Bitcoin Struggles Below $80K as Weekend Sell-Off Wipes Out $160B in Value

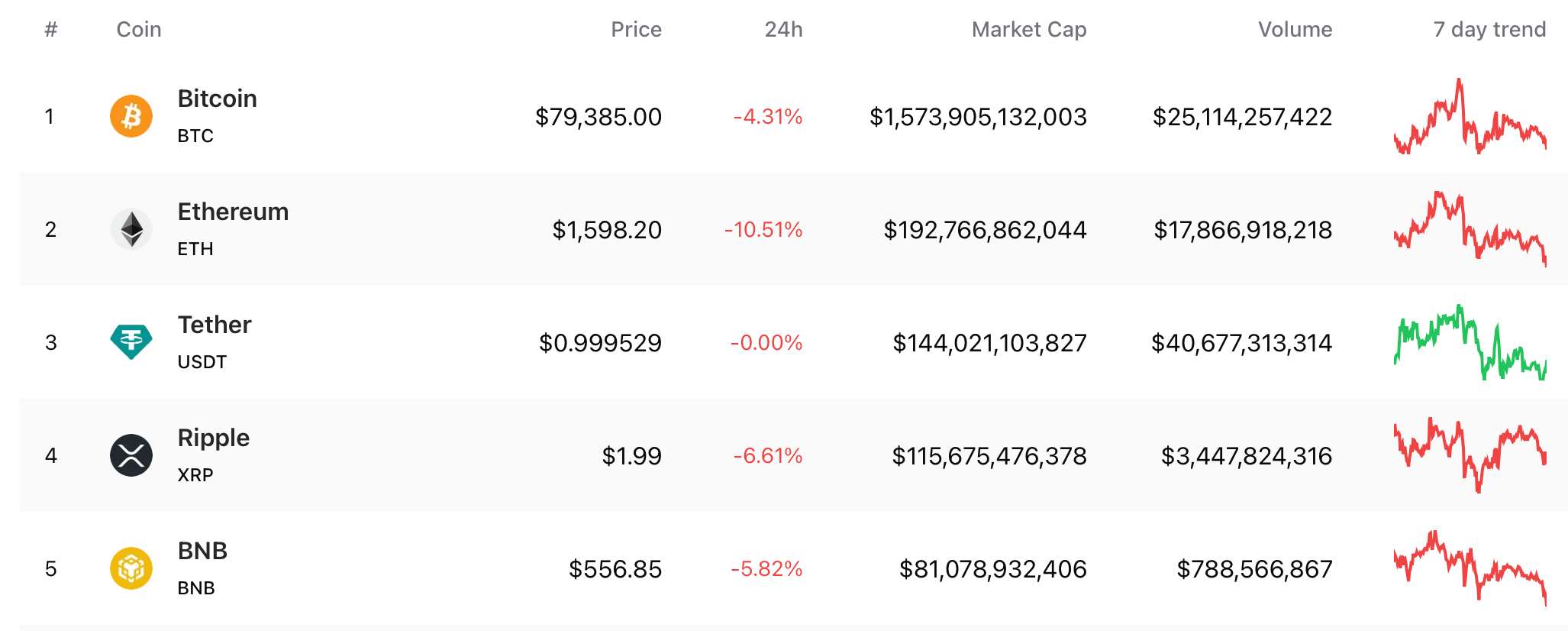

By Sunday evening, just before 5 p.m. ET, bitcoin ( BTC) was changing hands at $79,385 per coin, having earlier dipped to an intraday low of $78,639. As of this writing, BTC has declined 4.3% against the U.S. dollar and is showing a 30-day contraction of 9.3%. The evening’s most active trading pair remains USDT, followed in volume by USD, USDC, FDUSD, EUR, and KRW.

Top five crypto coins at 4:30 p.m. ET on Sunday April 6, 2025.

Bitcoin’s downturn has sent tremors through the broader digital asset sector, as altcoins follow suit with heavy declines. Ethereum ( ETH) endured a 10.5% drop today, while XRP is down 6.6%. BNB slipped by 5.8%, and SOL has relinquished approximately 9.5% of its value in the past 24 hours. Similarly, DOGE mirrored SOL’s retreat, losing 9.5% as well. Since Friday, the crypto market has experienced a staggering $160 billion contraction, the bulk of which unfolded on Sunday.

Elsewhere in the sector, several tokens registered double-digit pullbacks. TAO dropped 14.7% today, WLD fell by 13.7%, and OP retreated 13% against the greenback. At 1:45 p.m. ET on Sunday, crypto derivatives markets recorded $252.79 million in liquidations. That figure soared to a whopping $603.08 million by 4:30 p.m. as BTC fell beneath the $80,000 line. Roughly $165 million of those wiped-out positions were BTC long positions, with an additional $148 million in ETH long bets facing similar fates.

Sunday’s volatility laid bare the delicate equilibrium within crypto markets, as bitcoin’s decline rippled through altcoins and derivatives with swift consequence. Widespread liquidations exposed the fragility of leveraged positions, intensifying the extent of losses as prices sank beneath $80,000 and even $79,000. These sudden reversals challenge investor conviction, compelling a fresh evaluation of risk in the face of unstable valuations.

At precisely 5 p.m. ET on Sunday, BTC was trading below the $79,000 mark at $78,770 per unit.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CloneX NFTs Hit a Wall as Images Vanish From OpenSea

SUI Jumps 73% After Grayscale and Mastercard Boost

SUI gains 73% in a week, driven by a Grayscale Trust listing and a strategic partnership with Mastercard.SUI Skyrockets After Major Institutional MovesMastercard Partnership Fuels Adoption HopesWhat’s Next for SUI?

Whale Buys Back 8K ETH, Nets $159K in 10 Days

Whale repurchases 8,012 ETH at $1,779, repays debt, and earns $159K from ETH trading over 10 days.Whale Re-Enters ETH With $14M BuybackSmart Debt Management and Strategic TimingProfit Through Precision

Solana Price Eyes $162, Cardano Slides Again, While Unstaked Presale Goes Viral in April 2025

Explore a timely comparison of Cardano, Solana, and Unstaked ($UNSD) focusing on real-time utility, price levels, and presale potential. Find out what crypto to invest in for both short-term strategy and long-term value.Cardano Slides Back Into Multi-Year RangeSolana Faces Crucial Test Near Largest Supply ClusterUnstaked Is More Than Hype: A Real Use Case in a Meme-Driven MarketUtility, Timing, and the Case for $UNSD