Trump Tariff Pause Shakes Markets: Recovery, Recession Reversal, and Strategic Chess with China

Trump’s Strategy: “Somebody Had to Do It”

Trump didn't mince words in a series of public statements following the announcement. He asserted:

“No other President would have done what I did… Somebody had to do it. It had to stop because it’s not sustainable.”

He highlighted that China made over $1 trillion in trade gains last year from the U.S., claiming his administration has now “reversed it.” Trump’s narrative is clear: the tariff escalation was a long-overdue correction to a broken trade dynamic.

“China Wants to Make a Deal”

Just hours after the tariff pause announcement, Trump claimed:

“China wants to make a deal. They’re in the process of figuring it out.”

This suggests that the 125% tariff on Chinese goods may be a pressure tactic aimed at forcing Beijing to the negotiation table. Treasury Secretary Bessent reinforced this by saying this was Trump’s strategy all along—to goad China into a weakened position. She also confirmed the timing was deliberate and not a response to market panic.

Trump’s Tariff Pause: A Strategic Pivot that Rattled and Rallied Markets

On April 9, 2025, President Donald Trump shocked global markets by authorizing a 90-day pause on tariffs for most countries, excluding China, which now faces a steep 125% tariff hike. While the move initially sparked confusion and volatility, it has since been hailed by his allies as a calculated maneuver—and even prompted Goldman Sachs to walk back its recession forecast.

Let’s explore what led to this turnaround and how key voices are framing the impact.

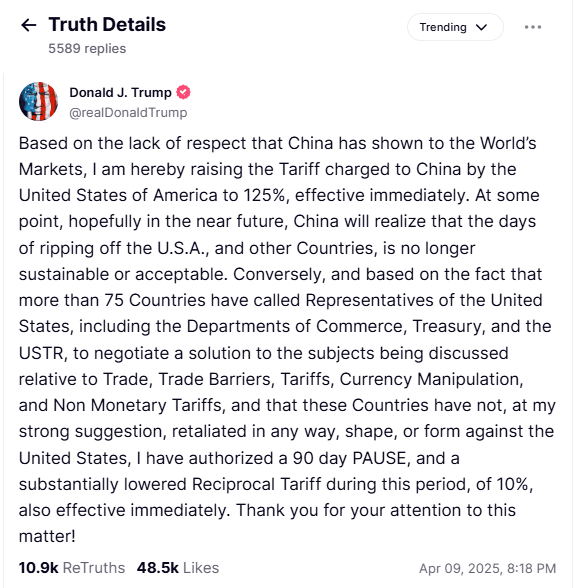

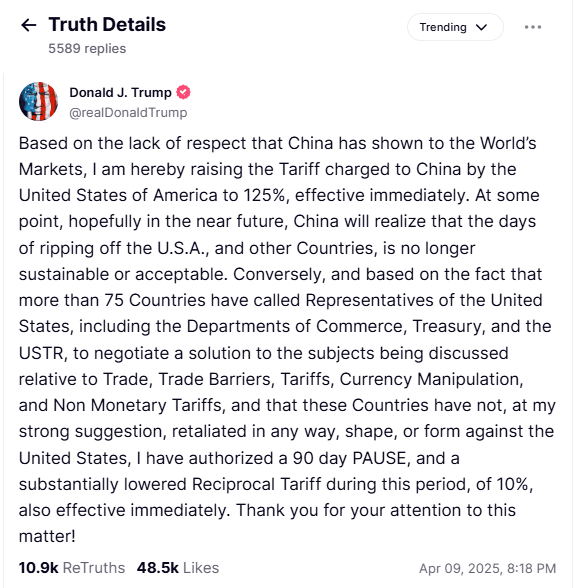

TRUMP Post on TruthSocial towards CHINA

TRUMP Post on TruthSocial towards CHINA

From Market Shock to Optimism: Goldman Sachs Reverses Recession Call

One of the most immediate effects of Trump's announcement was the sharp market rally. The S&P 500 jumped over 8%, while the Nasdaq gained more than 10%—signaling renewed investor confidence.

In a surprising development, Goldman Sachs officially rescinded its recession prediction, attributing the shift to the clarity and potential global de-escalation offered by the tariff pause. This marked a pivotal moment in Wall Street sentiment, flipping bearish expectations into cautious optimism.

