward product meant for sophisticated investors.

Inverse ETFs like ETHD are typically used for short-term speculation or hedging. Because of their leveraged structure, holding them long-term can be risky due to compounding effects, especially during volatile price swings. Still, with Ethereum facing ongoing bearish pressure in 2025, ETHD has turned into a gold mine for traders betting on further decline.

📊 Why Investors Are Turning to Inverse ETFs

Ethereum’s price drop reflects broader market uncertainty and shifting investor sentiment. While many crypto investors have seen their portfolios shrink, others have seized the moment with inverse ETFs like ETHD.

As bearish momentum continues, products like ETHD are gaining popularity, offering new ways to navigate a declining crypto market . But investors are reminded to approach leveraged ETFs with caution—they are tools for timing the market, not for holding through cycles.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin ETFs Experience Influx Amid Positive Sentiment Shift in Crypto Market

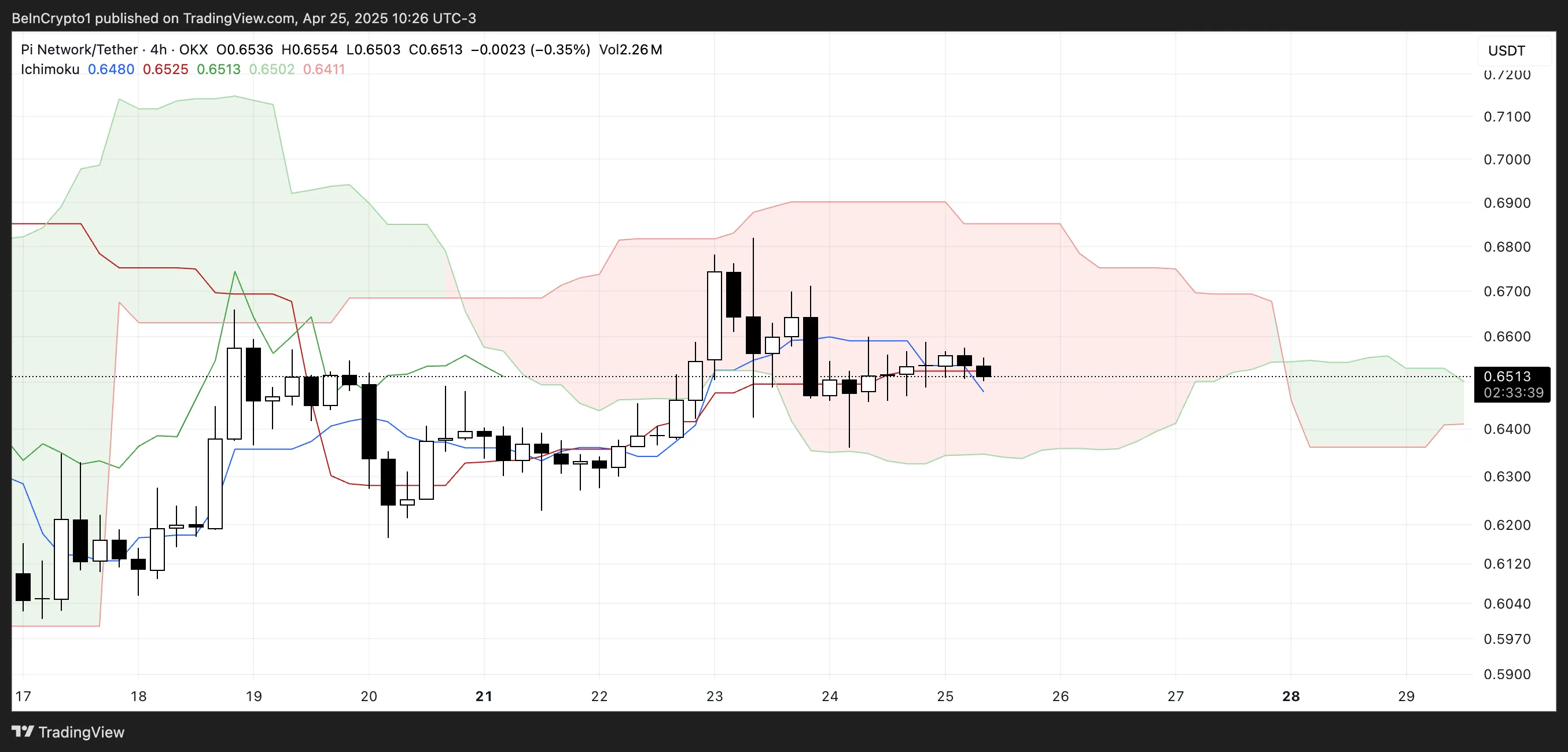

Pi Network Price Consolidation Holds Key to Possible Breakout Above $0.68

ARK Invest’s Bitcoin Forecast: Exploring Potential Paths to $2.4 Million Amid Adoption Concerns