Nearly 400,000 FTX users risk losing $2.5 billion in repayments

Nearly 400,000 creditors of the bankrupt cryptocurrency exchange FTX risk missing out on $2.5 billion in repayments after failing to begin the mandatory Know Your Customer (KYC) verification process.

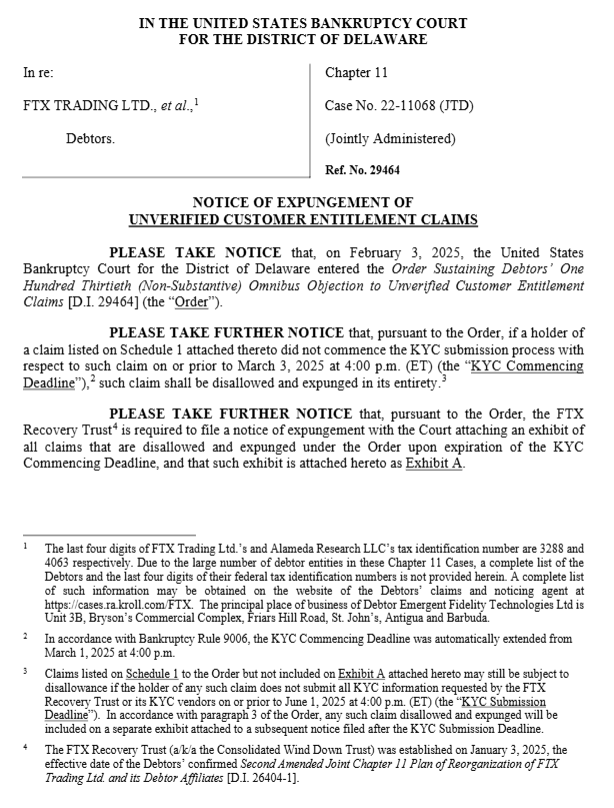

Roughly 392,000 FTX creditors have failed to complete or at least take the first steps of the mandatory Know Your Customer verification, according to an April 2 court filing in the US Bankruptcy Court for the District of Delaware.

FTX users originally had until March 3 to begin the verification process to collect their claims.

“If a holder of a claim listed on Schedule 1 attached thereto did not commence the KYC submission process with respect to such claim on or prior to March 3, 2025, at 4:00 pm (ET) (the “KYC Commencing Deadline”), 2 such claim shall be disallowed and expunged in its entirety,” the filing states.

FTX court filing. Source: Bloomberglaw.com

FTX court filing. Source: Bloomberglaw.com

The KYC deadline has been extended to June 1, 2025, giving users another chance to verify their identity and claim eligibility. Those who fail to meet the new deadline may have their claims permanently disqualified.

