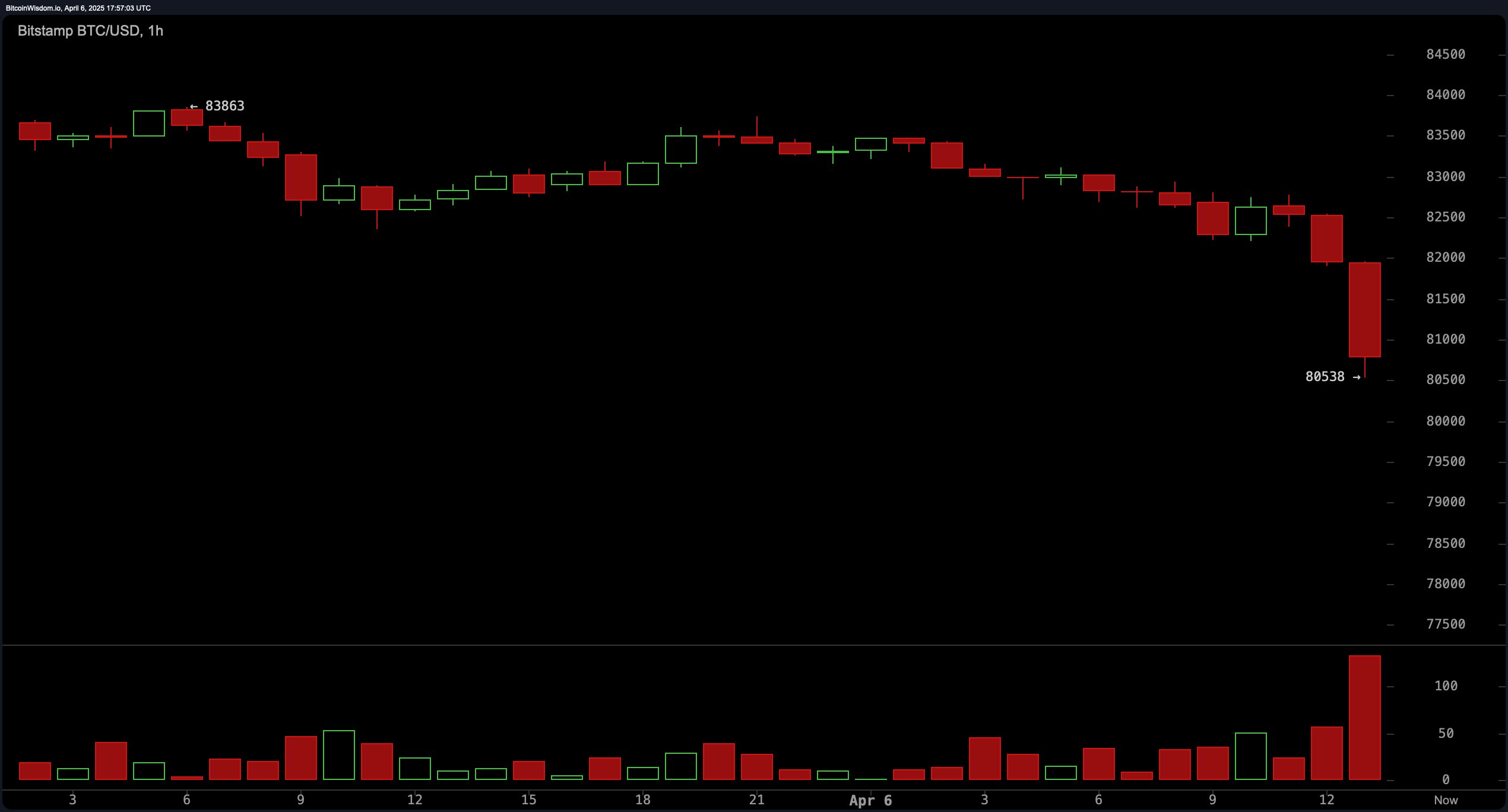

Crypto Chill: Bitcoin Dips 2.6% Under $81K Ahead of Wall Street’s Next Move

On April 6, bitcoin’s valuation declined, landing at $80,538 per unit after sliding from its recent high of $83,668. The premier digital asset saw its 24-hour trade volume contract to $14.16 billion—a 17% reduction. The day’s most active trading unfolded on platforms such as Binance, Bybit, OKX, Bitget, and Crypto.com, in that order.

Curiously, while the majority of exchanges clustered around relatively the same price, South Korea’s Upbit stood apart, listing BTC at $82,915—reflecting close to a 2% premium today and suggesting complex regional dynamics. Meanwhile, cryptoquant.com’s Coinbase Premium Index recorded a decline, pointing to diminished U.S. trading activity and lighter buy-side pressure. As of Sunday, the San Francisco-based exchange ranked sixth in trade volume, trailing just behind Crypto.com.

Losses from Sunday’s trading trimmed the broader crypto economy by 2.45%, bringing the total valuation to $2.59 trillion. Bitcoin maintains a commanding 62% share of that total, with ethereum ( ETH) holding 8%. In derivatives markets, liquidations reached $252.79 million on Sunday, of which $207 million were long positions. ETH long liquidations contributed roughly $72 million to that figure.

Bitcoin’s price trajectory continues to move in close step with global liquidity shifts—considered by some to be the “purest” gauge of macroeconomic and monetary policy forces. With Wall Street poised to reopen tomorrow, BTC’s latest turn may not bode well for traditional finance (TradFi)—but it offers a revealing pulse check on broader market sentiment. At press time, at 1:45 p.m. ET, BTC is exchanging hands for $80,613 per coin.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CloneX NFTs Hit a Wall as Images Vanish From OpenSea

SUI Jumps 73% After Grayscale and Mastercard Boost

SUI gains 73% in a week, driven by a Grayscale Trust listing and a strategic partnership with Mastercard.SUI Skyrockets After Major Institutional MovesMastercard Partnership Fuels Adoption HopesWhat’s Next for SUI?

Whale Buys Back 8K ETH, Nets $159K in 10 Days

Whale repurchases 8,012 ETH at $1,779, repays debt, and earns $159K from ETH trading over 10 days.Whale Re-Enters ETH With $14M BuybackSmart Debt Management and Strategic TimingProfit Through Precision

Solana Price Eyes $162, Cardano Slides Again, While Unstaked Presale Goes Viral in April 2025

Explore a timely comparison of Cardano, Solana, and Unstaked ($UNSD) focusing on real-time utility, price levels, and presale potential. Find out what crypto to invest in for both short-term strategy and long-term value.Cardano Slides Back Into Multi-Year RangeSolana Faces Crucial Test Near Largest Supply ClusterUnstaked Is More Than Hype: A Real Use Case in a Meme-Driven MarketUtility, Timing, and the Case for $UNSD