Vindication from Political Allies and Crypto Leaders

Crypto investor and "Crypto Czar" David Sacks added fuel to the narrative by accusing critics of rooting for Trump’s failure—even if it meant a market crash:

“Fortunately their hopes have been dashed. Trump has been vindicated.”

This echoes a broader sentiment across pro-Trump circles: that the market rebound and Goldman’s reversal prove the administration’s approach is not just working, but strategically sound.

What’s Next? More Volatility or Sustained Recovery?

While the market welcomed the pause, the road ahead remains uncertain. The 125% tariff on Chinese goods is still in place, and China’s retaliation via WTO complaint s and increased tariffs could reignite tensions.

Yet, if China comes to the negotiation table and broader trade relations improve, this move may mark a turning point for both Trump’s legacy and global economic stability.

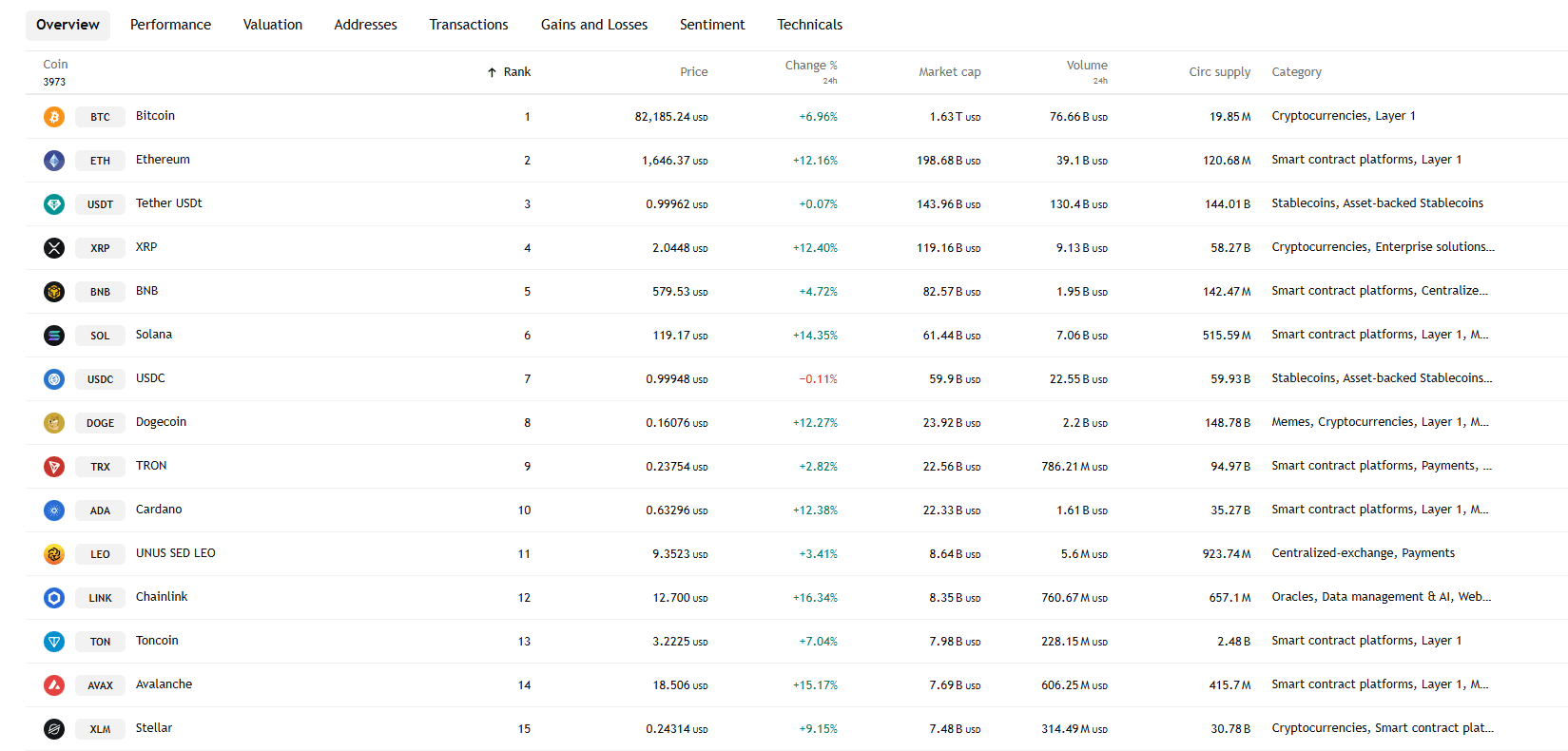

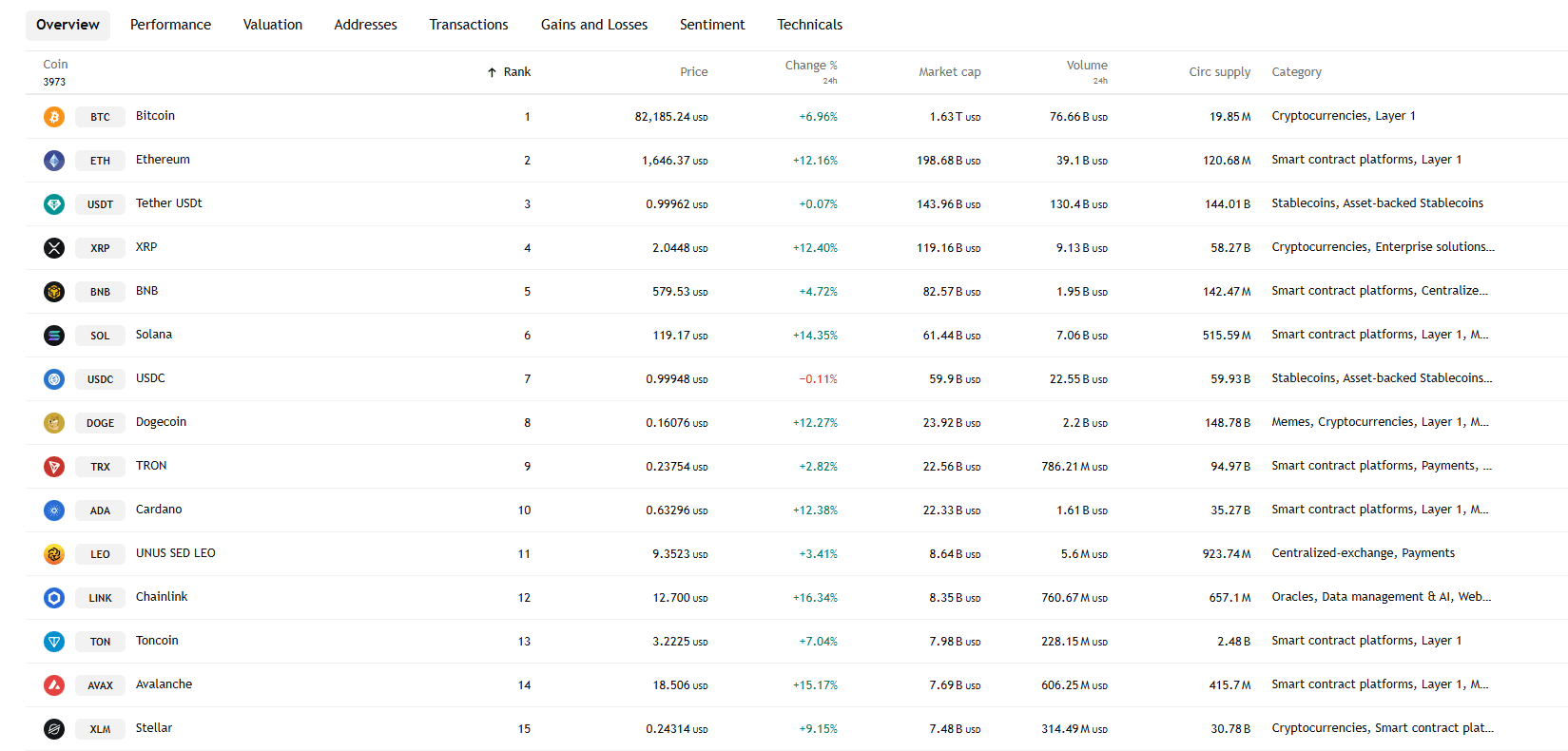

By TradingView - All Cryptocurrencies Performance

By TradingView - All Cryptocurrencies Performance

Trump’s 90-day tariff pause wasn’t just a policy decision—it was a market-moving, recession-reversing power play. With political allies and market analysts shifting their tone, and China reportedly “figuring it out,” the next few weeks could determine whether this rebound sustains—or if volatility rears its head once more.