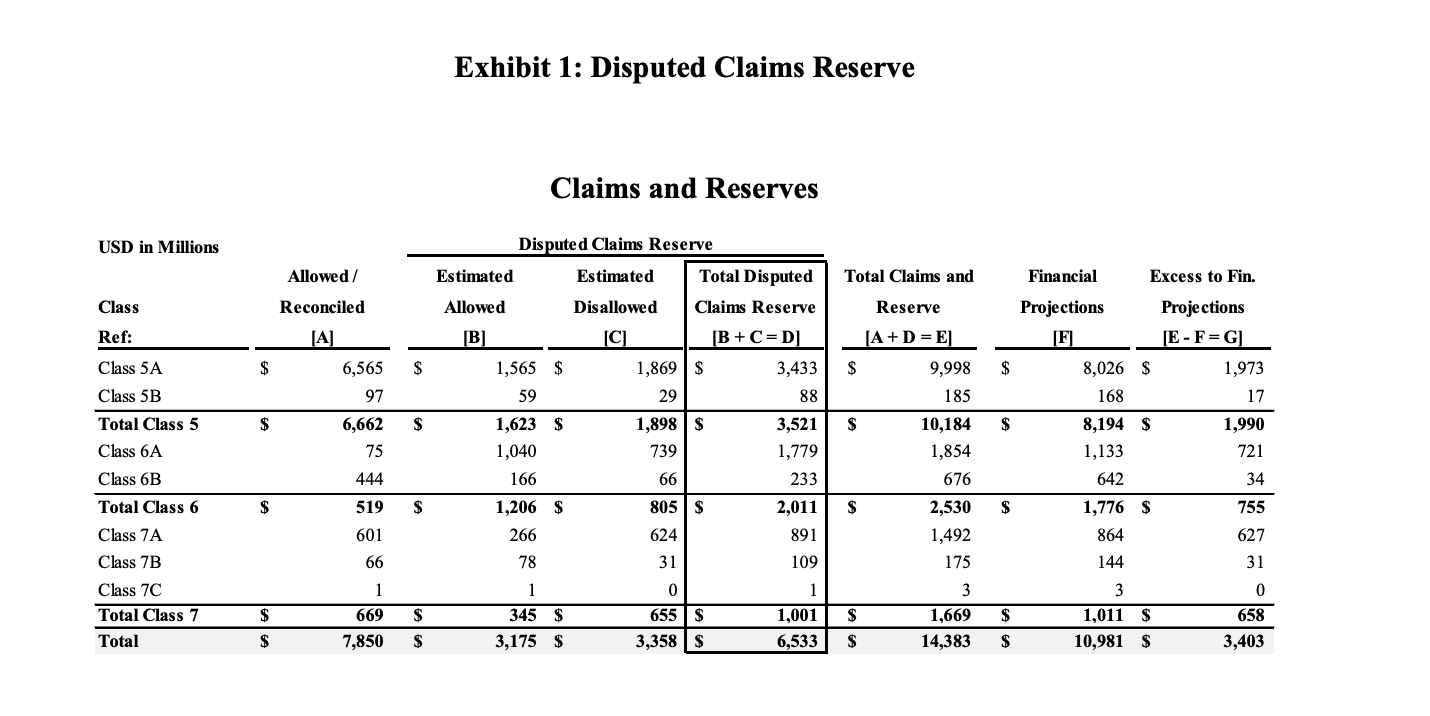

According to the court documents, claims under $50,000 could account for roughly $655 million in disallowed repayments, while claims over $50,000 could amount to $1.9 billion — bringing the total at-risk funds to more than $2.5 billion.

FTX court filing, estimated claims. Source: Sunil

FTX court filing, estimated claims. Source: Sunil

The next round of FTX creditor repayments is set for May 30, 2025, with over $11 billion expected to be repaid to creditors with claims of over $50,000.

Under FTX’s recovery plan, 98% of creditors are expected to receive at least 118% of their original claim value in cash.

