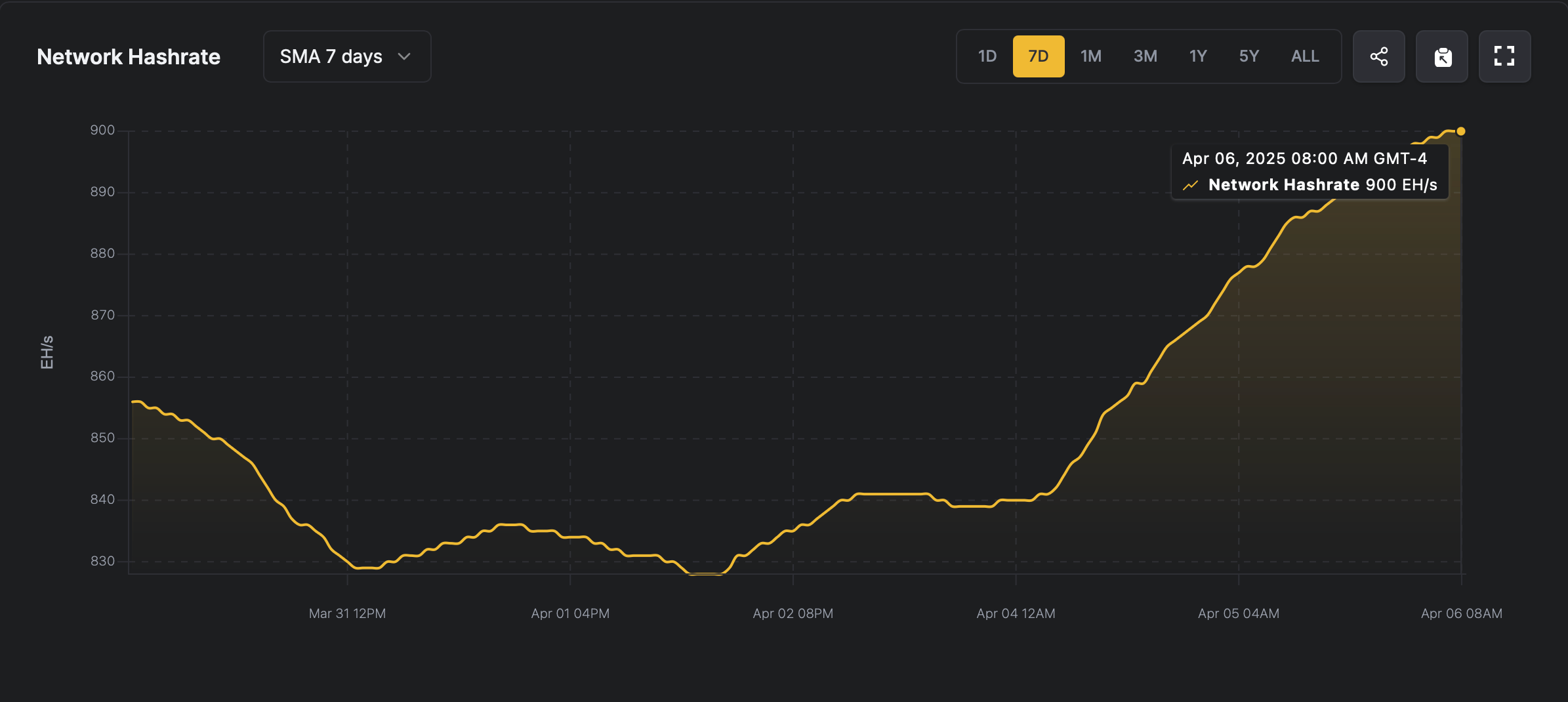

900 EH/s and Counting: Bitcoin Network Power Reaches Unprecedented Heights

Merely a day earlier, at block 891,072, the network’s difficulty adjusted upward from 113.76 trillion to 121.51 trillion—a striking 6.81% leap. Conventional wisdom suggests that as difficulty climbs, mining becomes more arduous, often driving computational power down as participants exit.

Yet, defying expectations, the hashrate not only held firm but accelerated further. After brushing against a lofty 883 EH/s on April 5, it vaulted to 900 EH/s the very next day. This translates to an additional 17,000 petahash per second (PH/s), or 17 EH/s, being woven into the network in just one day.

Seven-day simple moving average (SMA) via hashrateindex.com on Sunday April 6, 2025.

Before the difficulty adjustment, the spot hashprice—the projected earnings for 1 PH/s—hovered at $46.67 on April 5. Now, it has settled at $43.27 per PH/s, reflecting the shifting economics of mining. Additionally, block intervals were a lot faster than the 10-minute average, which led to the difficulty hike.

The current reality tells a different story. As of 9 a.m. on April 6, the hashrate has dipped to 889.62 EH/s, accompanied by sluggish block times—averaging a sluggish 11 minutes and 39 seconds, per hashrateindex.com. Transaction fees remain negligible, with high-priority transfers clearing for just 1 sat/vB (a mere $0.12). Meanwhile, a modest queue of 2,686 unconfirmed transactions lingers in the mempool.

The network’s latest performance reveals a mining sector that bends but doesn’t break, recalibrating with shrewd precision. Nuanced fluctuations in key metrics signal shifting tides that could reshape profitability and the tactical roadmaps of miners.

A delicate equilibrium between computational demand and supply points to a high-stakes dance of incentives, where ingenuity and tenacity push efficiency forward in a fiercely contested arena brimming with potential.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CloneX NFTs Hit a Wall as Images Vanish From OpenSea

SUI Jumps 73% After Grayscale and Mastercard Boost

SUI gains 73% in a week, driven by a Grayscale Trust listing and a strategic partnership with Mastercard.SUI Skyrockets After Major Institutional MovesMastercard Partnership Fuels Adoption HopesWhat’s Next for SUI?

Whale Buys Back 8K ETH, Nets $159K in 10 Days

Whale repurchases 8,012 ETH at $1,779, repays debt, and earns $159K from ETH trading over 10 days.Whale Re-Enters ETH With $14M BuybackSmart Debt Management and Strategic TimingProfit Through Precision

Solana Price Eyes $162, Cardano Slides Again, While Unstaked Presale Goes Viral in April 2025

Explore a timely comparison of Cardano, Solana, and Unstaked ($UNSD) focusing on real-time utility, price levels, and presale potential. Find out what crypto to invest in for both short-term strategy and long-term value.Cardano Slides Back Into Multi-Year RangeSolana Faces Crucial Test Near Largest Supply ClusterUnstaked Is More Than Hype: A Real Use Case in a Meme-Driven MarketUtility, Timing, and the Case for $UNSD