Ethereum Struggles Below $2,000: These 4 Charts Predict a 500% Surge Once Resistance Breaks!

- A brief resistance period below $2000 in Ethereum might end as it approaches breaking through its major resistance level.

- Market adjustments through declining active addresses and transaction fees demonstrate a healthy evolution rather than a failure of the market.

- The increase in Ethereum’s total supply after the Merge may prove to be short-term due to emerging deflationary sustainability mechanisms.

Ethereum faces durable resistance which exists near the $2,000 market level at this time. The digital currency experiences substantial downward force despite its exceptional recent achievements. The data from four significant charts indicates a transformative breakthrough could happen after resistance levels are broken which would produce a significant 500% price increase.

The upcoming price trends of Ethereum can be revealed through declining active addresses together with decreasing total fees burnt and fees per transaction and increasing total ETH supply after the Merge implementation.

Declining Active Ethereum Addresses: A Temporary Setback?

The active address numbers on Ethereum’s platform have diminished consistently over the past months. A decline in active addresses should not be mistaken for the end of Ethereum’s dominance because reduced activity rates do not indicate its demise. This data represents both changing user behavior and overall market adjustments because of market conditions.

The strong long-term value of Ethereum persists regardless of current conditions. Network activity shows periodic changes based on market forces that affects active addresses while new developments and uses may trigger a recovery phase. The observed decrease in active addresses shows no indication of long-term systemic problems because this appears to represent short-term dynamics.

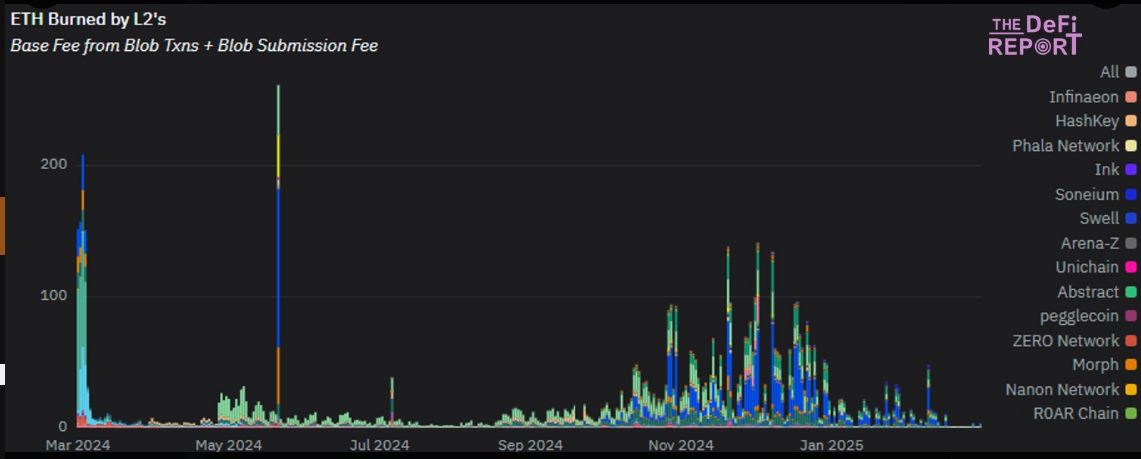

Drop in Total Fees Burnt: A Rebalancing Phase

The biggest shift within Ethereum’s network has resulted from declining total fees burnt metrics which EIP-1559 introduced to the platform. Fewer transactions are processed or users perform smaller-scale activities, which leads to a decrease in fees burned. Ethereum’s network sustainability faces no threat from the fees burned because network demand naturally produces these fees as a consequence.

Source :(X)

Source :(X)

A healthy market operates based on supply-demand dynamics that produce lower fees and demonstrate their balance with network demands. Ethereum’s blockchain will probably experience these lower transaction costs before its full optimization phase begins. The future growth of Ethereum’s value may be boosted through increased network fees subjected to burn conditions.

Decrease in Fees Per Transaction: An Optimistic Outlook

One significant indicator of a potential 500% growth is the decline in transaction fees that are burned during operations. Current operation fees within the Ethereum network demonstrate better efficiency because users can send transactions without a substantial financial burden.

Implementations of sharding and layer-2 solutions in Ethereum’s ecosystem, alongside decreased costs will stimulate user adoption on the network. Widespread adoption of Ethereum because of better scalability and reduced costs would lead to a major demand increase and consequently higher prices.

The Uplift in Total ETH Supply Post-Merge: A Surprising Shift

Since the Ethereum Merge occurred, the overall ETH supply has significantly increased. The rising supply of Ethereum creates apprehension within investor groups because it might decrease ETH’s market value.

The network deflationary potential increases when more ETH enters staking or gets locked in the Ethereum network. The new supply dynamics create conditions for Ethereum to gain greater value because escalating ETH demand is expected as more blockchain use cases emerge.

A 500% Surge Once Resistance Breaks?

The price surge prediction for Ethereum depends on breaking resistance levels according to these four critical indicators which signal major price momentum after resistance break. The Ethereum market appears set to experience a major price rally during its market rebalancing phase which will be driven by declining active addresses along with total fees burnt reduction, decreasing transaction expenses and a growing ETH supply after the Merge.

The crypto market will inevitably express its full support for the Ethereum network when it reaches a more mature state and enhances its network performance. Ethereum’s breakthrough of resistance may trigger its 500% price increase, which would open a profitable period.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trump’s meme token skyrockets 70% after VIP dinner invite

A whale spent over $4 million to buy VIRTUAL, WLD, COOKIE and other tokens

CloneX NFTs Hit a Wall as Images Vanish From OpenSea

SUI Jumps 73% After Grayscale and Mastercard Boost

SUI gains 73% in a week, driven by a Grayscale Trust listing and a strategic partnership with Mastercard.SUI Skyrockets After Major Institutional MovesMastercard Partnership Fuels Adoption HopesWhat’s Next for SUI?