Quant Analyst PlanB Says Bitcoin Correction ‘Normal Bull Market Dip’ After 30% Drop for BTC

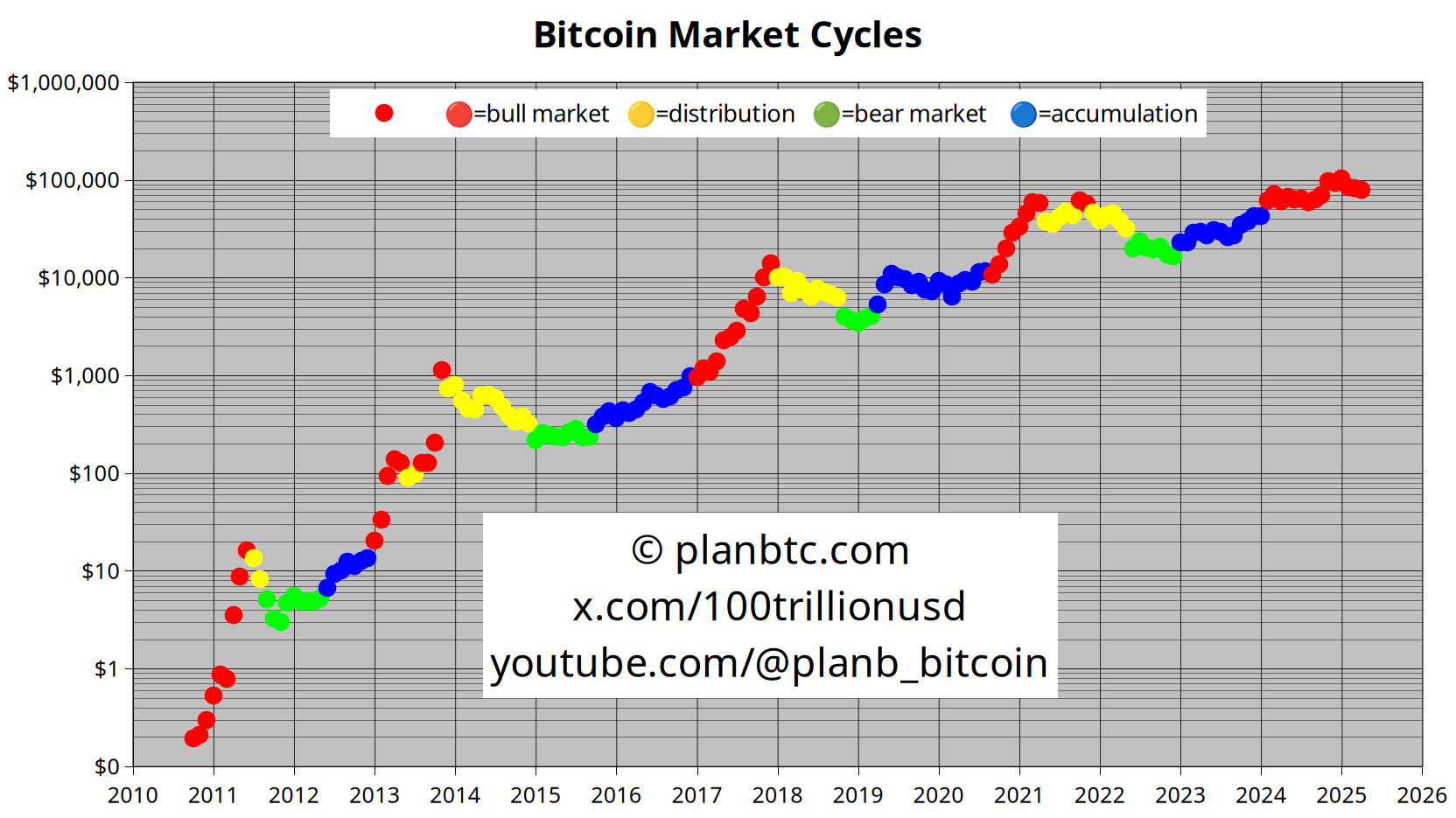

Widely followed on-chain analyst PlanB says that Bitcoin’s ( BTC ) current correction is part and parcel of regular bull market conditions.

The pseudonymous analyst tells his 2.1 million followers on the social media platform X that the indicators he watches are still signaling bullishness for the flagship crypto asset.

Says PlanB,

“Even with today’s low bitcoin prices my on-chain indicators still signal bull market. So in my opinion this is a normal bull market dip and not a transition from bull phase to distribution phase (and then bear phase).”

Source: PlanB/X

Source: PlanB/X

PlanB’s color-coded dot chart indicates the number of months until each halving – when BTC miners’ rewards are cut in half – with the red dots representing the beginning of the halving cycles.

In a recent video update, the analyst told his 209,000 YouTube subscribers that a combination of 200-week means suggests Bitcoin may soon enter an explosive uptrend based on historical precedent.

The analyst says that the 200-week arithmetic and the 200-week geometric are currently running close together on the chart, signaling a possible Bitcoin breakout.

“It might be that the bull market is still forming and that the [arithmetic mean] will separate again, will diverge again, from the geometric mean.

One more thing on those two lines. Notice that you can’t have a bear market or a big crash when the 200-week [arithmetic mean] and the geometric mean are together. The big crashes here [in 2021 and 2022] are happening when there’s a diversion between the two lines. Also, here in 2018, there was a big gap between the two [means]. Same here in 2014 and 2015.”

Follow us on X , Facebook and Telegram

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

HYPE Surpasses TRX in Fee Generation; Questions Arise About Long-Term Dominance

INIT is live! Bullish or bearish? Join to share 3,432 INIT!

XRP Network Explodes with 67% Growth—Here’s What It Means for the Price

VIPBitget VIP Weekly Research Insights

In 2025, the stablecoin market shows strong signs of growth. Research indicates that the market cap of USD-pegged stablecoins has surged 46% year-over-year, with total trading volume reaching $27.6 trillion, surpassing the combined volume of Visa and Mastercard transactions in 2024. The average circulating supply is also up 28% from the previous year, reflecting sustained market demand. Once used primarily for crypto trading and DeFi collateral, stablecoins are now expanding into cross-border payments and real-world asset management, reinforcing their growing importance in the global financial system. More banks and enterprises are starting to issue their own stablecoins. Standard Chartered launched an HKD-backed stablecoin, and PayPal issued PYUSD. The CEO of Bank of America has expressed interest in launching a stablecoin once regulations permit (via CNBC). Fidelity is developing its own USD stablecoin, while JPMorgan Chase and Bank of America plan to follow suit when market conditions stabilize. Meanwhile, World Liberty Financial (backed by the Trump family) has introduced USD1, backed by assets such as government bonds and cash.