Trump’s Strategy: “Somebody Had to Do It”

Trump didn't mince words in a series of public statements following the announcement. He asserted:

“No other President would have done what I did… Somebody had to do it. It had to stop because it’s not sustainable.”

He highlighted that China made over $1 trillion in trade gains last year from the U.S., claiming his administration has now “reversed it.” Trump’s narrative is clear: the tariff escalation was a long-overdue correction to a broken trade dynamic.

“China Wants to Make a Deal”

Just hours after the tariff pause announcement, Trump claimed:

“China wants to make a deal. They’re in the process of figuring it out.”

This suggests that the 125% tariff on Chinese goods may be a pressure tactic aimed at forcing Beijing to the negotiation table. Treasury Secretary Bessent reinforced this by saying this was Trump’s strategy all along—to goad China into a weakened position. She also confirmed the timing was deliberate and not a response to market panic.

Trump’s Tariff Pause: A Strategic Pivot that Rattled and Rallied Markets

On April 9, 2025, President Donald Trump shocked global markets by authorizing a 90-day pause on tariffs for most countries, excluding China, which now faces a steep 125% tariff hike. While the move initially sparked confusion and volatility, it has since been hailed by his allies as a calculated maneuver—and even prompted Goldman Sachs to walk back its recession forecast.

Let’s explore what led to this turnaround and how key voices are framing the impact.

TRUMP Post on TruthSocial towards CHINA

TRUMP Post on TruthSocial towards CHINA

From Market Shock to Optimism: Goldman Sachs Reverses Recession Call

One of the most immediate effects of Trump's announcement was the sharp market rally. The S&P 500 jumped over 8%, while the Nasdaq gained more than 10%—signaling renewed investor confidence.

In a surprising development, Goldman Sachs officially rescinded its recession prediction, attributing the shift to the clarity and potential global de-escalation offered by the tariff pause. This marked a pivotal moment in Wall Street sentiment, flipping bearish expectations into cautious optimism.

Vindication from Political Allies and Crypto Leaders

Crypto investor and "Crypto Czar" David Sacks added fuel to the narrative by accusing critics of rooting for Trump’s failure—even if it meant a market crash:

“Fortunately their hopes have been dashed. Trump has been vindicated.”

This echoes a broader sentiment across pro-Trump circles: that the market rebound and Goldman’s reversal prove the administration’s approach is not just working, but strategically sound.

What’s Next? More Volatility or Sustained Recovery?

While the market welcomed the pause, the road ahead remains uncertain. The 125% tariff on Chinese goods is still in place, and China’s retaliation via WTO complaint s and increased tariffs could reignite tensions.

Yet, if China comes to the negotiation table and broader trade relations improve, this move may mark a turning point for both Trump’s legacy and global economic stability.

By TradingView - All Cryptocurrencies Performance

By TradingView - All Cryptocurrencies Performance

Trump’s 90-day tariff pause wasn’t just a policy decision—it was a market-moving, recession-reversing power play. With political allies and market analysts shifting their tone, and China reportedly “figuring it out,” the next few weeks could determine whether this rebound sustains—or if volatility rears its head once more.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP’s 16-Day $3 Surge Sparks Hopes of Breaking All-Time Highs

Trump turns on ‘buddy’ Putin over Ukraine, says he’ll slap Russia with sanctions now

Share link:In this post: Trump warned he may hit Russia with new sanctions after fresh missile attacks on civilians. Trump met with Zelenskyy in Rome and called the meeting productive, but gave no full details. Trump offered a peace deal that includes recognizing Crimea as Russian territory, which Zelenskyy rejected.

Trump’s economic and geopolitical failures took center stage at Pope Francis’ funeral

Share link:In this post: Trump’s economic and diplomatic tensions took over the spotlight at Pope Francis’ funeral. Trump met briefly with Zelenskyy, Macron, and Starmer during the service but made little progress. Trump skipped a second meeting with Zelenskyy and left Rome quickly after the Mass.

Elon Musk and Nobel laureates call for investigation into OpenAI’s nonprofit mission

Share link:In this post: Elon Musk called OpenAI restructuring plan the “scam of the century” after experts oppose it. Legal and AI experts have called on Attorneys General of Delaware and California to OpenAI core mission as a non-profit. Concerns about Open AI deviating from its non-profit origins is not limited to Musk.