How FTX users can complete KYC

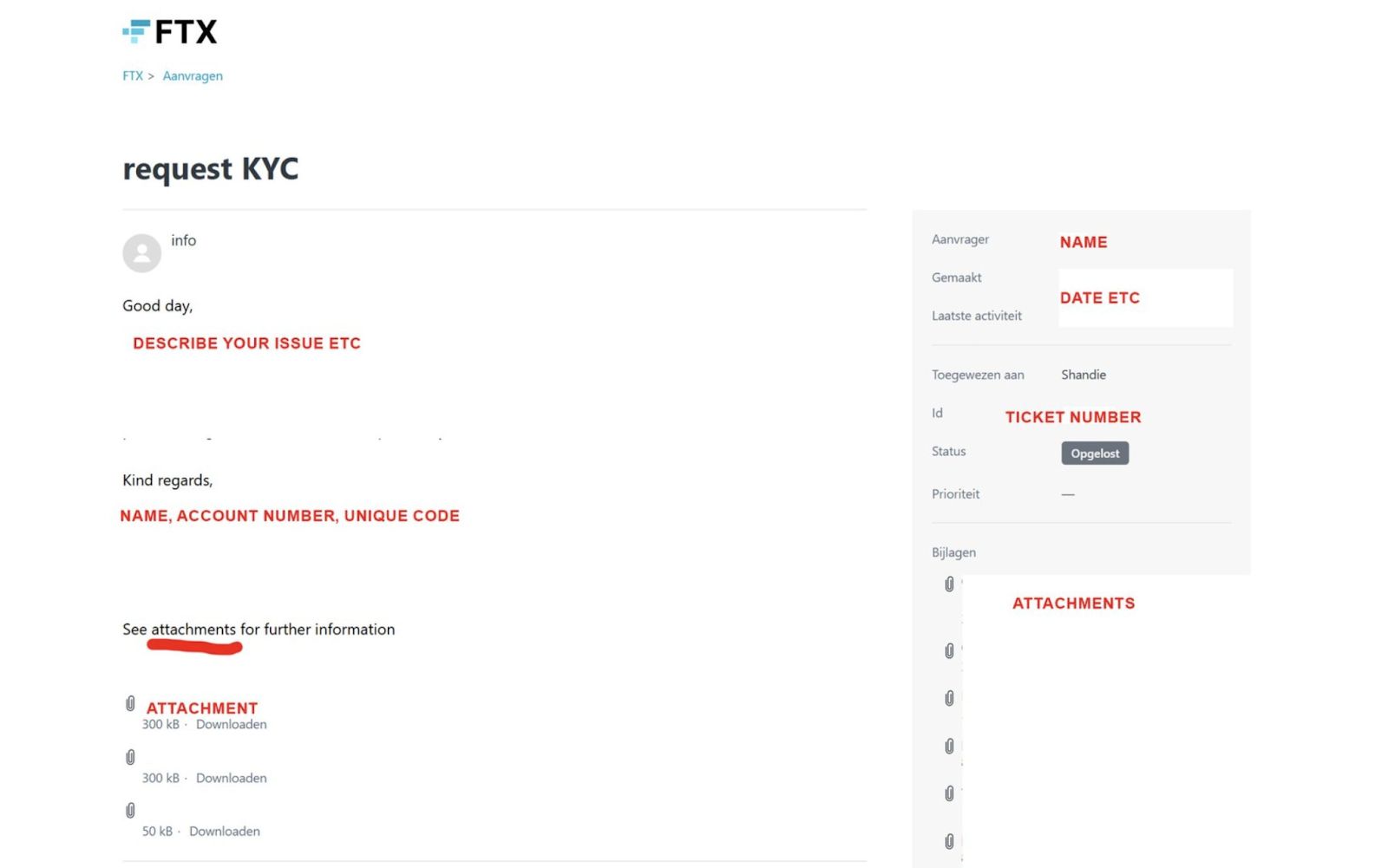

Many FTX users have reported problems with the KYC process.

However, users who were unable to submit their KYC documentation can resubmit their application and restart the verification process, according to an April 5 X post from Sunil, FTX creditor and Customer Ad-Hoc Committee member.

FTX KYC portal. Source: Sunil

FTX KYC portal. Source: Sunil

Impacted users should email FTX support ( [email protected] ) to receive a ticket number, then log in to the support portal, create an account, and re-upload the necessary KYC documents.

FTX’s Bahamian subsidiary, FTX Digital Markets, processed the first round of repayments in February , distributing $1.2 billion to creditors.

The crypto industry is still recovering from the collapse of FTX and more than 130 subsidiaries launched a series of insolvencies that led to the industry’s longest-ever crypto winter , which saw Bitcoin’s

BTC$82,784price bottom out at around $16,000.

While not a “market-moving catalyst” in itself, the beginning of the FTX repayments is a positive sign for the maturation of the crypto industry, which may see a “significant portion” reinvested into cryptocurrencies, Alvin Kan, chief operating officer at Bitget Wallet, told Cointelegraph.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Significant Outflows Hit Bitcoin Spot ETFs

31,000 BTC Options Expire Amid $105,000 Max Pain Point

Crypto Market Faces $384 Million Liquidation Hit

Maple Finance Deploys Yield-Bearing Stablecoin on Solana