HBAR’s $30 Million Short Liquidation Risk Eased by Death Cross: What Traders Need to Know

HBAR’s price is holding just above key support, saving short traders from liquidation—for now. But a looming Death Cross could shift momentum fast.

HBAR has recently experienced a significant price correction, pulling the altcoin to a critical support level. As the market conditions continue to show weakness, the price action has left HBAR vulnerable.

However, this downside movement might be offering short traders a chance to avoid heavy liquidation losses.

Hedera Traders Stand To Lose A Lot

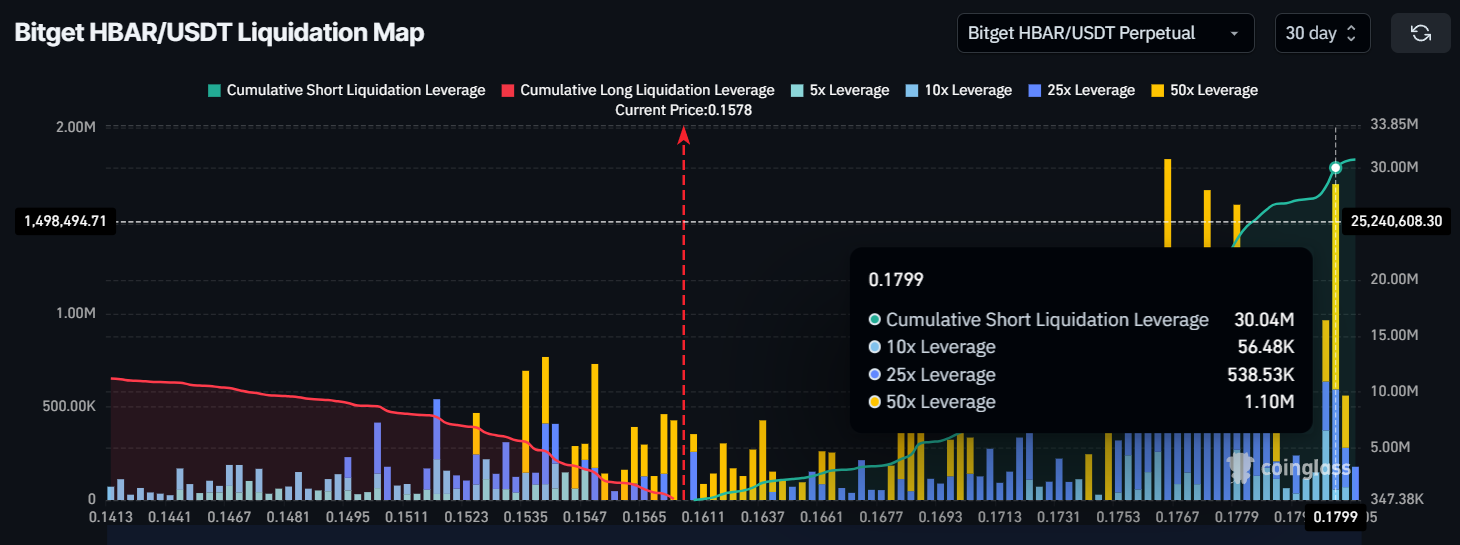

The liquidation map indicates a situation of concern for short traders. Approximately $30 million worth of short contracts are poised for liquidation if the HBAR price rises to $0.18. This could cause massive losses for traders who are betting against the asset. However, the current price range near $0.157 has provided some relief as the market struggles to breach lower support levels.

If HBAR maintains its position above key levels, these traders may be spared the liquidation risk for now. Despite the challenging market conditions, this scenario actually provides a buffer for traders, helping them avoid significant losses.

HBAR Liquidation Map. Source:

Coinglass

HBAR Liquidation Map. Source:

Coinglass

The overall macro momentum for HBAR shows signs of potential downside pressure as the cryptocurrency approaches a Death Cross. The 200-day exponential moving average (EMA) is just over 3% away from crossing the 50-day EMA.

This technical formation, when confirmed, signals a possible continuation of the bearish trend and could push HBAR further down in the coming days.

The close proximity of these two EMAs has increased the chances of the Death Cross, which could result in further losses for HBAR holders. The market’s lack of substantial improvement and the growing uncertainty surrounding price action contribute to the likelihood of the Death Cross forming.

HBAR EMAs. Source:

TradingView

HBAR EMAs. Source:

TradingView

HBAR Price Holds Above Support

HBAR is currently trading at $0.157, holding just above the critical support level of $0.154. While it has managed to stay above this support for now, it remains vulnerable to falling through it if bearish sentiment intensifies. A break below $0.154 would likely trigger a deeper decline, with the next support level at $0.143.

If HBAR fails to hold the $0.154 support, a further drop could confirm the Death Cross formation. Should this scenario unfold, the price might continue downward toward $0.143, and further declines could follow, pushing HBAR toward $0.12 or lower.

HBAR Price Analysis. Source:

TradingView

HBAR Price Analysis. Source:

TradingView

On the other hand, if HBAR can bounce back from $0.154, a recovery rally is possible. Successfully flipping the $0.165 resistance into support could push the price toward $0.177. This movement would bring the liquidation scenario closer to reality, as short traders could face significant losses in a reversal.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

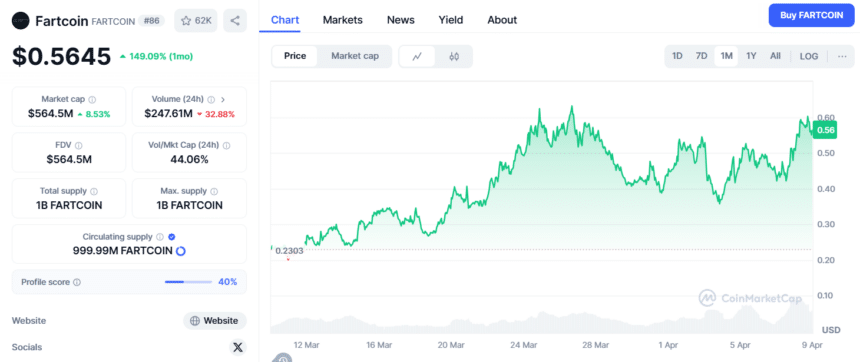

Fartcoin Surges in Value While Market Faces Setbacks

In Brief Fartcoin has increased by nearly 30% in the last 24 hours. Growing confidence among users as exchange reserves decline. Technical indicators predict a potential price target of $0.75.

Ethereum’s Price Drop Signals Potential Buying Opportunities for Long-Term Investors

In Brief The recent price drop of Ethereum may offer strategic buying opportunities. Historical data supports potential recovery after dips below realized price. Investor psychology plays a crucial role during uncertain market conditions.

Whale Makes Bold $1.89M Bet on Fartcoin, Would it play out?

FIL Price Over $150 Emerges as Filecoin Shows Highly Bullish Signals Amid Bitcoin Mirroring 2024 Correction